(Image via Canopy Growth Corp.)

(Image via Canopy Growth Corp.)

It has been another tumultuous week on Bay St. and Wall St. with investors busy keeping tabs on which way the markets are heading … trajectories change on what seems like a moment’s notice.

Weaker metal prices have weighed on mining stocks, but a rebound in the energy marked helped push Canada's main stock index higher this week after a multi-session losing slide. This has been a hot topic on Stockhouse’s Bullboards, along with the performances of the tech sector (for better and worse) as well as the cannabis market.

One of the biggest players in that space,

Canopy Growth Corp. (TSX: WEED, Forum), declared that it will release its financial results for the third quarter fiscal year 2022 (ending December 31st, 2021) before financial markets open on February 9, 2022.

For details on how to join the audience, click

here.

It was around this time last year when Canopy Growth reported its financial results for the

third quarter fiscal 2021, highlighting improved commercial and operational execution drives record net revenue of $153 million (CAD), up 23% vs Q3 2020.

Recently, WEED’s project with Martha Stewart CBD also made headlines upon the unveiling of

Martha Stewart CBD Wellness Topicals, marking the brand's first-ever category expansion in its growing CBD portfolio. Martha Stewart CBD provides consumers with an easy way to manage their needs throughout the day with convenient and trusted CBD products – including gummies, oils, softgels and the new CBD Wellness Topicals.

Elsewhere in the global cannabis lifestyle market, consumer packaged goods company

Tilray Inc. (NASDAQ: TLRY, Forum) has expanded its medical cannabis product suite in

Australia.

New whole flower options include GMP-certified balanced 1:1, mid-range and high THC varieties in 15 g packages. The company has also unveiled a medical cannabis educational platform for health care professionals centred on the benefits of medical cannabis use.

The platform complements Tilray’s ongoing research with Murdoch Children’s Research Institute in Australia on the effectiveness of medical cannabis for pediatric patients; a clinical trial with the government of New South Wales for a novel treatment for chemotherapy-induced nausea; and a study led by the University of Sydney examining the effects of driving under the influence of cannabis.

Denise Faltischek, Tilray’s Head of International and Chief Strategy Officer stated - “As medical cannabis demand increases worldwide, we remain committed to providing health care professionals and patients with safe and reliable access to the highest-quality medical cannabis products.”

The Tinley Beverage Company Inc. (CSE: TNY, Forum) manufactures a line of liquor-inspired, non-alcoholic, cannabis-infused beverages for use in California and will begin making

Green Monké products at its Long Beach facility.

Owned by St. Peter’s Spirits, Green Monké Happy Sodas are cannabis-infused sparkling drinks in tropical flavours, formulated with a fast-release microencapsulation emulsion, and contain only 25 calories per can.

The THC-infused beverages are currently available in California and launched in Canada in October 2021. Tinley’s is scheduled to begin can line production of five flavours of Green Monké at its Long Beach facility later in Q1 2022, with production of full batches expected to repeat near-monthly.

“We’re thrilled to be moving our California ‘Green Monké’ can production to Tinley’s impressive Long Beach Facility,” said Pat Gleeson, Founder and CEO St. Peter’s Spirits. “We are working with the like-minded professionals of the Tinley’s/Lakewood team towards ramping up production of our existing SKU’s and bringing additional tropical fruit flavours to market.”

In addition to the new production announcement, Tinley’s announced that Richard Gillis, president and CEO of Tinley’s USA, has purchased 2,080,666 units of the company under the first tranche of a non-brokered private placement.

The units sold for $0.15 per unit for gross proceeds of $312,000 (CAD). This investment brings the CEO’s aggregate position in the company to 4,080,666 common shares.

“I am investing once again in Tinley’s to tap into what I believe is an unrealized opportunity within the cannabis industry”, he said.

“The popularity of THC-infused beverages is accelerating,” he added, “and I believe that Tinley’s, through its Long Beach facility, with a newly activated distribution licence and growing menu of production methods and packaging capabilities, will continue to drive value by serving a growing roster of high-quality and high-volume client brands.”

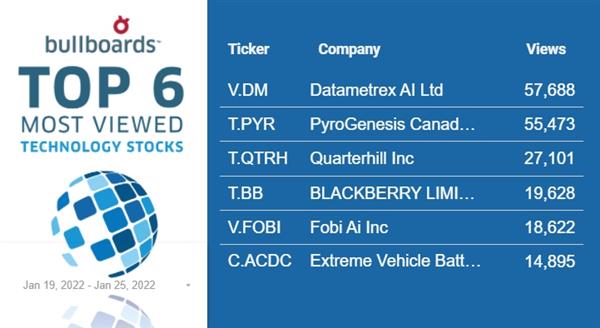

Datametrex AI Ltd. (TSX-V: DM, Forum)

Datametrex AI Ltd. (TSX-V: DM, Forum) announced plans to implement a

roll up strategy focused on Artificial Intelligence companies in 2022.

