In Here: Powertech Uranium | Abitibi Royalties | Angkor Gold

TAIPEI -- Keeping in the

TCR family is what I call it.

Uranium executive

Alex Molyneaux, a TCR member, is with privately held Azarga and was for a time CEO of sputtering

SouthGobi Resources (

TSX:T.SGQ,

Stock Forum). The 39-year-old Aussie plans on being chairman of

Powertech Uranium (

TSX:T.PWE,

Stock Forum) after it merges with Azarga.

The thesis here -- on adding PWE to my holdings -- is a seemingly insatiable appetite that high-risk investors have for uranium equities. [I also own Lakeland Resources (

TSX:V.LK,

Stock Forum) and Virginia Energy, along with obscure Uranium Valley Mines.]

Powertech, if it consummates the Azarga marriage, will have assets or uranium stakes in Turkey,

USA (

South Dakota, Wyoming) and Australia. At this price (8 cents Canadian and $12 million market worth), Powertech probably will get attention from funds in New York, London and Toronto.

Also from dice-rolling funds in Taipei, Singapore and Hong Kong, where Azarga and Mr. Molyneaux have offices, uranium warehouses and other interests.

Powertech has its HQ in Denver. Mr. Molyneaux has lots to prove. His exit from SouthGobi Resources came after a failed merger with a China entity. At one time, the Mongolia cousin to

Turquoise Hill (

TSX:T.TRQ,

Stock Forum) (formerly Ivanhoe Mines's Oyo Tolgoi copper-gold developer) was worth more than $1 billion in the stock market. Now, SouthGobi looks as if it could see

cash sources shrivel in a dire met-coal market. Alex has as many critics as he does supporters in Asia and North America.

Alex tells me this week in Taipei that the new entity will be fully financed to 2016. If that is so, and if Mr. Molyneaux succeeds in finding a 9.9 percent owner with deep pockets, Powertech looks poised for at least a 50 percent share rise in coming weeks.

As he explains it, all Azarga shareholders will be "locked up," and prevented from selling shares of the new PWE for one year. Some 75 percent of them are restricted for two years, Mr. Molyneaux says.

Alex also sits on the board of Ivanhoe Energy (

TSX:T.IE,

Stock Forum).

Please see uranium headlines at close of this report.

Heads-up on

Abitibi Royalties: You might think 15,000 shares of trading in an obscure Canada mining equity gets barely a sniff of interest from snobby Quebec investors.

Mais non. Ca va pas.

Serial CEO

Glenn J. Mullan's Abitibi Royalties (

TSX:V.RZZ,

Stock Forum) is getting attention today Tuesday. The Osisko joint venture partner at the Malartic hails from the Abitibi Greenstone belt in Val-d’Or, Quebec. Abitibi holds two pieces of property claims at

Canada’s largest gold mine: Canadian Malartic Mine, which is the work of Osisko Mining.

Mr. Mullan tells me the takeover headlines swirling around Osisko have prompted greater exposure of Abitibi's net smelter royalty and 30 percent working interest at Malartic.

Abitibi shares have doubled in mere days because of that greater attention and a PDF file making the rounds. There is no other news out there from Mr. Mullan's company.

I have owned RZZ since the July 2011 creation of Abitibi from a three-way distribution of

Golden Valley Mines (

TSX:V.GZZ,

Stock Forum). The three-way spin was Canada's first equity distribution to do a triplet. The other two companies were a uranium developer and a nickel property -- both of which I still own as KZZ and VZZ. [Mr. Mullan of Montreal and Vancouver is a TCR family member.]

Here is something straight out of that investor presentation circulating in Quebec and Ontario: Abitibi says, "

Hypothetical Profit Allocated to RZZ: $63,000,000 Hypothetical Value* per RZZ share: $6.85."

RZZ, or Abitibi, has 10 million shares outstanding, so it is worth about $10 million right now. About 30,000 RZZ shares in Canada have changed hands this month of April. This is more than any month, I believe, since January 2014.

The company could start receiving a Malartic royalty as soon as this year of 2014, I understand. Whether it distributes anything to shareholders remains to be seen.

