(Image via CGX Energy Inc.)

(Image via CGX Energy Inc.)

You’ve heard that what goes up must come down, but in the stock trading world, what goes down should come up.

Even a dead cat can bounce if it falls from high enough up, right? The markets coined this term believing that even the carcass of a derelict asset can recover temporarily when it drops from high levels, which is just what we’ve seen during this most recent run of market turbulence.

Bay Street and Wall Street have both seen intense selling over the previous few days and traders are ready to search for bargains among riskier assets. However, do any gains represent a buy-the-dip move … dead-cat bounce?

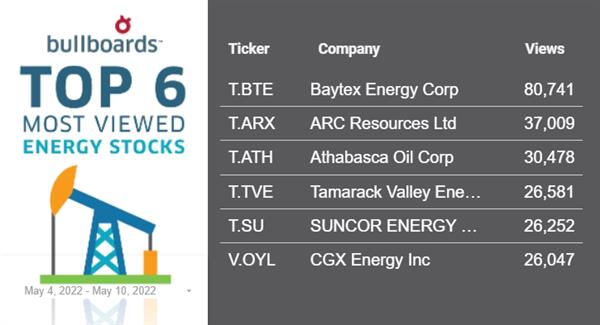

The energy sector has been a rollercoaster of late, but among the bad news stories, there are some bright spots. For instance,

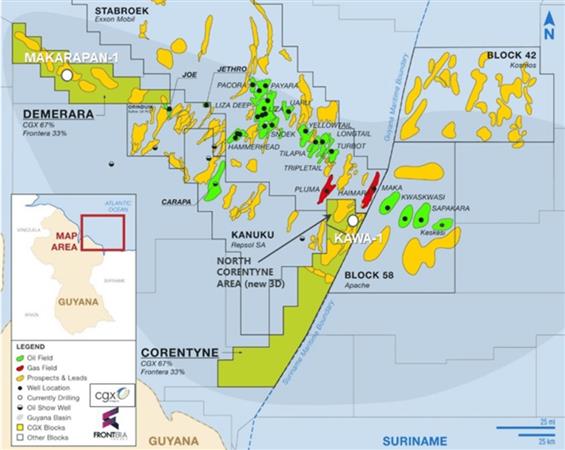

CGX Energy Inc. (TSX-V: OYL, Forum) and

Frontera Energy Corp. (TSX: FEC, Forum) made news this week upon the discovery of light oil from the Kawa-1 exploration well.

Both companies are

joint venture partners in the Petroleum Prospecting License for the Corentyne block.

Hydrocarbons were encountered in multiple zones extending from the Maastrichtian to the Coniacian. Nearly every sand encountered over this interval indicated the presence of hydrocarbons.

These findings are consistent with discovery wells reported by other operators surrounding the northern portion of the Corentyne block and de-risk the new upcoming exploration well.

The Kawa-1 well was drilled in a water depth of approximately 355 metres to a total depth of 6,577 metres in the northern portion of the Corentyne block.

Following completion of drilling activities at the exploration well, the two companies look to complete detailed studies, refined mapping, and analyses to decipher reservoir quality and hydrocarbon type.

The companies continue to integrate details from the Kawa-1 well into preparations for its new well, Wei-1, expected to spud by its third quarter. The next exploration well will be located northwest of Kawa-1 in the Corentyne block.

Based on the Kawa-1 discovery, the companies identified additional Maastrichtian, Campanian, and Santonian potential in the central channel complexes between Wei-1 and Kawa-1. The central channel complexes are the focus of ongoing technical work.

Biopharmaceutical company

Theratechnologies Inc. (TSX: TH, Forum) has initiated a

basket trial for its study in advanced resistant tumors.

A basket trial is a clinical trial that tests how well a new drug works in patients with different cancers that share the same mutation or biomarker, which the drug will target.

The first-in-human study is evaluating TH1902 for the treatment of solid tumors tied to sortilin-expressing cancers.

What the "Buzz"

Our Bullboards have up to 2 Million pageviews a day. Get the inside scoop on conversations around the most significant trends and stock appreciations in our weekly wrap up.