As artificial intelligence is becoming a growing influence in business, Datametrex is poised to leverage its AI experience to help reshape the entire industry.

Datametrex CEO Marshall Gunter sat down with Caroline Egan to highlight the company’s plans:

“As a CEO with a strong computer science background, I have seen AI produce huge changes to how we conduct our lives, from basic machine learning to business intelligence and automation to analytics; the possibilities are endless. We feel this opens the door to grow Datametrex exponentially by adding businesses and becoming leaders in these emerging technologies.”

As previously announced, the company currently has approximately $20 million (CAD) in cash and cash equivalent. Over the last few years, Datametrex has landed significant AI contracts with many entities including international conglomerates, government agencies and ministries, financial services, and international airports.

Data intelligence company

Fobi AI Inc. (TSX-V: FOBI, Forum) announced its partnership and integration of the Fobi platform with

Square this week, owned by global technology company, Block Inc. The partnership includes the availability of the Fobi app on the Square App Marketplace for businesses of all types and sizes including those in the retail and food and beverage industries.

The upcoming launch of Fobi’s app in the Square App Marketplace will give Fobi access to Square’s global sellers, which is expected to help drive customer acquisition and revenue for Fobi.

“At Square, we’re constantly working to help businesses improve customer engagement and give them better options and information when it comes to their integrated commerce solutions,” said Square’s Global Head of Partnerships, Vijay Vachani. “We’re looking forward to working with Fobi to offer our sellers around the world even more valuable data and real-time insights so they can continue to start, run, grow and adapt their businesses.”

The Fobi and Square integration will offer Square sellers a unified platform for connecting and enhancing existing business tools in Fobi’s Insight Portal to monitor sales performance and gain customer insights including:

Multiple retail outlets, franchises and channels - Businesses with multiple locations, franchisees and channels with different POS systems can use Fobi to integrate all their data into one unified dashboard and extract real-time insights to make informed business decisions.

Extreme Vehicle Battery Technologies Corp. (CSE: ACDC, Forum) stated this week that it had completed the necessary financing arrangements to enable its recently acquired subsidiary,

Optimal CP Inc., to execute on its business plan to develop state-of-the-art mining operations facilities.

Optimal is developing facilities in Canada’s energy hub in Alberta hoping to leverage direct access to clean, reliable, low-cost power generation facilities. Using a unique operating approach, Optimal’s facilities will continue to support the peak needs of the Alberta grid, thus offering increased value to generators while providing some of the lowest-cost, cleanest and most reliable mining operations in world.

With these funds in place, Optimal intends to move quickly in establishing and commissioning its initial mining facility, which will utilize at least 3.5 MW of clean, cost-effective generation to ultimately power a minimum of 1,000 mining ASIC mining machines.

Business moves like these are thanks in part to the company’s recently closed oversubscribed non-brokered private placement for total gross proceeds of

$900,000 (CAD).

“This private placement shows the considerable strength of the company and the faith investors have in its long-term business plan,” stated Bryson Goodwin, President and CEO of EV Battery Tech.

The company issued a total of 4.5 million units at a price of $0.20 per unit. Each unit consists of one common share and one share purchase warrant. Each warrant is exercisable into one additional common share at a price of $0.25 for a period of three years.

Net proceeds will be used for the development of its crypto mining facility, marketing, and general working capital.

Canadian mining company

Ivanhoe Mines Ltd. (TSX: IVN, Forum) has released an update on the construction of a

Phase 2 concentrator plant at Kamoa-Kakula.

One its three principal projects in Southern Africa, the Kamoa-Kakula Copper Project is a joint venture between Ivanhoe Mines, Zijin Mining Group, Crystal River Global Limited, and the Government of the Democratic Republic of Congo.

The Phase 2, 3.8-million-tonne-per-annum (Mtpa) concentrator plant is expected to reach 93% completion by January 31st, 2022. Hot commissioning, the process of introducing first ore into the plant at a reduced feed rate to set equipment parameters and test performance, is on track to begin in April 2022. After the plant’s hot commissioning, Kamoa Copper expects production of its first copper concentrate approximately one week after the ore is fed into the ball mills.

As of January 24th, the concentrator is on track to go live at the front end of previous Q2 2022 guidance and several months ahead of the original schedule. The Phase 2 plant is identical to the Phase 1 3.8-Mtpa concentrator plant and is expected to reach a faster ramp-up profile with the operational knowledge gained during the commissioning of Phase 1.

