The U.S. 10-year Treasury bond yield fell below 2 percent on Tuesday. Its global peers Japan and Germany have similarly witnessed their 10-year yields drop in recent weeks, though slightly more dramatic, hitting close to the zero mark.

This news, along with economic uncertainty out of the eurozone, will have investors seeking higher-yielding alternatives in the bond market.

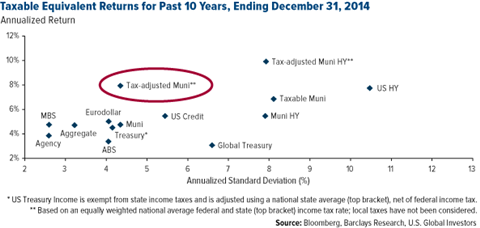

One place investors can look is to municipal bonds – consider the chart below.

When comparing muni bonds to similar investment options within the global marketplace, you can see that they have provided greater returns for investors on a tax-equivalent basis.

Director of Research and portfolio manager John Derrick explains that, “on a tax-equivalent basis, 5-year municipals are yielding close to 10-year Treasuries (approximately 1.95 percent), which offers considerable value, especially with the 5-year German and Japanese notes at, or very near, zero.”

We believe that in a low rate environment, there is opportunity to be found in short-term municipal bonds, like our Near-Term Tax Free Fund (NEARX). NEARX is actively managed by professionals who closely monitor the bond market and the overall interest rate environment.

“The fund is exactly what most people would expect from a short-intermediate municipal bond fund,” says John. “NEARX invests in high-quality municipals and invests for the long run with low portfolio turnover. The fund’s strong, long-term track record speaks for itself; it has a time-tested history of no drama.”

The Near-Term Tax Free Fund has received the coveted 5-star overall rating from Morningstar, among 173 Municipal National Short-Term funds as of 12/31/2014, based on risk-adjusted return. If you’re seeking an opportunity for yield and tax-free monthly income, I encourage you to turn in the direction of NEARX and request and information packet to learn more.

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by visiting www.usfunds.com or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Distributed by U.S. Global Brokerage, Inc.

Morningstar table

Morningstar ratings based on risk-adjusted return and number of funds

Category: Municipal National Short-term funds

Through: 12/31/2014

Bond funds are subject to interest-rate risk; their value declines as interest rates rise. Though the Near-Term Tax Free Fund seeks minimal fluctuations in share price, it is subject to the risk that the credit quality of a portfolio holding could decline, as well as risk related to changes in the economic conditions of a state, region or issuer. These risks could cause the fund’s share price to decline. Tax-exempt income is federal income tax free. A portion of this income may be subject to state and local taxes and at times the alternative minimum tax. The Near-Term Tax Free Fund may invest up to 20% of its assets in securities that pay taxable interest. Income or fund distributions attributable to capital gains are usually subject to both state and federal income taxes.

Morningstar Ratings are based on risk-adjusted return. The Morningstar Rating for a fund is derived from a weighted-average of the performance figures associated with its three-, five- and ten-year Morningstar Rating metrics. Past performance does not guarantee future results. For each fund with at least a three-year history, Morningstar calculates a Morningstar Rating based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a fund’s monthly performance (including the effects of sales charges, loads, and redemption fees), placing more emphasis on downward variations and rewarding consistent performance. The top 10% of funds in each category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars and the bottom 10% receive 1 star. (Each share class is counted as a fraction of one fund within this scale and rated separately, which may cause slight variations in the distribution percentages.)

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.