Get "Buzz on the Bullboards" delivered to your inbox every Thursday!

Buzz on the Bullboards | Sign Up Here

TH1902 enables the potential to accumulate 7.5 to 10 times more docetaxel, a well-established cancer drug, in infected cells, compared to administering the drug on its own.

Cancers to be studied include breast, ovarian, endometrial, melanoma, thyroid, small cell lung and prostate.

“We firmly believe that the unique mechanism of entry of TH1902 in cancer cells is a key advantage to improve the therapeutic window of docetaxel. Based on the pre-clinical results obtained so far, we are optimistic in the development of a first-in-class and promising treatment for patients with sortilin-positive solid tumors,” stated Dr. Christian Marsolais, Senior Vice President, and Chief Medical Officer at Theratechnologies.

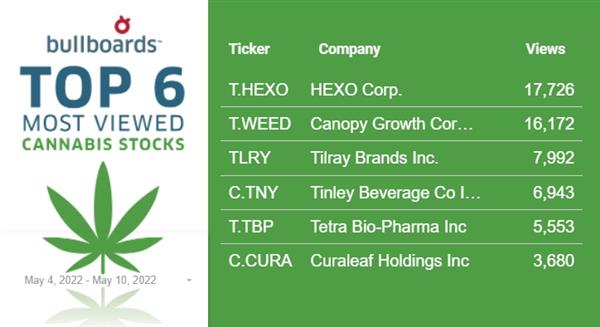

Tetra Bio-Pharma Inc. (TSX-V: TBP, Forum)

Tetra Bio-Pharma Inc. (TSX-V: TBP, Forum) has signed an R&D agreement with

Cannvalate Pty Ltd and a subscription agreement for a $7.5 million private placement.

Tetra is a company dealing in cannabinoid-derived drug discovery and development, and its partnership with Cannvalate will look at the clinical viability of drug candidates REBORN, PLENITUDE and CAUMZ in planned trials.

Cannvalate is a medical cannabis company focused on bringing safe and effective cannabinoid-based products to the Australian market. By conducting Tetra’s clinical trial activities in Australia, it will benefit from a 43.5% tax credit on all money spent on clinical trials.

Tetra will also have increased access to patients seeking participation in trials where the pharmaceutical cannabis drug is provided at no cost.

Cannvalate also agreed to acquire common shares of Tetra on a private placement basis, through seven distinct tranches, for the proposed $7.5 million.

The first tranche of $500,000 was triggered by the signing of the subscription agreement, whereas the subsequent tranches will be prompted by the completion of various operational events in connection with the drug candidate clinical trials, such as the achievement of the first patient enrolments in each such trial.

Tetra intends to use the proceeds to fund its clinical trials and research and development activities in collaboration with Cannvalate and

iNGENu.

The subscription price per common share shall be adjusted upwards to ensure that Cannvalate and its affiliates will not beneficially own more than 19.99% of the issued and outstanding common shares.

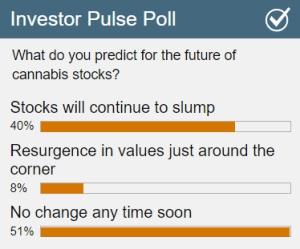

To our Investor Pulse Poll, the results are in from last week. We gathered your thoughts on the future of the cannabis industry, which is doing about as well as whatever a non-fungible token is ….

This week … we’ve all seen the fiery crash of NFTs and the muted performance of the Metaverse. Some may have thought these digital offerings could pave the way to a new economic promised land and maybe that is still possible … agree? Disagree? Click the image below to let us know what you think.

(Click image to vote.)

(Click image to vote.)

This week’s results set up a flurry of questions next week: Is the energy rebound going to stick? Is the continued spread of COVID a concern, or are we numb? Same goes for the invasion of Ukraine … are we ready for things to get worse? What companies are rising? For all these answers and more, make sure to stay up to date on Stockhouse and the latest small-cap investor discussions on Buzz on the Bullboards. For previous editions:

click here.