The Canadian stock market had a good start to 2023. Financial and technology sectors opened strong, driving Canada’s main stock index higher. Energy stocks, however, weakened as the price of oil fell.

Oil prices fell nearly 5 per cent yesterday after slumping in the previous session.

The S&P/TSX composite index was up 91.66 points to 19,535.43 as of yesterday morning.

The market still remains volatile amid concerns that consistent inflationary pressure and further rate hikes could hurt the economy.

In this edition, we will cover top stories in three of our most popular sectors.

Surge Battery Metals (NILI) has released assay results from holes NN2207 and NN2208 at its Nevada North Lithium Project.

Results extend mineralization strike length to 1,620 m from NN2205 to NN2208. Mineralization width is not as well determined since the holes are mostly on a north-south alignment because of topography and access, but it is at least 400 m, with soil anomalies indicating it is likely much more.

A detailed 2023 drilling program will commence when ground conditions allow. In the meantime, 2022 drill cuttings will undergo mineralogical and spectral analysis along with in-depth reviews of surface and sub-surface geochemistry.

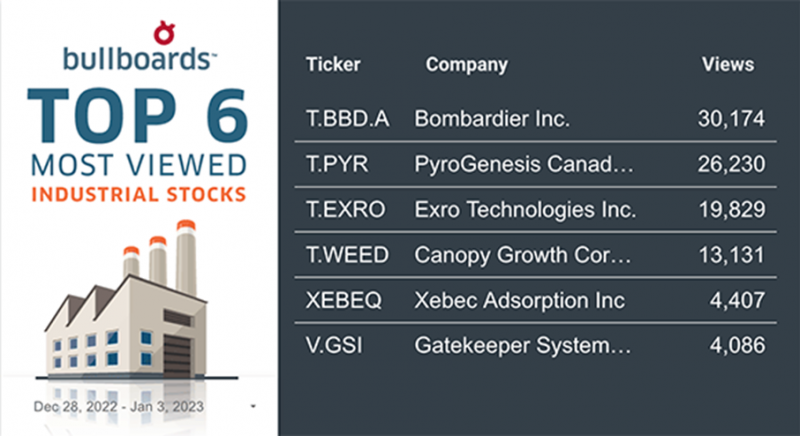

A leading clean technology company, Exro Technologies (EXRO), has closed its bought deal convertible debenture financing for gross proceeds of $15 million.

Exro sold 15,000 units at a price of $1,000 per unit. Each unit consists of one senior secured convertible debenture in the principal amount of $1,000 and 416 common share purchase warrants.

Exro will use the net proceeds from the offering for working capital and general corporate purposes.

The debentures will mature on December 31, 2027, and will accrue interest at the rate of 12.0 per cent per annum, payable semi-annually in arrears beginning on June 30, 2023.

Technology is becoming immensely critical for most day-to-day functions and this sector continues to show strong growth potential.

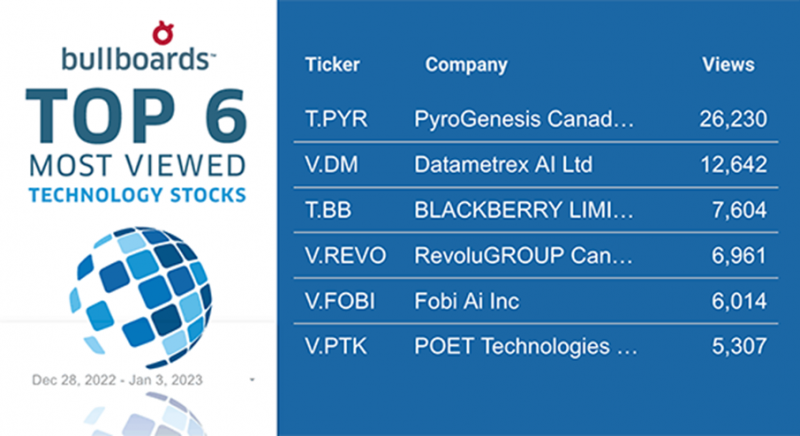

Datametrex’s (DM) Medi-Call subsidiary has signed a partnership agreement with Lucira Health to provide telehealth services to Lucira clients.

Lucira will direct patients to Medi-Call’s telehealth services through the Lucira app and website. This will expose Medi-Call to more potential patients.

Lucira has combined the most accurate COVID-19 test with the only commercially available at-home flu test. Within 30 minutes or less, users will know whether they have COVID-19 or the flu.

Once results are in, if Lucira users are positive for any viruses, their platform will redirect users to Medi-Call’s telehealth services to see a physician or get a prescription.

Medi-Call is a subscription-based software as a service (SaaS) mobile application that connects patients with physicians in real-time.