(Image via TAAT Lifestyle & Wellness Ltd.)

(Image via TAAT Lifestyle & Wellness Ltd.)

Investors don’t prosper on potential. Investors prosper on returns. And in recent years, there haven’t been many mining companies able to reward return-starved investors with a strong stock performance.

Short-term trading or chasing momentum to look for a quick gain is not investing at all; it is just gambling.

The Stockhouse Bullboards serve several functions for our community. They can be convenient sources for news and information, and on the more active Bullboards there is also discussion/debate among members.

Having said that, here is a quick snapshot of the Bullboard leaders for the individual sector groupings that we track.

TAAT Lifestyle & Wellness Ltd. (CSE: TAAT, Forum)

TAAT Lifestyle & Wellness Ltd. (CSE: TAAT, Forum) has entered into a letter of intent with a US subsidiary of

Shanghai Shunho New Materials Technology Co. to undertake development work for a white-labelled “heat-not-burn” device as well as heatable sticks containing TAAT’s proprietary tobacco-free and nicotine-free Beyond Tobacco material in all three flavours (Original, Smooth, and Menthol).

Heat-not-burn tobacco products first became commercially available in the 2010s as an alternative to combustible tobacco cigarettes, addressing many of the weaknesses of e-cigarettes which deliver nicotine through vapour instead of smoke. As heat-not-burn has proven to retain users exceptionally well compared to other tobacco cigarette alternatives, TAAT has identified the opportunity to build upon its existing international market share in the tobacco industry by planning an expansion into the heat-not-burn category with a tobacco-free and nicotine-free offering that would be among the first of its kind in the United States.

TAAT’s Chief Executive Officer Setti Coscarella reiterated the team’s mission - to provide consumers better alternatives to tobacco cigarettes, giving them the option to leave nicotine behind while keeping the experiences they expect.

“After just over one year of selling TAAT with launches all over the United States, we have realized exceptional success in offering consumers the novel concept of a combustible product that largely resembles the experience of smoking a tobacco cigarette, but with no tobacco or nicotine. Although this credibly positions us to capture market share in the largest segment of the tobacco category, it is important to remember that there are several niche tobacco segments besides cigarettes. The reason we chose to pursue the heat-not-burn segment is because it is the most ‘sticky’ option out of all commercially available alternatives to cigarettes. The tobacco industry has invested heavily in cultivating a user base for heat-not-burn to the point that it may even replace major brands of tobacco cigarettes altogether in certain markets. We are excited to be leveraging innovative technologies to create a unique nicotine-free and tobacco-free experience using heat-not-burn for consumers who currently use and prefer this method. Because the TAAT heat-not-burn device will work with TAAT sticks as well as certain competitors’ heatable tobacco sticks, we believe this strategy authentically embodies our values as a company by providing consumers the choice and flexibility they deserve to have.”

Medical diagnostic and device technology company

Therma Bright Inc. (TSX-V: THRM, Forum) announced a

$6 million (CAD) private placement with institutional investors.

The company will issue 20 million units priced at $0.30 comprised of one common share and one common share purchase warrant.

Each warrant entitles the holder to purchase one common share for $0.375 for five years following the issuance date. The company will use the proceeds for general working capital purposes. It developed the AcuVid COVID-19 Rapid Antigen Saliva Test.

What the "Buzz"

Our Bullboards have up to 2 Million pageviews a day. Get the inside scoop on conversations around the most significant trends and stock appreciations in our weekly wrap up.

Get "Buzz on the Bullboards" delivered to your inbox every Thursday!

Buzz on the Bullboards | Sign Up Here

HEXO Corp. (TSX: HEXO, Forum) entered into a transition agreement with Adam Arviv and his fund,

Kaos Capital, to refresh the company’s board of directors, effective immediately. The new Board will stand for election at the company’s upcoming annual and special meeting of shareholders to be held on March 8th, 2022.

The new board is composed of seven directors, all of whom are independent:

- Rose Marie Gage (Vice-Chair and Chair of the ESG Committee)

- Vincent Chiara, Hélène F. Fortin (Chair of the Audit Committee)

- Rob Godfrey, Peter Montour, and William Montour

As part of the changes, John Bell has also announced that he has decided to step down as Chair of the Board of Directors, effective immediately.

HEXO’s Chief Executive Officer, Scott Cooper said that his company had built a reputation as a leader in the cannabis sector and will continue to pave the way as the industry evolves.

“I look forward to working with the refreshed board as we build the company’s next chapter and deliver on the Path Forward.”

