A little pillow talk turned her husband on to bonds

One study done by Wells Fargo earlier this year found that nearly half of Americans find it harder to discuss money than other touchy topics such as politics or religion. Even after being married to someone for years, talking about money isn’t always easy – especially if your views differ.

In this hypothetical story you’ll meet a couple who learned that when it comes to investing, verbalizing their concerns helped them find a balanced approach, one they are both thankful for today.

Meet George and Karen.

In 2014 George turned 67 years old and Karen turned 64. Each morning over breakfast George and Karen would watch the news. They liked to see what was going on around the world, and were particularly interested in economics. George had been retired for two years and Karen retired about six months ago.

“I’m sure glad you listened to me when I told you we’re too old to be so risky with our money,” Karen said as she nudged George and motioned her head to the news story on the television. Oil prices were plummeting and the stock market was feeling it. Global economies were all dealing with issues of their own.

“Seeing all of this market drama reminds me of the dotcom bubble, not to mention what happened to stocks when 9/11 happened,” she said.

George smiled and recalled his wife’s persistence in being extra cautious with their savings as they approached retirement. Fourteen years ago, back in 2000, they had finally sat down to decide where they would invest the $100,000 they had built up over the years and saved outside of their 401(k)s.

George had approached Karen with his plan for supplementing their retirement savings. They would take the $100,000 from their savings account and put it into an S&P 500 index fund, sit back and watch it grow. He knew this would allow them to retire even earlier than planned because the S&P had gone up with a compounded return of 18 percent per year for the decade of the roaring 90s. The two already had 401(k) and IRA accounts, but this money came from years of strict saving.

Karen hadn’t disregarded her husband’s fool-proof plan for their money; in fact she acknowledged the impressive performance the S&P had been delivering. Investing would surely earn them more than their savings account would, but she was fearful of going “all in.”

Karen had told George she was worried about putting all of their hard-earned money into an S&P 500 index fund. She was aware that past performance was no guarantee of future results and had reminded George of this. Her husband, the more aggressive investor, still felt Karen would thank him if only she would follow his advice.

Uneasy about the situation, one night Karen spoke up again. She told George that since the savings account was a combination of their years of disciplined savings, they should compromise on how to invest the money. Somewhat reluctantly, he agreed.

The next day, George put 50 percent of the money into an S&P 500 fund, while Karen placed the other half into short-term, investment grade municipal bonds. They agreed to rebalance their allocations annually. As the decade progressed, the couple watched the ups and downs in the market.

In the end, their capital was nurtured.

Thinking back to that uncertain time, George scanned the negative headlines that flashed across the screen. After all these years, he finally found it within himself to express his gratitude that Karen had made the decision to place a part of their savings in a safer investment vehicle.

“It was a smart move, Karen,” he said with a smile. “Luckily we were able to avoid the stress of a lot of the dips. You know my buddy Will ended up losing 40 percent of all his money, right?”

George’s friend Will had sold out of equities on a dip during the 2008 financial crisis. He lost a large portion of his initial investment due to his 100-percent investment into an index fund.

Karen nodded because she remembered like it was yesterday. She remembered Will calling her husband completely destroyed. His years of hard work were gone at the hands of an all-in-one, risky investment allocation.

“That could have been us,” continued George. “Thank god it wasn’t.”

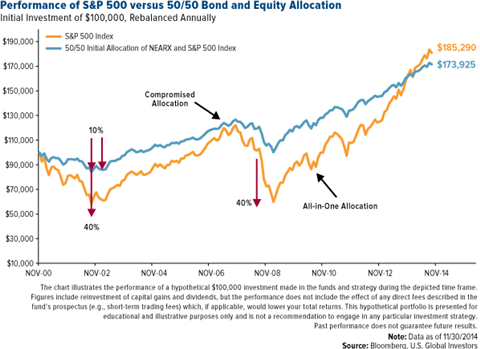

Take a look at the chart below. What would have been restless nights for George through those years were moderated by the effect of the short-term muni fund Karen chose. And the great leaps in the S&P 500 that Karen would have missed out on were captured by her husband’s 50-percent allocation.

