The $20 million market cap CGX Energy Inc. (TSX:V.OYL, Stock Forum) holds 3.3 million acres in one of the last frontier oil basins on the planet; the Guyana-Suriname offshore basin. CGX’s grounds are considered analogous to West Africa’s prolific oil fields, and could hold multiple billion barrels of oil. CGX is already ~64% owned by Pacific Rubiales, and will need to attract another major partner to held subsidize the heavy costs of drilling their targets. CEO Dewi Jones explains the company’s huge potential and go forward plans in an exclusive interview.

Recently I sat down with Michael Galego, Deputy General Counsel and Secretary of Pacific Rubiales (

TSX:T.PRE,

Stock Forum), the largest non-state owned oil company operating in Colombia (produces ~126,000boe/d).

Although interested in Pacific Rubiales, the reason for our meeting was to get an introduction to a much earlier-stage company that he and other key Pacific Rubiales members are involved with;

CGX Energy.

Mr. Dewi Jones, CEO of CGX Energy (Photo: CGX Energy)

Mr. Dewi Jones, CEO of CGX Energy (Photo: CGX Energy)

After hearing the story from Mr. Galego in Pacific Rubiales’ impressive downtown Toronto offices, he arranged for me to have a call with the Houston based CEO of CGX, Mr. Dewi Jones.

CGX holds one of the largest packages of petroleum blocks in the Guyana-Suriname basin. They are targeting multi-hundred million barrel shallow water targets which, if successful, could mean an exponential increase to their share price from current levels.

“Thank you for your interest in CGX, we are very excited,” Mr. Jones told me with a thick Colombian accent.

The Guyana-Suriname Basin:

The Guyana-Suriname basin is one of the last true frontier hydrocarbon basins in the world.

In 2000, the

United States Geological Survey identified the Guyana-Suriname basin as having the second highest resource potential in the unexplored basins of the world with estimated mean recoverable oil reserves of over 13.6 billion barrels and 32 trillion cubic feet of gas reserves.

The basin is estimated to hold more than 117 fields with > 1 million barrels of recoverable oil each, 24 fields with elephant potential of > 100 million barrels of recoverable oil each and 6 with > 500 million barrels of recoverable oil each.

Mr. Jones is a +25 year veteran of the international E&P sector where he was most recently the Manager of Exploration for the Caribbean region with Repsol YPF S.A. (the Spanish integrated oil and gas major).

“We are very enthusiastic about this basin,” he tells me.

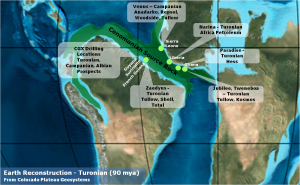

The rock that hosts huge oil endowments offshore West Africa, is the same that is found in the Guyana-Suriname basin (Image: CGX Energy)

The rock that hosts huge oil endowments offshore West Africa, is the same that is found in the Guyana-Suriname basin (Image: CGX Energy)

A geologist by training, Mr. Jones explains that the first thing he looks for when exploring for hydrocarbons is a world-class source rock. He claims the source rocks found in the Guyana-Suriname basin are analogous to those in West Africa as well as Colombia, Venezuela and Trinidad and Tobago (where he spent time with

Repsol).

The source rock here is the Cenomanian-Turonian Canje Formation. The majority of the resource potential here is found in the Lower Tertiary to Cretaceous turbidite fans (the best play-type among offshore targets in the Atlantic basin including those found in West Africa and Brazil).

The best analogy here is the Gulf of Guinea in West Africa which stretches from Guinea to Angola and includes major oil producing nations such as: Nigeria, Ghana, Cote d’Ivoire, DRC, Congo, Gabon and Cameroon. According to the

US Energy Information Administration, Nigeria alone produces over 2.5 million barrels of oil per year (2011) and holds 37 billion barrels of crude oil in proven reserves.

Venezuela, bordering Guyana to the northeast, is home to an estimated 211 billion barrels of oil in proven reserves (US Energy Information Administration).

The source rock, Mr. Jones speaks to, clearly holds world-class oil and gas

potential.

CGX Energy:

CGX Energy has a market capitalization of less than $20 million and an enterprise value of ~$8 million ($10 million in cash as of Dec 31/13).