For comparison, the Phase 1 concentrator reached monthly design throughput during September 2021, which was the fourth full month of operation.

The Phase 1 concentrator currently is running at a throughput higher than its design capacity of 3.8-Mtpa by more than 15%, and copper recoveries are being achieved in excess of design recovery of 86%.

“While most of the mining industry struggles to meet construction timelines and budgets, Kamoa Copper continues to exceed expectations in delivering on the project’s first two development phases,” said Ivanhoe Mines co-chair Robert Friedland.

“Kamoa-Kakula,” he added, “represents only the beginning of our undertaking to unlock the potential of this remarkable new copper province, which has the unique combination of outstanding scale, grade, mine life, and environmental, social, and governance credentials.”

The company also announced that Kamoa Copper’s CEO, Mark Farren, will retire from his position following the commissioning of the Phase 2 expansion project. Kamoa Copper has initiated a search for Mr. Farren’s replacement and Mr. Farren will help support a smooth and seamless transition.

New Found Gold (TSX-V: NFG, Forum) is pleased to announce assay results from one diamond drill hole designed to expand

the newly discovered high-grade gold zone found in the Keats footwall.

This hole was drilled as part of the Company’s ongoing 400,000 metres diamond drill program at its 100%-owned Queensway Project, located on the Trans-Canada Highway 15 km west of Gander, Newfoundland.

(Photo of mineralization from NFGC-21-413A via New Found Gold Corp., approximately 463.5m down hole depth. Note that these photos are not intended to be representative of gold mineralization in hole NFGC-21-413A.)

Highlights:

(Photo of mineralization from NFGC-21-413A via New Found Gold Corp., approximately 463.5m down hole depth. Note that these photos are not intended to be representative of gold mineralization in hole NFGC-21-413A.)

Highlights:

Exploration drilling into the Keats footwall domain has identified a second new zone of high-grade gold mineralization with the intercept of 28.20 g/t Au over 4.50m in NFGC-21-413A.

Mineralization in NFGC-21-413A is characterized by a broad domain of brecciation and quartz-stockwork veining containing visible gold. Future drilling will focus on expanding this new zone of high-grade gold mineralization.

Approximately 34% of the planned 400,000 metres program at Queensway has been drilled to date with approximately 32,400 metres of the core with pending assay results. Ten core rigs are currently operating and New Found is targeting an increase in the drill count to 14 rigs by the end of Q1 2022.

Finally,

Fortune Minerals Limited (TSX: FT, Forum) announced this week that it had entered into an option agreement with

JFSL Field Services ULC, a wholly-owned subsidiary of international engineering company

Jacobs (NYSE: J), to purchase its former steel fabrication plant, located in Lamont County within Alberta’s Industrial Heartland northeast of Edmonton.

Under the agreement, Fortune will have six months to carry out additional due-diligence and complete the purchase of the JFSL facility for $5.5 million (CAD). Fortune intends to acquire this brownfield site to construct the hydrometallurgical refinery for the planned NICO Cobalt-Gold-Bismuth-Copper mine in the Northwest Territories.

The proposed refinery would process concentrates from the mine and produce cobalt sulphate for the rapidly expanding lithium-ion rechargeable battery industry and their use in electric vehicles, portable electronic devices, and stationary storage cells to make electricity use more efficient. In addition to cobalt, the unique mineral assemblage of the NICO deposit includes a highly liquid 1.1 million ounce in-situ gold co-product, 12% of global bismuth reserves, and copper.

The vertically integrated NICO development would provide a reliable North American source of three Critical Minerals produced responsibly with Canadian environmental-social governance values that are essential to support the transformation to new technologies and the growing green economy.

This brings us to this week’s Investor Pulse Poll question - How important is ESG to your investment decisions? Some companies, like Fortune, tout their ESG initiatives heavily. Some think it is the defining metric of a new investor generation, while others don’t even know what it is. Where does your loyalty lie? Let us know your thoughts by casting your vote and click the image below.

(Click image to vote.)

(Click image to vote.)

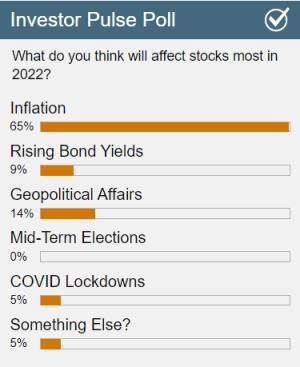

The big idea from last week’s survey confirms that many of you are watching the growth of inflation and its impact on where stocks are headed. It has been a major news story this week, and judging by the results, for good reason.

For previous editions of Buzz on the Bullboards:

click here.

FULL DISCLOSURE: Datametrex AI Ltd. and Extreme Vehicle Barttery Technologies Corp. are clients of Stockhouse Publishing.