One of last year's biggest REIT stories resulted in American Realty Capital Properties Inc (NASDAQ: ARCP) Executive Chairman Nick Schorsch and then-new CEO David Kay stepping down amid accounting errors and related cover-ups.

Fast forward to Thursday and five weeks into his tenure, new CEO Glenn Rufrano hosted his first ARCP earnings call. He took the reins of a triple-net REIT in transition, which owns 4,660 properties, containing in excess of 100 million square feet, spread across 49 states, Puerto Rico, Washington D.C. and Canada.

Additionally, $8 billion cap ARCP owns non-traded REIT broker/dealer Cole Capital. The only other triple-net REIT that also manages and acquires properties on behalf of its non-traded REITs is dividend stalwart W.P. Carey Inc (NYSE: WPC).

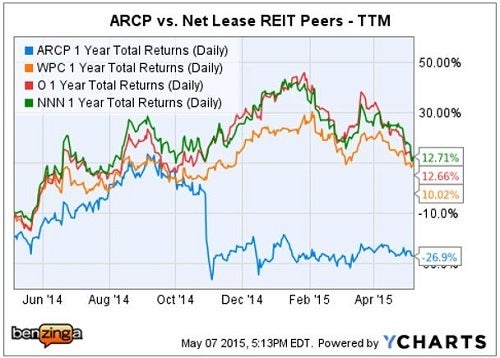

Net-lease REIT stalwarts Realty Income Corp (NYSE: O) and National Retail Properties, Inc. (NYSE: NNN) only underwrite and acquire properties for their own balance sheets. This makes for a more transparent story that is easier for Mr. Market to understand, and therefore, to fully value.

Tale Of The Tape: Past Year

ETF Risk/Return Alternative

The Vanguard REIT Index Fund (NYSE: VNQ) is a good proxy for the entire equity REIT sector and has delivered a total return of 12.75 percent to investors over the same period.

The VNQ ETF is diversified with over 144 REIT holdings, ...

/www.benzinga.com/news/earnings/15/05/5491198/arcp-ceo-glenn-rufrano-key-takeaways-from-first-earnings-call alt=ARCP CEO Glenn Rufrano, Key Takeaways From First Earnings Call>Full story available on Benzinga.com

More...

More...