Investors don’t prosper on potential. Investors prosper on returns. These days, plenty of companies are able to reward return-starved investors with a strong stock performance.

However, many still look to short-term trading or chasing momentum for a quick gain. Many would say that is not investing at all, just gambling.

The Stockhouse Bullboards serve several functions for our community. They can be convenient sources for news and information, and on the more active Bullboards there is also discussion/debate among members.

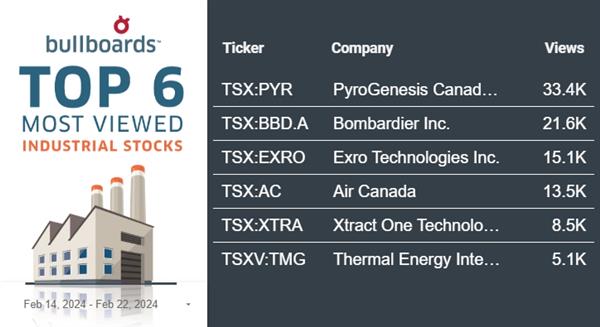

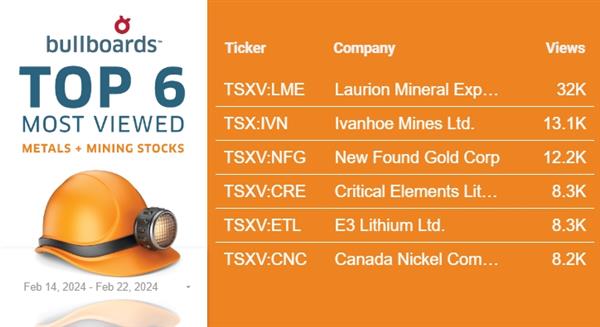

Having said that, here is a quick snapshot of the Bullboard leaders for the individual sector groupings that we track.

This week, the TSX Venture Exchange released its annual top 50 rankings, highlighting outperforming companies across energy, mining, clean technology and life sciences, diversified industries and technology to guide investors as to the nature of growth in these sectors.

The TSX Venture 50 gathers the strongest performance on the TSX Venture Exchange over the past year. The list gathers the top 10 companies in each of the five major industry sectors, based on a ranking formula with equal weighting given to market cap growth, trading volume amount and share price appreciation.

The average share price appreciation was 121 per cent from 2024’s winners, with an average market capitalization increase of 248 per cent. The Venture’s market capitalization added more than C$7.5 billion in 2023 to a year-end total of C$23.1 billion.

The tech sector added an average of 224 per cent in market capitalization and 178 per cent in share price appreciation, up from 20 per cent and 12 per cent, respectively last year.

Canadian tech firm Gatekeeper Systems Inc. (TSXV:GSI, Forum) scored a spot in the top 10 technology stocks on the Venture Exchange.

The smart video and data solutions provider to the transport industry was recognized for its significant growth over the past five years, reaching more than 50,000 installed mobile data collectors, all achieved with overall profitability. Gatekeeper’s share price grew by 104 per cent in 2023, while its market capitalization grew by 105 per cent.

Aviation heavyweight Bombardier (TSX:BBD, Forum) will debut its Global 7500 aircraft at the Singapore Airshow this week.

In a news release, the Montreal-based aviation company stated its latest aircraft holds the title of the longest-range flight in business aviation, with more than 8,225 nautical miles flown.

The Global 7500 jet is said to have seamless, smooth rides and is the largest and longest-range business aircraft that is certified and in service. It has flown multiple record-breaking missions over the past six-months, while the company has delivered more than 150 of the aircraft. The aircraft also has a top speed of Mach 0.925 and a range of 7,700 nautical miles. Its latest flight includes from Los Angeles to New York, and New York to London. Its longest flight was out of London City Airport.

What the “Buzz”

Our Bullboards have up to 2 million pageviews a day. Get the inside scoop on conversations around the most significant trends and stock appreciations in our weekly wrap up.

Get “Buzz on the Bullboards” delivered to your inbox every Thursday!

Buzz on the Bullboards | Sign Up Here

In addition to debuting its Global 7500 aircraft in Singapore, Bombardier announced it has expanded its cost-per-flight-hour program by introducing Smart Services Defense for its special mission, medevac, head-of-state and government operators.

The Smart Services Defense program provides its clientele with cost-per-flight-hour programs that provide budget predictability for essential aircraft parts and maintenance costs.

Resource stock E3 Lithium (TSXV:ETL, Forum) provided an update on the selection process for direct lithium extraction (DLE) technology in its field pilot plant.

In determining the basis for its commercial design, E3 Lithium evaluated its proprietary DLE technology along with four third-party DLE technologies. The company stated that each one demonstrated technical success for the extraction of lithium from its brines.

The company evaluated the DLE technologies along with the downstream refining process and has selected the optimal combination that outlines the best technical and economic results, while helping de-risk its path to commercialization.

E3 Lithium is proceeding with third-party DLE technology for its first commercial facility and will continue to pursue the development of its proprietary technology for subsequent commercial facilities.

Who knows what next week will bring, and which stocks will survive and thrive? What we can predict is that we will be able to get a clearer picture of where the markets are headed, and which companies will do well in the times to come.

Join the discussion: Find out what everybody’s saying about public companies and hot topics about stocks at Stockhouse’s stock forums and message boards.

For previous editions of Buzz on the Bullboards: click here.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.