The past week the TSX and Wall Street saw a significant surge following Donald Trump’s return to the presidency.

This political shift is expected to have profound implications for various sectors, particularly the financial and energy industries. Investors are speculating on potential gains, especially in the financial sector, as Trump’s policies may favor deregulation and tax cuts. However, the impact extends beyond finance; his victory promises to reshape U.S. energy and environmental policies, influencing oil production, offshore wind development, and electric vehicle sales.

Energy sector performance

The energy sector emerged as one of the biggest gainers on both Wall Street and Bay Street this week. A prime example is Baytex Energy (TSX:BTE, Forum), which recently announced its financial and operational results for Q3 2024. Here are some highlights:

- Production: Baytex achieved production of 154,468 barrels of oil equivalent per day (boe/d), with 86 per cent comprising oil and natural gas liquids (NGL). This marks a 3 per cent increase from Q3 2023.

- Per-share growth: Production per basic share increased by 10 per cent compared to the previous year.

- Exploration and development: The company executed a C$306 million exploration and development program, bringing 82 wells onstream.

- Cash flow: Operating cash flows were reported at C$550 million ($0.69 per basic share).

- Net income: Baytex generated a net income of C$185 million ($0.23 per basic share).

- Free cash flow: The company reported free cash flow of C$220 million ($0.28 per basic share), returning $101 million to shareholders through share repurchases and dividends.

Baytex’s strong performance and strategic initiatives position it well for continued growth, especially as energy policies evolve under the new administration.

What the “Buzz”

Our Bullboards have up to 2 million pageviews a day. Get the inside scoop on conversations around the most significant trends and stock appreciations in our weekly wrap up.

Get “Buzz on the Bullboards” delivered to your inbox every Thursday!

Buzz on the Bullboards | Sign Up Here

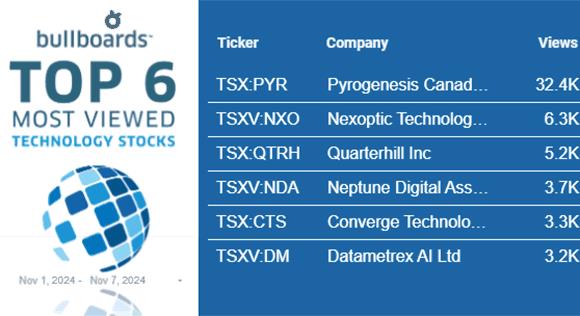

Technology sector gains

The technology sector also saw substantial gains in the wake of Trump’s election. Converge Technology Solutions Corp. (TSX:CTS, Forum) recently celebrated being named a 2024 Triple Crown Award winner by CRN, a prestigious recognition awarded to solution providers who excel in three key areas:

- Solution Provider 500: Ranking the largest IT solution providers in North America based on revenue.

- Fast Growth 150: Highlighting the fastest-growing organizations in the channel.

- Tech Elite 250: Recognizing companies with the highest-level certifications from leading technology vendors.

Being featured on all three lists in the same year underscores Converge’s exceptional business acumen and commitment to innovation, making it a compelling stock for investors looking to capitalize on the tech sector’s growth.

Addressing the illicit cannabis market

As the political landscape shifts, many individuals may seek ways to calm their nerves, leading to increased interest in the cannabis sector. Curaleaf International (TSX:CURA, Forum) is at the forefront of addressing the challenges posed by the growing illicit cannabis market. Their latest report highlights alarming trends:

- Illegal online sales: Sales via the open and dark web have surged by 50 per cent over the past two years.

- Health risks: Many consumers are turning to illegal cannabis for relief from conditions like chronic pain and anxiety, often unaware of the potential dangers, including contamination with harmful substances.

Curaleaf advocates for a comprehensive reform strategy that includes:

- Tightened regulation: Strengthening enforcement against unlicensed online sales.

- Public awareness initiatives: Educating consumers about the risks of unregulated products.

- Policy changes: Improving patient access to medical cannabis through regulatory adjustments.

- Expanded research: Promoting clinical studies to better understand cannabis’s therapeutic potential.

Everyone is talking about it

As investors navigate this dynamic landscape, staying informed about market developments is crucial. The recent political changes and their implications for sectors like energy, technology, and cannabis present both opportunities and challenges. Keeping a close eye on stocks like Baytex Energy, Converge Technology Solutions, and Curaleaf International could position investors to capitalize on potential gains or mitigate risks in the near term.

For previous editions of Buzz on the Bullboards, click here.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.

(Top image generated with AI.)