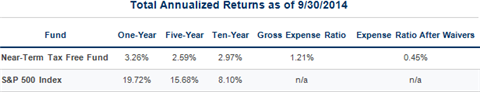

Over 14 years, if Karen and George had put all of their money into an S&P 500 fund, they would have earned $185,290. But with the 50-percent allocation in a short-term municipal bond fund, such as the Near-Term Tax Free Fund (NEARX), they were around 6 percent short of the full returns from the S&P exposure, coming in at $173,925.

So was George right? Not necessarily.

Was the slight difference in returns worth the huge dips and pops experienced over time by a 100-percent allocation to the S&P 500, not to mention the added stress and anxiety? As you can see, the muni bond fund added a regulating effect, allowing the couple to sleep better at night during this time. Karen and George missed several massive drops along the way, no longer fearful that their years of savings would diminish before their eyes.

Although we cannot guarantee how the fund will perform in the future, NEARX has historically shown an ability to dodge the dramatic swings and volatility in the equity market, similar to the ones we experienced during the first decade of the century.

Of course there will be times when equities like an S&P 500 index fund will strongly outperform the 50/50 allocation to the S&P and NEARX combo, but George and Karen’s story is one example of how these two investment strategies have previously performed.

“I guess I owe you one, dear,” George told Karen as she offered to take his breakfast plate from the table.

“You know, I would have to say the same,” Karen said. “We make a good team. I need a little risk in my life – otherwise, how boring would it be?” She winked at George.

Karen and George’s story is simply one allocation strategy to having a well-diversified portfolio: allocate 50 percent to equities like the S&P 500 stocks and 50 percent to a muni bond fund like NEARX. A short-term municipal bond fund, invested in high credit quality names, can act as a buffer for your riskier investment choices, no matter your age.

Our Near-Term Tax Free Fund could be what you’re looking for. NEARX has recently received the coveted 5-star overall rating from Morningstar, among 173 Municipal National Short-Term funds as of 11/30/2014, based on risk-adjusted return. To learn more about how the Near-Term Tax Free Fund might fit into your portfolio, request an information packet here.

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by visiting www.usfunds.com or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Distributed by U.S. Global Brokerage, Inc.

Morningstar ratings based on risk-adjusted return and number of funds

Category: Municipal National Short-term funds

Through: 11/30/2014

Expense ratio as stated in the most recent prospectus. The expense ratio after waivers is a contractual limit through December 31, 2014, for the Near-Term Tax Free Fund, on total fund operating expenses (exclusive of acquired fund fees and expenses, extraordinary expenses, taxes, brokerage commissions and interest). After December 31, 2014, this arrangement will become a voluntary limitation that may be changed or terminated by U.S. Global Investors at any time, which may lower the fund’s yield or return.Performance data quoted above is historical. Past performance is no guarantee of future results. Results reflect the reinvestment of dividends and other earnings. For a portion of periods, the fund had expense limitations, without which returns would have been lower. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance does not include the effect of any direct fees described in the fund’s prospectus which, if applicable, would lower your total returns. Performance quoted for periods of one year or less is cumulative and not annualized. Obtain performance data current to the most recent month-end at www.usfunds.com or 1-800-US-FUNDS.

Bond funds are subject to interest-rate risk; their value declines as interest rates rise. Though the Near-Term Tax Free Fund seeks minimal fluctuations in share price, it is subject to the risk that the credit quality of a portfolio holding could decline, as well as risk related to changes in the economic conditions of a state, region or issuer. These risks could cause the fund’s share price to decline. Tax-exempt income is federal income tax free. A portion of this income may be subject to state and local taxes and at times the alternative minimum tax. The Near-Term Tax Free Fund may invest up to 20% of its assets in securities that pay taxable interest. Income or fund distributions attributable to capital gains are usually subject to both state and federal income taxes.

The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies.

Morningstar Ratings are based on risk-adjusted return. The Morningstar Rating for a fund is derived from a weighted-average of the performance figures associated with its three-, five- and ten-year Morningstar Rating metrics. Past performance does not guarantee future results. For each fund with at least a three-year history, Morningstar calculates a Morningstar Rating based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a fund’s monthly performance (including the effects of sales charges, loads, and redemption fees), placing more emphasis on downward variations and rewarding consistent performance. The top 10% of funds in each category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars and the bottom 10% receive 1 star. (Each share class is counted as a fraction of one fund within this scale and rated separately, which may cause slight variations in the distribution percentages.)

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Diversification does not protect an investor from market risks and does not assure a profit.