It’s game on in the resource space at long last. There are plenty of market players that are still cautious but that is how it should be early in a bull market. Technically, we need to be 20% off the bottom for a Bull to be official but it seems very unlikely we won’t get there now.

As this issue was finished the Crimea announced the voting result everyone expected. It hasn’t generated a negative impact but it’s too early to sound the all clear on that. It will be a few days before all the political players have read their lines so things could still go wrong. I don’t expect too many surprises which means I don’t expect higher gold prices because of Ukraine but the chance of more serious repercussions is real enough.

The elevated rate of financings continues. Most of it is still going to producers or companies drilling existing exploration successes. More important will be fund raising for new ideas but we are not quite there yet.

I did add a new company this issue and I plan to add a few more between now and autumn. Traders are starting to bid up the stronger exploration stories and that is the time to be adding names to the list. It looks like we finally have a bull market to work with after three years of market pain. Better late than never and it did feel like never for a while there.

Another PDAC has come and gone. I spent several days in Toronto attending the PDAC and, of course, the Toronto Subscriber Investment Summit the day before the PDAC began.

I want to thank my subscribers who made the effort to attend. Attendance was good again this year and everyone seemed pleased with the companies that presented. I also want to be sure I thank Nichola Vermiere and Katy Severs.

As always with the SIS, they did the heavy lifting required to make sure the event went smoothly and was a big success. Keith, Lawrence and I show up and get the kudos but its Nichola and Katy that get it done.

The attendance was a bit lighter at the PDAC this year with an official attendance figure just over 25,000 against 30,000+ figures in 2012 and 2013. I don’t read as much into PDAC attendance as many others do. It’s important to remember that the largest contingent there is a fairly static one. Very large mining houses and countries send large contingents and there are always a few thousand attendees from the supplier side as well.

It looked like several countries tried a charm offensive to increase mining related FDI. Peru seemed to have a particularly large contingent. Guys with red Peru scarves were everywhere. I take it as positive that several favored exploration destinations decided they had to sell themselves hard. If that marketing is backed up with better access to good geology it could be a win-win.

Booths in the Investor Exchange portion of the show looked as full as last year. Some might read this as a sign the sector needs more pain but the list of attending companies did change quite a bit. This is significant. For years the PDAC had a long waiting list of companies wanting booths and those that had them rarely gave them up.

Booths at the PDAC are cheaper than those at any investor conference. If you run a company based in the GTA attending is a bit of a no-brainer.

The high booth turnover is unusual and speaks to some long overdue attrition of weaker names. A lot of the companies replacing them were plenty weak themselves though. Quite a few of the companies I looked at have no hope of doing any real exploration until a major financing is completed.

A large number of the exhibiting companies were really there trying to find a JV partner. Many major companies send representatives to PDAC to look for new projects. Some deals will come out of it but most companies left in as poor shape as when they arrived.

While there were quite a few companies that were new exhibitors there were not many that I hadn’t seen before. I’m still waiting for the turnover of stories and new projects that mark the start of many cycles. I did make the decision to add a new name to the HRA list based on discussions there but this was a company I’ve been tracking for a while. The decision was based as much as anything on the fact that other people have started to notice it.

The good thing about light news flow ahead of the conference is the reduced danger of a “PDAC Curse” this year. Yes, the junior space has had a pretty nice bounce so far but that is thanks to higher gold prices and seller exhaustion. There were only a handful of news releases that seemed to have market impact prior to the big confab. Not enough one-off spikes to generate a succeeding letdown.

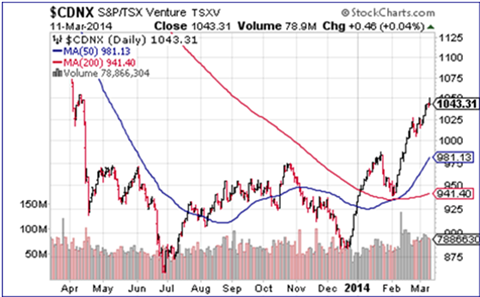

If the Venture pulls back meaningfully in the next few weeks it will be due to falling gold prices or major markets reacting to some black swan event like things going really wrong in the Ukraine. The chart above still looks fairly strong to me. The past few sessions have featured rising gold prices and weaker major markets.

That combination meant Venture Index traded better than most of its larger cousins. A fall could still happen of course but I’m impressed with the way it’s holding up so far. Similar conditions six months or two years ago would have surely led to a pullback.

There was a lot of evidence of money looking for a way back into the sector both at the PDAC and at the Subscriber Summit. There were a number of private equity and European fund representatives at both events.

I’ve been cynical on the subject of private money. It’s real enough and I’ve had approaches from a couple of groups looking for ideas. Initially these groups were very much vultures looking cheap carcasses to pick over. I haven’t seen a lot of deals announced. There seems to be a shift to stronger deals starting now and talk about taking control blocks in deals that remain public. I’m not sold yet on private equity being a savior but it should be a bigger force at least.

On the more traditional brokerage side activity has continued with a number of companies announcing financings in the $10 million plus range, most of them bought deals. That indicates new institutional interest though it’s still focused on the top of the food chain. Trading has begun to improve for companies with discoveries but no resources yet and others with good targets and money to spend. This has helped the junior sector keep rising as the small producers flattened out and awaited another leg up in metals prices.

The charts below show a contradictory picture. While NY markets are hovering near all-time highs there hasn’t been a lot of strength in either bond yields or the $US. Both are much weaker than expected, especially the latter. Bond traders might be more skeptical about weak economic readings being all weather related and the situation in the Ukraine undoubtedly has some traders buying safety nets.