Arviv noted that his team will work closely with the management team as they continue to fast-track the company’s path to becoming a cash flow positive business. Through his fund Kaos Capital, he currently owns an approximate 3% stake of HEXO's outstanding shares.

Investing in small-cap tech stocks is a tricky gambit for many investors, but well-versed Stockhouse users sought out value in everything from well-known start-ups to unknown micro-caps. Though each month gave us largely different leaders on the most-viewed tech Bullboards with varying stories,

Patriot One Technologies Inc. (TSX:PAT, Forum) caught great attention when it was awarded a contract worth nearly $1 million (CAD) with

Canada’s Department of National Defence (DND), to further develop an artificial intelligence (AI)-enabled full motion video analytics application.

This technology will be used to detect, classify, and track objects and events of interest, initially for DND applications, and in the future across multiple domains. As an innovative piece of AI-powered intellectual property, Patriot One will leverage the technology across its current and future product portfolio to enhance solutions for customers.

The project, named

RECCE, is being developed by

Xtract AI, the AI innovation and development arm of Patriot One. It will initially be used by the DND and the Canadian Armed Forces to detect, classify and track, as well as geospatially and textually log, objects of interest to improve situational awareness. Xtract AI is scheduled to deliver the solution to DND by March 31st, 2022.

Vice president of Strategic Partnerships and Technology at Patriot One, Cornell Pich called this application yet another example of the company’s AI innovations providing flexible solutions to address a set of requirements, that then provides a foundation for broader applications.

“While RECCE will first be used by the Canadian government for specific projects, such as military applications and the detection, identification and tracking of objects of interest or concern, the opportunity-space for this type of AI is unlimited.”

Patriot One’s CEO Peter Evans said that this advanced object recognition technology can be applied in countless ways, from providing a higher level of safety to people on the streets through video camera systems in specific locations around the world, to integrating it with drone cameras to survey large crowds of people. Imagine the value of very high threat detection and categorization in environments where the people, cameras and other elements are in motion.

“These types of foundational innovations are a key part of Patriot One’s overall business strategy to integrate advanced AI analytics into our existing and future products and in particular, would be ideally suited for enhanced crowd or threat detection management for large entertainment venues.”

Datametrex AI Ltd. (TSXV:DM, Forum)

Datametrex AI Ltd. (TSXV:DM, Forum) updated investors on its current operations of for its

Medi-Call Inc. telehealth mobile application, this week.

The Company has just finalized the recruitment of two new medical physicians based in British Columbia to meet the demand of this rapidly growing market. They already have an existing team of nurses based in BC and Ontario. The company has an existing established team of nurses in BC and Ontario.

DM is looking forward to expanding into this new Telehealth vertical with the goal to provide faster treatment and care for patients and help physicians to efficiently manage appointments.

Highlights:

- A subscription service that connects patients with doctors proactively

- Integrated grid system that connects patients with providers in real time

- Solves accessibility issues for patients living in rural or isolated communities or with limited mobility

- Improves coordination and communication of treatment among healthcare team members and their patients

- Facilitates mobile health care services including prescriptions

Tech developer and provider

Quarterhill Inc. (TSX:QTRH, Forum) returned to the top of the most-viewed chart with a vengeance. If you aren’t familiar with QTRH, the company is big on the Internet of Things (IoT) sector and signed a contract with the

Alameda County Transportation Commission to provide an interim electronic toll collection system and maintenance services on the Interstate 680 (I-680) Express Lanes in California. The initial term of the contract is two years and is subject to customary terms and conditions and valued at around $4 million (USD) for the implementation.

Over the short term of the integration contract, ETC will reuse existing infrastructure along with the integration of ETC's latest all-overhead lane solution to launch the express lanes into revenue service in 2022. This approach enables Alameda CTC to rapidly put a cost-effective interim solution in place and deliver the anticipated value of the I-680 Express Lanes to their customers while the toll agency finalizes procurement plans for the expansion of the roadway network and integration of a permanent tolling solution.

ETC's Chief Executive Officer Kevin Holbert said the team was thrilled to continue serving as Alameda CTC's trusted technology provider.

“Motorists in Alameda County have become accustomed to being served by well-run seamless systems over the years, and we look forward to helping maintain this high standard, while the Commission is charting the course towards its next comprehensive technology evolution.”

Aviation heavyweight Bombardier Inc. (

TSX: BBD,

Forum) just appointed

Christophe Degoumois, a former senior sales leader with the company, to the role of independent Executive Advisor, assisting the management team in strategic projects.