The company underwent a restructuring in July last year and consolidated its shares 10-for-1.

“This really is the new CGX,” says Mr. Jones.

What intrigued me most about the company, was not only did it have some of the leading energy entrepreneurs in Latin America (namely Serafino Iacano, Ronald Pantin and Jose Francisco Arata – all founders of Pacific Rubiales), but also that this micro-cap company held one of the largest land packages with enormous prospective resource potential in the Guyana-Suriname basin.

The play is big. They are targeting shallow water offshore prospects with large commercial potential. These are elephants, most in excess of 100 million barrels of recoverable oil. Well costs can be +$100 million so obtaining a partner (or partners) is critical. Being the first movers in the basin, they say they were able to obtain the best blocks, however, they still need to find a partner to make it work.

CGX is roughly 64%

owned by Pacific Rubiales on a non-diluted basis. It was evident by Mr. Jones’ tone that he is thrilled to have Pacific Rubiales as a partner.

“Pacific Rubiales has one of the smartest technical and financial teams in the space and we have the benefit of using their expertise in the sector as we need,” he explained.

2012 Offshore Drilling:

In 2012, CGX drilled two offshore wells; Jaguar-1 and Eagle-1.

Jaguar-1 was located on the Georgetown Petroleum Prospecting License with CGX holding a 25%-interest with partners, Repsol (15%-operator), YPF (30%) and

Tullow (30%).

The well was targeting a Turonian zone at a depth of 6,500m. Later in the year, the well reached a depth of 4,876m but had to be plugged and abandoned for safety reasons.

The well, although unsuccessful at reaching its target depth, did encounter light oil shows in two Late Cretaceous turbidite sands.

The shares were cut in half on the results of Eagle-1 and again when Jaguar-1 had to be plugged.

After seeing the potential of the initial target, and bearing the frustration of having to abandon such a promising well, CGX made it clear it intended to continue with the Georgetown block. Repsol, as operator, was responsible for maintaining the license. They let the license lapse without informing CGX and then proceeded to re-acquire the license under 100% interest and subsequently farmed-out a 30% working interest to Tullow.

In late 2013, CGX initiated arbitration against Repsol and was able to obtain an

injunction from the Commercial Court of Guyana restraining Repsol from closing an additional 30% farm-out agreement in the license.

When I asked Mr. Jones how the Georgetown block stands up against Corentyne, he responded: “I’m much more excited to drill into the Corentyne block as it appears to be a shallower target with a better geologic formation than the targets we went after in Jaguar-1. The risk-reward is significantly better here.”

The other well they drilled in 2012 was Eagle-1 which was drilled to a target depth of 4,200m and tested the Eocene and Maastrichtian/Campanian zones.

The well encountered oil shows and although wire-line logs were encouraging, they needed to do additional open hole logs to determine the nature of the fluids. After pressure testing and fluid sampling, the sandstone reservoirs proved to be water bearing.

Eagle-1 cost ~$71 million to complete.

The Blocks:

CGX is in the basin with majors and super-majors including Shell, Tullow and Inpex (Image: CGX Energy)

CGX is in the basin with majors and super-majors including Shell, Tullow and Inpex (Image: CGX Energy)

CGX holds three majors blocks, two offshore and one onshore: the Corentyne, Demerara and Berbice (onshore). The Corentyne block is their current focus and covers over 1.5 million acres in the shallow waters offshore Guyana.

The

Corentyne block is surrounded by majors and super-majors including Esso, Shell, Inpex, Repsol and Tullow.

A 2012 resource estimate completed by Gustavson estimate prospective (P50) resources at 2.5 billion barrels over two targets (the Eagle Upper Turonian – 1.2 billion barrels and the Lower Turonian – 1.3 billion barrels).

This massive potential was

reconfirmed in a 2013 report completed by DeGolyer and MacNaughton which showed prospective (P50) resources to be 779 million barrels of oil, 743 million barrels of condensate, 6,943 billion cubic feet of sales gas and 696 billion cubic feet of solutions gas (~2.79 billion barrels of oil equivalent).

The first well planned for the Corentyne block will target the Eagle Deep and aims to test all of the geologic zones present there.

