`

Mercenary Alert: An Athabasca Basin Prospect Generator

A Special Alert Musing from Mickey the Mercenary Geologist

For Subscribers Only

Contact@MercenaryGeologist.com

April 26, 2015

`

Mercenary Alert: An Athabasca Basin Prospect Generator

A Special Alert Musing from Mickey the Mercenary Geologist

For Subscribers Only

Contact@MercenaryGeologist.com

April 26, 2015

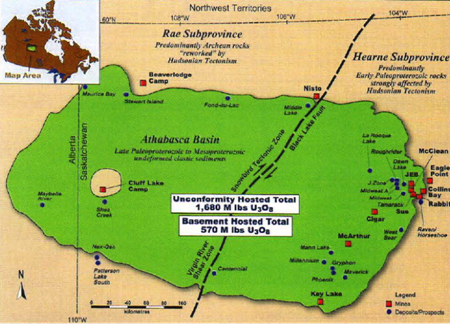

The Athabasca Basin of Saskatchewan is the world’s premier uranium province. Since its initial discovery in 1945, production, reserves, and resources have totaled over 2.3 billion pounds U

3O

8. The Basin dwarfs other uranium-producing regions in both the size and grade of its deposits. Deposits over 100 million pounds are relatively common with economic grades ranging from 1% to 25%. It currently supplies about 16% of annual world mine production.

Geology, Mines and Deposits of the Athabasca Basin (Kerr and Wallis, 2014)

Geology, Mines and Deposits of the Athabasca Basin (Kerr and Wallis, 2014)

The original mines were outcrop discoveries along the northern margin of the Basin in the mid-1940s to early 1950s. In the period from1968-70, shallow deposits were discovered at Rabbit Lake along the east-central edge and at Cluff Lake in the west central part of the province. These successes ushered in a modern exploration boom that resulted in a steady stream of more than 80 new discoveries in the Basin over the past 35 years. Most were located along the eastern side and often under thick geological cover. Recent exploration has concentrated outside the basin margins and in particular on the southwestern edge.

Two geological types of deposits are recognized:

· Unconformity-hosted deposits lie at or near the contact of the overlying basin sandstones and crystalline basement rocks. They tend to be mostly horizontal deposits with very high-grades at 5-25%, and are characterized by intense fracturing and wall-rock alteration, voluminous water inflows, and complex mineralogy.

· Basement-hosted deposits occur in high- and low-angle veins along structures within the crystalline rocks. They are of generally lower grade at 1-2% with minor wall rock alteration, lesser water inflows, and simple mineralogy.

Exploration in the Athabasca Basin, like other parts of northern Canada, is difficult due to its remote location, cold climate, low terrain with boreal forest and swamps, lack of infrastructure, and paucity of outcrop with glacial till cover. Most drilling occurs in the winter from January to April with equipment, supplies, and personnel moved onsite by ice road or helicopter. Despite these challenges, significant discoveries continue to be made, mostly because of technological advances in remote sensing, geophysics, and geochemistry.

It is expensive to explore in the Athabasca Basin, partly because of large project size. For example, a summer field season consisting of airborne geophysics, lake sediment geochemistry, ground radon surveys, and boulder prospecting commonly costs $1 million or more. A modest winter drill program can burn another $2-4 million.

Because of the high costs of exploration, many junior companies operating in the Basin concentrate on one or two claim blocks to develop and drill initial targets. If successful, they must find a bigger funding partner to drill out the deposit and develop a resource.

For these reasons, the prospect generator model (

Mercenary Musing, July 12, 2010) is an especially effective exploration strategy in this uranium province.

My choice for an Athabasca Basin prospect generator is

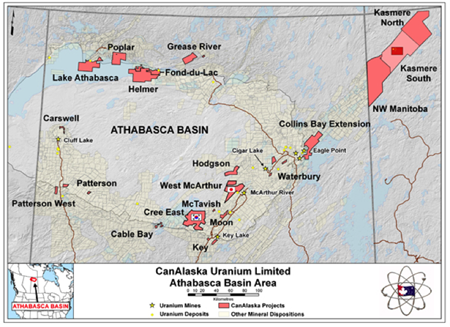

CanAlaska Uranium Ltd (CVV.V). CanAlaska has five joint venture uranium projects and another 14 available projects in the province. In addition, CVV uses its in-house technical team to identify prospects in other regions in western Canada. It holds several claim blocks in the Pikoo diamond region of east-central Saskatchewan and base metal projects in British Colombia and Manitoba that are for sale or option.

CanAlaska has a favorable share structure with 22.1 million shares outstanding and 26.4 million fully-diluted. Included are 4.1 million options with strike prices from 11.5 to 25 cents and expiries from 2016-2019 and some minor property obligations. There are no warrants. The company was rolled back in late 2010. Despite the four-year bear market for juniors and especially for uranium stocks post-Fukushima, it has maintained a very low number of shares.

