Stocks on both sides of the border have wilted in this short trading week.

Stocks have since suffered after the Bank of Canada said this week that it would hold its key interest rate at 5 per cent, a 22-year high. The rate pause is in line with economist expectations.

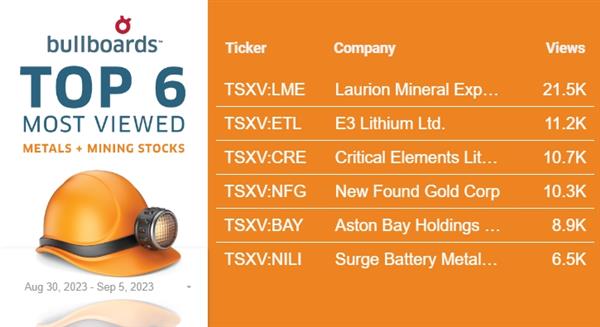

It is no surprise that a lot of the top names appearing in this week’s top 6 lists are familiar and popular ones among the Bullboard communities.

First up, one of the most popular, BlackBerry (TSX:BB, Forum). Once known for being the world’s largest smartphone manufacturer, this one-time tech heavyweight is now exclusively a software provider with a stated goal of end-to-end secure communication for enterprises.

The Waterloo, Ontario-based company reported its preliminary Q2 fiscal year 2024 results this week, highlighting in the neighbourhood of $132 million, which is a drop from $168 million in Q2 2022.

Its IoT business unit revenue is expected to be approximately $49 million, representing 9 per cent sequential growth, while its cybersecurity business unit revenue is expected to be approximately $80 million, lower than anticipated, primarily because of certain large government deals not closing in the quarter.

What the “Buzz”

Our Bullboards have up to 2 million pageviews a day. Get the inside scoop on conversations around the most significant trends and stock appreciations in our weekly wrap up.

Get “Buzz on the Bullboards” delivered to your inbox every Thursday!

Buzz on the Bullboards | Sign Up Here

“Like many software companies, our cybersecurity business has experienced elongated sales cycles, particularly in BlackBerry’s core government vertical, where we have a strong market position. Given the product mix, delays in closing certain large deals are expected to impact revenue recognized in the quarter. However, we expect to close these deals this fiscal year and are therefore reiterating the full-year outlook for the cybersecurity business unit given previously,” John Chen, BlackBerry’s executive chairman and CEO, said in a news release. “Our IoT business unit continues to capitalize on its large market opportunity and multi-year secular tailwinds by securing new design wins at a strong rate. However, in the short term we are seeing some automakers shift the start of software development programs, as well as production schedules, and therefore we’ve revised our current year revenue outlook, but not our long-term targets.”

More details may be released during a conference call and webcast at 5:30 pm ET on Sept. 28.

Healthcare technology company Reliq Health Technologies (TSXV:RHT, Forum) intends to onboard 10,000 patients from a respiratory therapy clinic in Texas by mid-2024.

Beginning in September 2023, patients will be added to the company’s iUGO Care platform, which offers modular software solutions and care management services to provide virtual healthcare across remote patient monitoring, principal care, telemedicine, wound care, chronic care, behavioral health integration and transitional care.

The company expects to collect $65 per patient per month at a more than 70 per cent gross margin.

Source: Reliq Health Technologies Inc.

Source: Reliq Health Technologies Inc.

“The iUGO Care platform supports patients with asthma, chronic obstructive pulmonary disease (COPD) and other breathing issues by providing remote monitoring with connected spirometers, inhalers and nebulizers,” Lisa Crossley, CEO of Reliq Health, said in a statement. “According to the Centers for Disease Control and Prevention, over 20 million Americans have COPD and it is the fourth-leading cause of death in the United States. Remote monitoring of asthma and COPD patients allows healthcare providers to identify early changes in lung function that can be easily treated at home with antibiotics, steroid inhalers or nebulizer treatments. These early interventions help prevent complications like inflammation, bronchitis and pneumonia that can cause permanent lung damage and lead to lengthy, disruptive, and costly ICU stays.”

Top-performing mining stock New Found Gold Corp. (TSXV:NFG, Forum) has released results from 30 follow-up diamond drill holes on the Jackpot discovery on its Queensway project in Newfoundland and Labrador.

The Jackpot discovery is 2.5 kilometres north of the Keats zone along the highly prospective Appleton Fault Zone.

Results sought to determine the discovery’s orientation for continued expansion drilling:

NFGC-23-1425 and NFGC-23-1423 are 20 metres down-dip and 15 m along strike of the previously reported NFGC-23-1292.

Left: at ~38 m in NFGC-23-1425. Right: at ~22.5 m in NFGC-23-1423. Source: Business Wire.

Left: at ~38 m in NFGC-23-1425. Right: at ~22.5 m in NFGC-23-1423. Source: Business Wire.

Initial drilling suggests Jackpot is an east-west striking, steeply north-dipping high-grade gold-bearing fault laced with coarse-grained visible gold.

Follow-up drilling continues with Jackpot open in all directions as part of the company’s ongoing 500,000-metre drill program at Queensway. Approximately 36,400 metres of core are currently pending assay results.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, click here.