Degoumois, who until recently was Vice President, Sales, International, at Bombardier, has more than 17 years of experience with the company, and played a key role in instilling its customer-centric culture.

The company’s President and Chief Executive Officer Eric Martel said that he would bring valuable strategic insight to our leadership team as Bombardier executes its plan toward 2025 growth objectives.

“The business aviation industry continues to perform well and to attract interest from around the world.”

The country’s top airline,

Air Canada Inc. (TSX: AC, Forum) reported its

Q4 2021 and full year 2021 financial results this week.

Highlights:

- Q4 2021 operating revenues of $2.731 billion (CAD), 30% higher than Q3 2021, and over three times Q4 2020’s operating revenues

- Q4 2021 operating loss of $503 million compared to an operating loss of $1.003 billion (CAD) in Q4

- Q4 2021 EBITDA excluding special items, of $22 million compared to negative EBITDA (excluding special items) of $728 million in the same quarter of 2020

- Full year 2021 operating revenues of $6.400 billion (CAD) compared to 2020 operating revenues of $5.833 billion (CAD)

- Record cargo revenues in 2021 of $1.495 billion (CAD) compared to 2020 cargo revenues of $920 million (CAD)

- Full year 2021 operating loss of $3.049 billion (CAD) compared to an operating loss of $3.776 billion in 2020 (CAD)

- Full year 2021 negative EBITDA (excluding special items) of $1.464 billion (CAD) compared to negative EBITDA (excluding special items) of $2.043 billion in 2020 (CAD)

- Unrestricted liquidity of $10.4 billion (CAD) at December 31, 2021, practically unchanged from September 30, 2021, excluding funds that were available at September 30, 2021 under the financial package with the Government of Canada

Air Canada’s President and CEO, Michael Rousseau pointed to the unpredictable course of COVID-19 having made 2021 extremely challenging for the global airline industry.

“But the sequential and year-over-year improvement in Air Canada's fourth quarter results shows the underlying recovery remains intact despite the Omicron variant. Our progress rebuilding our airline is due to the hard work, resourcefulness, and commitment of our people. I warmly thank our employees for their dedication and professionalism, which have been unwavering through nearly two years of a global pandemic. I also thank our customers, including shippers, for their steadfast loyalty in continuing to choose Air Canada. As restrictions lift and more people return to flying with us, they will discover measures introduced for COVID safety have been adapted to smooth their journey. As we look at our renewed commitment to customer service excellence, we have more exciting initiatives to come.”

Cielo Waste Solutions (CSE: CMC, Forum) is a waste to renewable fuel company with a game changing technology engineered to help solve the world’s garbage crisis. CMC provided investors with an update on the closing of its

$11 million (CAD) mortgage loan, as well as the partial repayment and amendment of its existing loan.

The loan carries an annual interest rate of 3%, has a term of 24 months, maturing on February 18, 2024, subject to early repayment terms and is secured by facility in Aldersyde and property in Fort Saskatchewan, Alberta.

Cielo’s Chief Executive and Operating Officer, Gregg Gegunde called the settlement of this loan a significant step forward in simplifying the company’s financial structure and providing additional capital to fund the activities at the Aldersyde facility and Fort Saskatchewan research and development facility.

“This quarter is an exciting time in Cielo's operational development as we prepare for the commissioning of Aldersyde facility. With the additional fund and the favorable amendment of the Existing Loan, we will allocate additional capital to execute on our plans at both Aldersyde and Fort Saskatchewan facilities.”

Switching to our Investor Pulse Poll this week, headlines have been full of stories about COVID-19 restrictions easing and travel stocks, be they airline related, or some other subset of the market, are eager to revive their businesses after years-long shutdowns and stagnation of travel. What do you think? Is the time now to get in on travel stocks, or is the market just not ready? Let us know your thoughts by clicking the survey below.

(Click image to vote.)

(Click image to vote.)

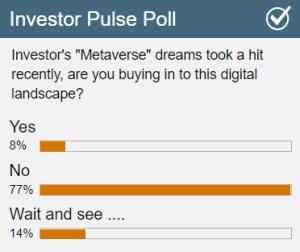

Looking at our poll from last week, it seems that most of you aren't buying into the metaverse. Guess I won't invite you to my Minecraft grotto any time soon.

You can always find the Investor Pulse Poll on the Stockhouse

homepage to register your vote. Readers interested in previous editions of Buzz on the Bullboards can find these

here.

FULL DISCLOSURE: Patriot One Technologies Inc. is a client of Stockhouse Publishing.