Management controls 2.7% and the company classifies positions in strong hands at about 25%. There are no large institutional holdings with all less than 5%. The vast majority of shares are held in small retail positions.

At a current price of 19.5 cents, CVV has a market capitalization of $4.3 million. Working capital is over half of that with a cash position of $1.5 million and $0.7 million in tradable securities. Current burn rate is about $65,000 per month. There are no exploration or landholding costs, and the company funds operations with sales and joint-ventures of non-core properties.

Here is the 52-week chart showing a high of 24 cents, low of 8 cents, and generally low liquidity interspersed with spikes of higher volume:

CanAlaska shares have moved up 30% over the last three trading days due to positive drill results from a joint venture partner. That will be discussed in detail below.

The company is led by CEO Peter Dasler, a New Zealand-born and educated geologist with over 20 years in Canada’s junior resource sector. I have known Peter for several years. V-P Exploration Dr. Karl Schimann is a longtime uranium geologist with 20 years of experience at AREVA and is credited as a discoverer of Cigar Lake. Other directors of note include COB Thomas Graham, Jr., a former US ambassador specializing in arms and nuclear treaty negotiations, and Washington, D.C.-based lawyer and politician Kathleen Kennedy Townsend.

Upon a restructuring by Dasler in 2004, CanAlaska began assembling a large portfolio of properties in the Athabasca Basin that now total over 500,000 hectares. About $85 million has been spent in exploration, with the majority funded by major international partners.

CVV currently controls 17 uranium projects. Most are in Saskatchewan with two in northwest Manitoba. They run the gamut from grassroots prospects to drill-ready targets, advanced drill projects with uranium intercepts, and historic resources:

CanAlaska has the following properties in active joint-ventures:

· West McArthur is a 50%-held project with partner Mitsubishi Corp. It is adjacent to Cameco-Areva’s Fox Lake deposit, a major exploration project. Drilling at the Grid 5 target has encountered strong hydrothermal alteration coincident with electromagnetic conductors that are on trend with Fox Lake.

· Cree East is a 50%-held project with a Korean consortium partner located 22 km from the past-producing Key Lake mine. Previous drilling has encountered alteration and geophysical conductors that mark several high-priority targets.

· Fond du Lac on the eastern end of Lake Athabasca is a 50% joint venture with the Fond du Lac Denesuline Nation. Previous work in the 1960s-1970s outlined a small, low-grade unconformity deposit. CVV has drilled into adjacent basement mineralization of higher grade and numerous targets are drill-ready.

· Patterson borders Fission Uranium’s PLS discovery on the southwest edge of the Basin. Makena Resources can earn 50% with payments, share issuances, and exploration work. Strong, coincident geophysical targets have been outlined and drilling is planned.

· NW Manitoba is a joint-venture project with partner Northern Uranium required to spend $11.6 million and issue share tranches to CanAlaska to earn 80%. Drilling is in progress with initially encouraging results.

The company has another 12 projects strategically located along the edges of or near mines and deposits within the Athabasca Basin that are available for purchase, option, or joint-venture.

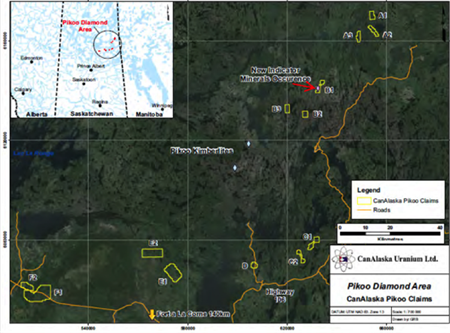

The company also claimed 11 blocks of ground in the Pikoo diamond region of east-central Saskatchewan, site of North Arrow’s recent discoveries. Four of the eleven have been sold with retained NSRs. The remaining blocks are non-core assets and available for option or purchase:

I have followed CanAlaska Uranium for a number of years but just recently established a share position in the company. The catalyst for me was recent drill results on its NW Manitoba joint-venture project funded by

Northern Uranium Corp (UNO.V) and led by infamous geologist Chuck Fipke. Here’s the claim map:

Based on high-grade uranium-bearing outcrop and cobbles, lake sediment uranium anomalies, a 35 km long graphite-bearing electromagnetic conductor, magnetic anomalies along fault corridors, coincident resistivity highs and gravity lows indicating strong alteration, and very high land and water radon values, the project has strong potential to host basement-style mineralization.

Current core drilling is focused from the ice on targets under Maguire Lake, will continue until break-up, and then move to land-based sites.

Three holes in the ongoing campaign have hit intense clay-hematite (“war-paint”) alteration at relatively shallow depths.

The drill hole shown above was extended another 30 meters but little core was recovered due to the alteration intensity, and it was lost before a gamma ray probe could be sent down-hole. After losing this hole, Northern Uranium brought in a larger core rig capable of angle-drilling large diameter (HQ) core.

