Inflation continues to surge out of control to the point where grocery rebates seem to offer little help to struggling Canadians.

This holiday-shortened week, markets are adjusting to the U.S. Federal Reserve’s move to raise interest rates. Investors are watching Meta Platforms Inc. (NASDAQ:META), whose stock has outpaced its megacap tech and growth peers, ahead of today’s release of Threads, its Twitter-rival app. Later this week, traders will take stock of employment and wage data for insights into the strength of the labour market.

It has been a tough couple of weeks for Canopy Growth Corp. (TSX:WEED). We’ve covered its Q4 C$648 million losses and this week, attorneys called upon investors with substantial losses to lead the securities fraud class action lawsuit against the cannabis company.

Canopy Growth struck a privately negotiated agreement to equitize C$12.5 million in debt due this month. It will cancel 4.25 per cent unsecured senior notes in exchange for 24.3 million shares plus accrued and unpaid interest.

Keeping things classy, Canopy Growth extended congratulations to fellow cannabis business TerrAscend Corp. (TSX:TSND) who began trading its shares on the Toronto Stock Exchange. The Toronto-based company was transitioning from the Canadian Securities Exchange.

Reliq Health Technologies Inc. (TSXV:RHT), a high-growth health tech stock, has signed six new contracts in the United States.

The contracts include 20 skilled nursing facilities, 10 physician practices and 2 home care agencies in California, Florida, Nevada, and Texas.

The company expects to earn average revenue of $65 per patient per month (with an expected 75 per cent gross margin), adding the more than 30,000 new patients expected to sign on to Reliq’s iUGO Care platform by the end of June 2024.

Source: Reliq Health Technologies Inc.

Source: Reliq Health Technologies Inc.

Reliq Health’s CEO, Dr. Lisa Crossley explained that the skilled nursing facility market has been a source of rapid growth.

“Skilled nursing facilities are excellent partners for Reliq as they provide training on the iUGO Care system to their patients prior to discharge, which helps ensure high adherence levels for this patient population. We have already documented greater than 70 per cent adherence in our existing post-discharge skilled nursing facility patients, and we expect their adherence to improve over time. All of the new clients will be using the iUGO care remote patient monitoring, chronic care management and behavioural health integration modules, and the skilled nursing facilities will also be the transitional care management module. Onboarding with these clients will begin next month and will ramp up to a monthly average of 2,500 new patients per month in 2024.”

What the “Buzz”

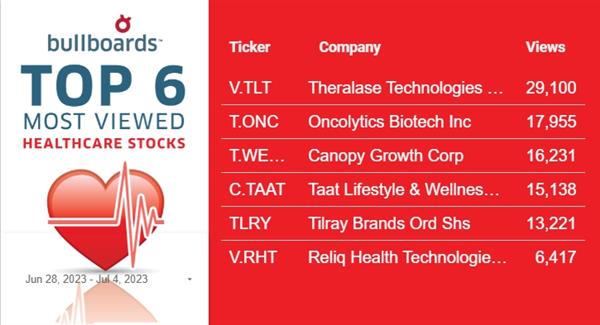

Our Bullboards have up to 2 million pageviews a day. Get the inside scoop on conversations around the most significant trends and stock appreciations in our weekly wrap up.

Get “Buzz on the Bullboards” delivered to your inbox every Thursday!

Buzz on the Bullboards | Sign Up Here

CGX Energy Inc. (TSXV:OYL) and Frontera Energy Corp. (TSX:FEC) have made a massive oil discovery through their joint venture.

In a press release, the companies stated that oil had been discovered at its Wei-1 well, located just offshore from Georgetown, Guyana.

The well encountered 64 metres of hydrocarbon-bearing sands in the Santonian horizon and completed drilling operations without any incidents. The companies said they expect to release the drilling rig in early July.

Source: OilNOW

Source: OilNOW

This week has shown what many previous weeks have proven – you never know what to expect when it comes to each sector’s performance, or the general market. Investors should stay as up-to-date as possible, and for the latest on small-cap stock movements. Next week we’ll dive back into the Bullboards and see where the small-cap markets are headed. The likes of CGX and Fontera may be on top for now, but no reign lasts forever, and an uncertain market demands constant attention from investors to stay up-to-date and ready. For previous editions of Buzz on the Bullboards: click here.

Join the discussion: Find out what everybody’s saying about public companies and hot topics about stocks at Stockhouse’s stock forums and message boards.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.