Dollar weakness is more a function of its trade against the Euro than anything else from what I can see. While the US was generating negative surprises the EU was chalking up positive ones. Growth is a bit stronger than expected and more traders are deciding the EU crisis is “over”. The ECB has been taking a more hawkish tone lately as well. I think it’s too early for that but it’s put a bid under the Euro.

Most of the move off the bottom by gold was physical market demand but current trading is dominated by the situation in the Ukraine. As I noted in a recent SD I hate geopolitical gold price moves. They are unpredictable and can reverse themselves several times as events unfold. Nonetheless the market is what it is so they can’t be ignored.

I think the Ukraine situation is likely to go Russia’s way. Possession is nine tenths of the law and pretty much the entire Crimean peninsula is a Russian military base. That has been the case for a couple of hundred years. The only reason it’s officially part of Ukraine is that Khrushchev thought it made administrative sense to join it up 60 years ago.

Back then no one was seriously contemplating the breakup of the Soviet Union.

I’m not commenting on the equity or ethics of the situation, just the geopolitical realities. I don’t see the US and its allies starting a war with Russia over the Crimean peninsula and I am highly skeptical that the EU will enforce sanctions with any real teeth against the country that supplies the bulk of its natural gas. Perhaps I’m being too cynical but that is the way I see it.

We’ll have to see how Ukrainians react to Russia effectively annexing the Crimea even if its done “democratically”. Obviously, they wouldn’t stand a chance against Russia in a real shooting war. Even so, there could be enough partisans calling for western help as they blow up bridges and rail yards to keep a bid under the gold price. Not a great scenario but not one to hurt the gold market.

No one who hasn’t lived under a rock since Putin became the leader of Russia is surprised how the vote in the Crimea went. We’ll see how the arm waving and sabre rattling unfolds after that vote but I wouldn’t be short gold with all this going on.

The picture is rather different on the base metal side, particularly in copper, iron ore and coal. What those markets have in common is the dominance of China as a buyer. China’s growth has been slowing and traders are getting increasingly concerned about the shadow banking sector.

That’s weighing heavily on base metal markets. Charts for iron ore, copper and the Reuters CRB commodity index appear on the previous page. Interestingly, the CRB looks like its broken a 3 year downtrend. That significant but the big gainers are energy (natgas) all “softs” - coffee and sugar—all weather related price moves.

I’ve noted before that while LME warehouse inventories have dropped rapidly I’m not comfortable I know where it’s all going. Some is being consumed but I’m concerned a good portion of the drawdown is going to non LME bonded warehouses. The buyers might be planning to consume or resell it but its not out of the market yet.

In the past couple of sessions iron ore and copper in particular have gotten slapped down hard. Some of this selling followed on the first major corporate bond default in China on March 6th. Traders are worried the “there’s never just one cockroach” theory will apply to corporate China. I agree. There will definitely be more bankruptcies. There should be if the system is functioning properly.

The question is how traders react to events. There wasn’t much panic as the default was well telegraphed. Very weak stats on China’s February trade balance looked scarier. It’s hard to tell because the Lunar New Year skews things so much. Also important is that there was fake overbilling by exporters last year and perhaps fake under-billing this year.

This isn’t done to fake the trade figures. Companies were overbilling so that inflated invoices could be “paid”, allowing money to flow into China and avoid currency controls. On top of the trade numbers there were indications that the Bank of China is starting to succeed in squeezing credit demand. I suspect some copper and iron ore are being used as loan collateral in leveraged trades.

When the loan gets called the metal must be sold. We have to wait to see how this plays out but until the market calms assume there is more downside in copper and iron ore and hold off accumulating in those subsectors. You may get better deals later.

On the gold side I think we’ve got the “all clear”. Pick weak days but if you have been waiting to accumulate producers and those with viable resources and good exploration targets I wouldn’t wait longer. As long as Ukraine doesn’t blow up I see the rally continuing through spring.

?

Eric Coffin, editor of HRA Advisories presented at the Toronto Subscriber Investment Summit on March 1st, 2014. Click here to view the video, "You Can Come Out Now".

Eric Coffin, editor of HRA, looks for companies with the potential to at least double over one or two years based on asset growth and development of metals deposits for production or take over by larger companies. HRA also uncovers high risk/high potential exploration plays, the kind of "swing for the fences" trade that can yield returns of hundreds or even thousands of percent.

Eric and his late brother, David Coffin, were early proponents of the commodity super cycle and correctly called a rapid turn in the markets and positioned readers in early 2009 when most commentators were expecting years of bear markets. This broad experience and hard work helped to generate an average gain of over 200% for nearly 100 companies tracked in the 2003-2013 period, including over 20 that were taken over by larger companies.

The HRA-Journal and HRA-Special Delivery are independent publications produced and distributed by Stockwork Consulting Ltd, which is committed to providing timely and factual analysis of junior mining, resource, and other venture capital companies. Companies are chosen on the basis of a speculative potential for significant upside gains resulting from asset-based expansion. These are generally high-risk securities, and opinions contained herein are time and market sensitive.

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer, solicitation or recommendation to buy or sell any securities mentioned. While we believe all sources of information to be factual and reliable we in no way represent or guarantee the accuracy thereof, nor of the statements made herein. We do not receive or request compensation in any form in order to feature companies in these publications. We may, or may not, own securities and/or options to acquire securities of the companies mentioned herein. This document is protected by the copyright laws of Canada and the U.S. and may not be reproduced in any form for other than for personal use without the prior written consent of the publisher. This document may be quoted, in context, provided proper credit is given.

©2010 Stockwork Consulting Ltd. All Rights Reserved.

Published by Stockwork Consulting Ltd.

Box 85909, Phoenix AZ, 85071 Toll Free 1-877-528-3958

customerservice@hraadvisory.com / https://www.hraadvisory.com