The Eagle Deep prospect they are targeting could hold a total of over 800 million barrels of oil according to the DeGolyer and MacNaughton report.

Applying a conservative $5 value to those potential barrels, that is potentially worth $4 billion (gross).

Assume whatever ownership they would maintain in a joint venture you want and if successful, the value gap from current levels is still exponential.

CGX are committed to complete 2 wells on the Corentyne block by November 2016.

There are 6-8 wells planned by the companies exploring in the basin between now and 2016. If anyone can make a discovery in the Guyana-Suriname basin, it would be game changing for everyone active there, but especially CGX given their market cap (leverage to the play).

“These frontier basins are always a statistics game. With a geological setting like we see here, it is just a matter of how many wells it takes for someone to make a discovery,” Mr. Jones tells me, explaining from his years of experience in other frontier oil basins around the world.

The fact there is already an onshore heavy oil discovery makes the theory even more compelling. In other basins similar to this, an onshore heavy oilfield is typically present, Mr. Jones informs me.

The Tambaredjo and Calcutta fields, operated by

Staatsolie, onshore Suriname hold oil (in place) resources of close to 1 billion barrels of oil and produces ~16,000bbls/d.

The

Demerara licence comprises roughly 1 million acres, also offshore Guyana. They have an old seismic data set which has led them to identify two potential targets; a toe thrust as well as an amplitude target.

To refine these they are planning to shoot a new 3D seismic survey to bring these to the drill-ready stage. The Demerara license was issued in February 2013 and is valid for up to ten years (renewable after four). During the first four years, they are committed to shooting 1,000 square kilometers of 3D seismic and one exploration well.

Catalysts:

Management, along with assistance from Pacific Rubiales, is currently re-interpreting the seismic data on the block.

“Due to our large acreage, we are getting a lot of interest from the players in the basin as well as the ones trying to get in,” Mr. Jones tells me.

As part of the most recent licence commitments, they have to spud their first well on the Corentyne block by Q2/2015.

Because these are complex offshore operations, the wells take time to define, refine and construct.

They have committed to a total of 3 wells and some seismic work, with an estimated total gross capital spend of ~$420 million (of which CGX will only be responsible for a fraction of, assuming a partner earns in).

The total gross cost of the first Corentyne well will depend on which prospect is chosen for drilling and is estimated to be between $80 and $135 million.

These are big, expensive, high impact targets and that is why successfully negotiating joint venture agreements with the majors or large independents is crucial.

They won’t have to drill the Demerara block until the second half of 2016 but will shoot 3D seismic on the block in Q3/2014. They continue to seek joint ventures for this offshore block as well.

Closing:

Due to the nature of these high impact offshore plays, it is sometimes difficult to determine a value.

Often these are binary in nature, meaning they either have success or they don’t.

However, in CGX’s case there are a few caveats:

1.) They are backed, financially and technically, by Pacific Rubiales which is one the most successful oil explorers in Latin America (over 80% success rate).

2.) They hold some of the largest and most prospective blocks in the Guyana-Suriname basin, which is seeing a revival in exploration and development work.

3.) They have already drilled wells targeting similar depths and formations and as a result they have learned from them.

OYL

OYL data by

YCharts

Remember, they are targeting elephants here. These are between 100 and 800 million barrel targets. Do they cost a lot? Yes. But, unlike many targets, these will actually move the needle for major international oil companies, especially given this basin has still yet to see a major oil discovery. Given CGX’s current cash position (~10 million) they will have to finance their part of a joint venture.

The value of these types of discoveries, if validated through successfully and economically flowing wells, is in the billions of dollars.

The most significant near-term catalyst that should move the stock will be to have a joint venture partner (or partners) commit for a substantial portion of the exploration expenditures on the Corentyne or Demerara blocks. This will be a huge validation for their play and will mean many millions of dollars of work will be committed by someone else (and someone else’s bank account).

Add to that the fact that if any of the 6-8 wells planned in the basin make any type of significant oil/gas discovery, then there will surely be a surge in activity which will increase CGX’s share price; many multiples from current levels.

Disclaimer: The author is not a registered investment advisor and this is not investment advice. This is an extremely high-risk small-cap stock. All facts to be verified by the reader. Always do your own due diligence.