The combined Canada Day/U.S. Independence Day long weekend breaks usually signal the seasonal slow-down of lumber production and sales in North America. When economic cycles and the home building season are relatively normal, these July holidays are usually followed by decreased buying of solid wood commodities. Customers would normally have stocked up by now, after all.

Usually this is the time of year when hot, dry weather in the main timber harvesting and lumber producing areas brings maintenance curtailments, seasonal shutdowns, and a halt to activity in the back country due to fire danger. While all other variables are in play this year, customers have most decidedly NOT been keeping inventories up.

As a result, the extended absence of buyers, who were out celebrating last week, combined with depleted lumber stocks throughout the supply chain, allowed producers to push up prices on some of the most desirable items. But only slightly. And no one is sure if this week's price increases will maintain their hold next week.

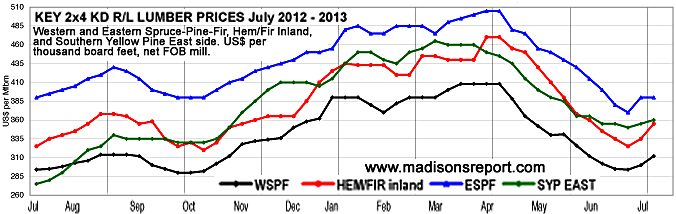

Benchmark Western Sprice-Pine-Fir KD 2x4 #2&Btr lead other dimension lumber prices upward, popping $12, or 3.2 per cent, to US$312 mfbm. This is an $18, or 5.8 per cent, improvement over print two weeks ago, of US$294 mfbm. Next week will demonstrate if that price proves to be the quarterly low.

In the east, an uptick in demand was not enough to push prices on ESPF items higher, but mills were very happy with sales volumes.

Most buying came from the U.S., especially in the standard construction grades. Customers from China also made their presence felt this week, buying up available stocks of lower grade products.

At the moment weather is the greatest concern for almost everyone, with continued heavy rains in the east causing problems in the forest and on the roads. Meanwhile hot, dry weather in the west is sure to bring the usual fire ban, preventing the use of heavy equipment in the bush and on remote roads. There were no significant transportation problems in the west.

In a normal year, the second week of July marks the long slow slide of lumber and panel prices, which generally culminates on the Labour Day long weekend. Even the most veteran players can't say if that will be the case this year. Traders are just happy the phones are ringing with encouraging frequency.

Follow me on Twitter!

https://twitter.com/KetaK

Keta Kosman

Publisher

Madison's Lumber Reporter

604-984-6838

www.madisonsreport.com