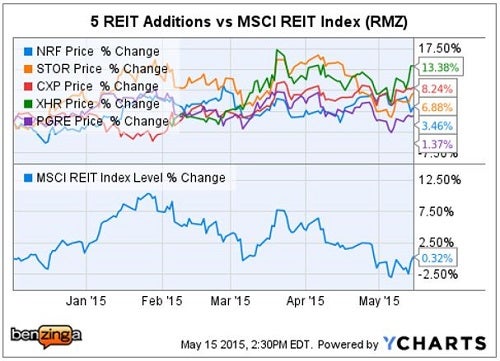

The five new REITs include two recent IPOs, one recent REIT spin-out and two other evolving REIT business models.

On May 29, the MSCI REIT Index will be growing to 144 member equity REITs as a result of its semi-annual review process, by adding:

- Northstar Realty Finance (NYSE: NRF)

- Paramount Group Inc. (NYSE: PGRE)

- STORE Realty Capital (NYSE: STOR)

- Columbia Property Trust (NYSE: CXP)

- Xenia Hotels & Resorts (NYSE: XHR)

Paramount Group and STORE Realty were both recent REIT IPOs; while newly listed Xenia Hotels was recently spun out of a non-traded REIT.

Northstar's RMZ selection recognizes its evolution from an mREIT into a highly diversified equity REIT over the past few years.

Office REIT Columbia Property Trust clearly meets the overall RMZ selection criteria: 1) Member of MSCI US Investible Market 2500 Index, 2) Equity REIT, 3) Market cap of at least $100 million; plus an adequate number of shares and trading volume for a liquid market.

Tale Of The Tape - Since Recent IPOs

The Vanguard REIT Index ETF (NYSE: VNQ) efficiently tracks the RMZ charging just a 0.10 percent expense ratio. The 144 REITs comprise about two-thirds of the entire REIT sector by market cap.

1. Xenia Hotels & Resorts - REIT Spin

On February 3, 2015 shareholders of non-traded REIT Inland American received one share of Xenia ...

/www.benzinga.com/trading-ideas/long-ideas/15/05/5517109/the-msci-reit-index-is-adding-these-5-reits-should-you alt=The MSCI REIT Index Is Adding These 5 REITs - Should You?>Full story available on Benzinga.com

More...

More...