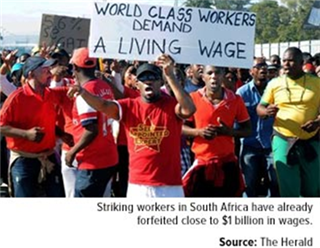

All eyes are on South Africa, where a labor strike, now in its fifth month, has brought a halt to the production of platinum and palladium. As a result, platinum prices have inched up 8.25 percent this year to just under $1,500 an ounce, while palladium prices have surged 19.28 percent to over $850 an ounce, a three-year high.

the production of platinum and palladium. As a result, platinum prices have inched up 8.25 percent this year to just under $1,500 an ounce, while palladium prices have surged 19.28 percent to over $850 an ounce, a three-year high.

The downside to this activity is that even before the strike broke out in January, platinum and palladium had supply issues. A British geological survey, in fact, placed the platinum group metals (PGMs) on its supply risk index in 2012, ranking them 13th among 41 “endangered” elements of economic value. One of the primary reasons for this is that approximately 80 percent of palladium and 70 percent of platinum production is concentrated in only two countries, South Africa and Russia

Now, with the former country in the throes of its costliest strike ever and the latter experiencing economic sanctions because of its aggression against Ukraine, the world faces an even greater shortage risk of the precious metals.

Stocks are running low.

The worldwide demand for palladium is strong, driven predominantly by the automotive industry, which uses 67 percent of the metal’s global supply to manufacture catalytic converters, or mufflers. Because a growing number of countries are tightening carbon emission standards, the demand for the metal is increasing. So too are supply deficits, which might soon reach a 30-year high.

The largest South African producers have so far managed to make good on their deliveries by tapping into their reserves. But the well is drying up fast.

“We probably have another six to eight weeks to go before producers run really low on material they’ve stockpiled,” Standard Bank analyst Walter de Wet told Reuters in late May.

Even if a firm resolution were reached this week between top PGM producers and the Association of Mineworkers and Construction Union (AMCU), the group leading the strike, active mining wouldn’t resume for at least another three months.

“AMCU members are steadfast,” Joseph Mathunjwa, President of the AMCU, told Reuters, “and we are not turning back” on the demand for a wage hike to 12,500 rand ($1,200) a month.

Neither, it seems, are the producing companies, who claim they can’t meet the AMCU’s wage demands without being forced to slash jobs and shutter mines.

At the same time, companies are eager to resume production, having already lost a combined $2 billion. For each day the strike drags on, 10,000 ounces of platinum and 5,000 ounces of palladium are lost.

As of this writing, the production companies have offered the AMCU a wage deal which Mathunjwa has yet to sign it, despite urges from his fellow mine workers.

When one door closes…

As worrisome as this news might sound, there is a silver—or, shall I say, platinum—lining. The strike in South Africa and Western tensions with Russia have given Stillwater Mining Co. (NYSE: SWC, Stock Forum), the only U.S. producer of PGMs, an opportunity to grow its global market share.

The company, which we own in our Global Resources (PSPFX) and Gold and Precious Metals (USERX) Funds, announced in a press release last month that it has agreed to a five-year, multimillion-dollar refining and sales contract with Johnson Matthey, the third-largest manufacturer of auto catalysts in the world.

“We believe that this agreement provides numerous benefits to both parties at a time in the PGM industry when supplies are constrained and demand for our products continue [sic] to grow,” noted Mick McMullen, Stillwater’s president and CEO.

Located in Billings, Montana, Stillwater extracts its PGMs from the J-M Reef in southern Montana, the only known large-scale source of the rare metals in the U.S. The mine contains some of the world’s highest-quality ore grades.

Although McMullen sees the strike in South Africa as an opening to a stronger foothold in the global PGM market, he is hesitant to ramp up production too impulsively. Speaking with the Wall Street Journal, he explained that he would prefer to keep production costs down to maximum shareholders’ returns.

Stillwater’s net income in the first quarter, $19.6 million, was up 34 percent from the same time a year ago.

To receive the latest updates on this story, be sure to follow our Investor Alert.

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by visiting www.usfunds.com or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Distributed by U.S. Global Brokerage, Inc.

Foreign and emerging market investing involves special risks such as currency fluctuation and less public disclosure, as well as economic and political risk. Because the Global Resources Fund concentrates its investments in specific industries, the fund may be subject to greater risks and fluctuations than a portfolio representing a broader range of industries. Gold, precious metals, and precious minerals funds may be susceptible to adverse economic, political or regulatory developments due to concentrating in a single theme. The prices of gold, precious metals, and precious minerals are subject to substantial price fluctuations over short periods of time and may be affected by unpredicted international monetary and political policies. We suggest investing no more than 5% to 10% of your portfolio in these sectors.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Fund portfolios are actively managed, and holdings may change daily. Holdings are reported as of the most recent quarter-end. Holdings in the Global Resources Fund as a percentage of net assets as of 03/31/2014: Stillwater Mining Company 0.95%. Holdings in the Gold and Precious Metals Fund as a percentage of net assets as of 03/31/2014: Stillwater Mining Company 0.26%.

By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

url: /south-africa-strike-platinum-palladium-prices-stillwater-mining