Golden Valley Mines owns about two-thirds of Abitibi. So GZZ will receive royalties as well via its stake holding.

My royalty meter will be gauging RZZ, along with my other royalty-related holdings: Eurasian Minerals (

TSX:V.EMX,

Stock Forum) and TCR 8 member

Angkor Gold (

TSX:V.ANK,

Stock Forum).

Speaking of

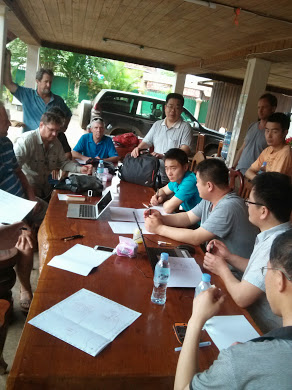

Cambodia, I continue to develop a report on Angkor Gold. The focus will be the China geologists and engineers we just left in Ban Lung, Ratanakiri Province.

A

At the table with Angkor Gold's operations chief J P Dau and senior geologist Kurtis Dunston are technicians from new Angkor Gold partner Beijing Eplo-Tech Engineering Co. Ltd. (

BETEC) and China Chemical Geology and Mine Bureau Shandong Geological Prospecting Institute --

Thom Calandra credit.

Not sure if this is out there yet, but I just left yet another group from

outside Cambodia, one that is performing research of ANK's property portfolio: seven licensed minerals concessions in Cambodia, the most of any prospector. ANK already has China and India partners, It will receive a

7 percent net smelter royalty from its India joint venture partner

Mesco Gold, operator of the

Phum Syarung gold mine rapidly rising, in my own on-site review, on Angkor Gold property in northeast Cambodia.

That royalty could come as early as December 2015 and possibly sooner, Mesco Steel Chairman

J K Singh tells me.

I purchased more ANK shares the other day and continue to build a large stake in

Mike Weeks' Angkor Gold. Another TCR-fueled report is available:

at CEO.ca.

Those uranium headlines:

China Premier Plans to Boost Clean Energy

China, the world’s biggest investor in renewable energy, reiterated plans to boost construction of solar and wind power plants. The nation will also ?start ?erecting ?nuclear power projects in eastern coastal areas, according to Premier Li Keqiang.

?To read: ?click here

China Buying Westinghouse Reactors for $24 Billion Projects

China may sign as early as next year the first of several contracts for eight new reactors from Westinghouse Electric Co., as ?the nation presses ahead with the world's biggest civilian nuclear power expansion since the 2011 Fukushima accident in Japan.

https://www.reuters.com/article/2014/04/21/china-nuclear-idUSL3N0ND1GS20140421

?

Niger Could Sign New Deal with AREVA Within Days

The government of Niger, the world's fourth largest uranium producer, is on the verge of renewing an agreement with French state-controlled nuclear group AREVA, the West African nation's mines minister says.

https://news.yahoo.com/niger-could-sign-deal-areva-within-days-mines-072758752.html;_ylt=AwrBJSCXMlVTKHMABvPQtDMD

Australia: Analyst Hopeful About New Uranium Export Market

A commodities analyst says there's hope for investors in uranium mining in far-west New South Wales, with a new uranium export market opening in the Middle East.

https://www.abc.net.au/news/2014-04-21/analyst-hopeful-about-new-uranium-export-market/5401658

Nuclear Energy to Take Center Stage in Taiwan Politics

?Nuclear energy is set to take center stage as mid-term elections in Taiwan ROC ?draw near.

?

https://www.globalpost.com/dispatch/news/kyodo-news-international/140421/nuclear-energy-take-center-stage-taiwan-politics

?

China Will Have 88 Giga -watts of Nuclear Power by 2020

China's nuclear power installed capacity, including that in operation and under construction, is predicted to top 88 GWe by 2020, says the chief of China Nuclear Energy Association.?

?

https://nextbigfuture.com/2014/04/china-will-have-over-88-gigawatts-of.html

?-- Thom Calandra

?

Thom Calandra

@thomcalandra for Twitter