On April 22, a news release documented one of three new holes had hit a wide zone of significant alteration with highly anomalous down-hole gamma ray values.

The rig has now moved along strike and is drilling an angle hole toward the center of the gravity low where the previous vertical intercept was lost.

In addition to the current area, Northern Uranium has defined another four lake-based and seven land-based targets that warrant drilling. To accomplish this ambitious program, a second large diamond drill is being mobilized to the project.

Folks, I am excited about the NW Manitoba project and think it could be the next uranium discovery outside the Athabasca Basin margins. It has all the geological, geochemical, and geophysical ingredients that led to basement-hosted discoveries at Fission Uranium’s PLS deposit and NexGen Energy’s Rook 1 project on the southwest side of the Basin.

If you consider this project a worthy speculation, there are two approaches; each has its pros and cons:

· Buy CanAlaska Uranium with a market cap of $4 million and trading in the high teens.

CanAlaska has a tight share structure with low liquidity and because of this, large orders or aggressive buying can send the market bounding higher. After my recent musing on Tuesday evening, it opened at 15 cents (

Mercenary Alert, April 21, 2015) and closed at 19.5 cents at week’s end.

That said, CVV is a well-leveraged prospect generator with many possibilities for success in the Athabasca uranium patch. It has a low burn rate with significant cash and tradable securities on hand and is well-situated for the long haul until junior resource markets recover. These are among the reasons I have chosen to own and cover it.

· Buy Northern Uranium with a market cap of $8 million and trading in the 7 cent range. The company has a very large number of shares outstanding and fully-diluted, but it has good liquidity, a legendary geologist at the helm, and can earn up to 80% of the project.

However, UNO is a one-trick pony and is currently raising funds via another highly-dilutive private placement to fund the exploration earn-in with CanAlaska.

Here’s what I did over the past two weeks: hedged my bets and bought both companies.

I now own two nice positions in a project that, in my opinion, has a good chance to become a significant uranium discovery.

It may not happen in the current drill program, but the NW Manitoba project sure looks like fertile ground. So I put some speculative funds into the play. And I may buy some more of one or the other or both companies if the exploration program pans out.

Note that my views are biased because I have skin in the game and CanAlaska Uranium is a paying sponsor of my website.

As always, do your own due diligence and see if this hot uranium play gets your glow on.

Ciao for now,

Mickey Fulp

Mercenary Geologist

Acknowledgment

Acknowledgment: Gwen Preston is the editor of

MercenaryGeologist.com.

The

Mercenary Geologist Michael S. “Mickey” Fulp is a Certified Professional

Geologist with a B.Sc. Earth Sciences with honor from the University of Tulsa, and M.Sc. Geology from the University of New Mexico. Mickey has 35 years experience as an exploration geologist and analyst searching for economic deposits of base and precious metals, industrial minerals, uranium, coal, oil and gas, and water in North and South America, Europe, and Asia.

Mickey worked for junior explorers, major mining companies, private companies, and investors as a consulting economic geologist for over 20 years, specializing in geological mapping, property evaluation, and business development. In addition to Mickey’s professional credentials and experience, he is high-altitude proficient, and is bilingual in English and Spanish. From 2003 to 2006, he made four outcrop ore discoveries in Peru, Nevada, Chile, and British Columbia.

Mickey is well-known and highly respected throughout the mining and exploration community due to his ongoing work as an analyst, writer, and speaker.

Contact:

Contact@MercenaryGeologist.com

Disclaimer and Notice: I am a shareholder of CanAlaska Uranium Ltd and it pays a fee of $4000 per month as a sponsor of this website. I am not a certified financial analyst, broker, or professional qualified to offer investment advice. Nothing in any report, commentary, this website, interview, and other content constitutes or can be construed as investment advice or an offer or solicitation or advice to buy or sell stock or any asset or investment. All of my presentations should be considered an opinion and my opinions may be based upon information obtained from research of public documents and content available on the company’s website, regulatory filings, various stock exchange websites, and stock information services, through discussions with company representatives, agents, other professionals and investors, and field visits. My opinions are based upon information believed to be accurate and reliable, but my opinions are not guaranteed or implied to be so. The opinions presented may not be complete or correct; all information is provided without any legal responsibility or obligation to provide future updates. I accept no responsibility and no liability, whatsoever, for any direct, indirect, special, punitive, or consequential damages or loss arising from the use of my opinions or information . The information contained in a report, commentary, this website, interview, and other content is subject to change without notice, may become outdated, and may not be updated. A report, commentary, this website, interview, and other content reflect my personal opinions and views and nothing more. All content of this website is subject to international copyright protection and no part or portion of this website, report, commentary, interview, and other content may be altered, reproduced, copied, emailed, faxed, or distributed in any form without the express written consent of Michael S. (Mickey) Fulp, MercenaryGeologist.com LLC.

Copyright © 2015 Mercenary Geologist.com, LLC. All Rights Reserved.