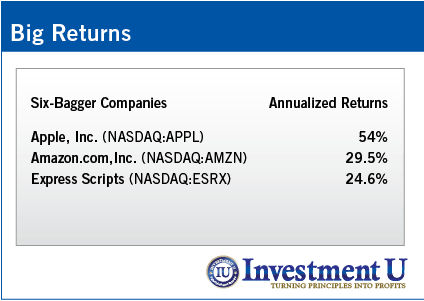

Fortune magazine’s most recent “Fortune 500” issue tracked the stock-price performance of the 500 biggest U.S. companies from 2002-2012, and found that 46 of them produced annualized compound gains of more than 20%.

That’s means over the 10-year period studied, these stocks were six-baggers:

They each produced a six-fold gain.

Here are the top three:

So how do we pick companies that are going to be on the list 10 years from now? I can tell you they’ll all be disruptor companies, just like the top three listed above.

I have two good candidates, both disruptors in their beginning stages of growth. Both companies are in the same energy sector – a sector where conventional wisdom is several decades old.

I’ll tell you about the first one today and the second one tomorrow, so check your inbox.

First, let’s go through the energy sectors.

Which sector offers the biggest opportunity?

Coal. Roughly 74% of the nation’s 500 coal-fired power plants are 30 years old or more. According to the National Association of Regulatory Utility Commissioners, a coal plant’s average life is just 40 years. New EPA rules will shut down close to 280 of them across 32 states over the next several years. It’s not coal.

Nuclear. Three Mile Island… Chernobyl… Fukushima… Accidents happen. Nuclear wastelands have resulted from two of them. Oh, and then there’s the 20,000-year-long spent fuel problem. It’s not nuclear.

Oil. There are only 23 oil-fired power plants left in the United States. It’s another dirty fossil fuel, and isn’t well-suited as a power plant fuel source. The price of oil keeps going up, not down. We aren’t all of a sudden going to be driving around on 29 cents-a-gallon gas like I did in my teen years. So it isn’t oil either.

Natural gas. Our newfound wealth of shale gas deposits has driven domestic natural gas prices to historic lows. With the lowest CO

2 output levels of any fossil fuel, natural gas-fired power plants are the current choice for utilities needing additional capacity. We have so much natural gas, in fact, 16 companies are lining up to build liquid natural gas export facilities. Yet surprisingly, it’s not natural gas either.

What’s left?

It turns out that forecasts for the growth of the

renewable sector, done in 1990, were way off the mark.

Here’s what Dr. Eric Martinot, director of research for the Institute for Sustainable Energy Policies in Tokyo, said at the Pathways to 100% Renewables Conference this past April: “We’re 15 to 20 years out of date in how we think about renewables. It’s not 1990 anymore.”

Martinot was part of a team that compiled the 2013 Renewables Global Futures report, which spent two years interviewing more than 170 experts from 15 countries and reviewing in excess of 50 scenarios published by energy companies, research institutes and other credible international organizations.

The report notes, “The history of energy scenarios is full of similar projections for renewable energy that proved too low by a factor of 10, or were achieved a decade earlier than expected.”

Here’s an example. The International Energy Agency’s (IEA) 2000 published estimate for wind power in 2010 was 34 gigawatts (GW). It turns out the IEA was a little off:

More than 200 GW was installed by the end of 2010.

Six-bagger in solar

SolarCity Corporation (

NYSE: SCTY) is one company that’s poised to exploit the growth in renewable energy. It installs solar power systems in homes and businesses profitably and affordably by providing financing for all of its customers – a radically different approach in the market.

“This gives the consumer the advantage of solar power, which is 10-15% cheaper than regular electricity,” explained Ben Kallo, senior analyst at Robert W. Baird & Company. “They don’t have to invest so heavily in the hardware. That easy model is getting some traction. That is probably the biggest growth area we are seeing right now.”

Since going public last December, SolarCity’s shares are up a whopping 257%. There’s plenty of upside for the company. With panel prices continuing to drop, the company’s upfront costs will drop as well. Lower costs translate into increased rates of adoption by customers.

Speaking of customers,

Wal-Mart Stores, Inc. (

NYSE:WMT) plans SolarCity installations on all of its Wal-Mart and Sam’s Club stores nationwide. The U.S. government is using SolarCity to install solar systems on military base housing. The list of new customers continues to rise daily.

Renewable energy is the only market sector poised for explosive growth over the next decade, and SolarCity is one company within it that’s well-positioned to lead the charge.

There’s another company in the solar-power business that’s in a similar position. Tune in tomorrow to find out more about it.

https://www.investmentu.com/