First and foremost, Northstar Realty Finance (NYSE: NRF) President Albert Tylis went to great lengths in his NAREIT Investor Forum opening remarks to distance NRF, and its external manager Northstar Asset Management (NYSE: NSAM), from other external managers.

He lambasted "self-interest" focused REIT external managers, who have "poor track records," and have engaged in "poor behavior … couched in terms of doing things for shareholders."

Tylis unequivocally stated that "we're not that."

Immediately prior to REITWeek, one of the biggest REIT stories had been the terms of the REIT Management & Research LLC (RMR) partial sale of a large minority interest, to shareholders of its four publicly traded managed REITs.

Last year NSAM was created by a pro rata spin-out of shares to all NRF shareholders on a pro-rata basis, without any special voting rights.

Tale Of The Tape - Past Five Years

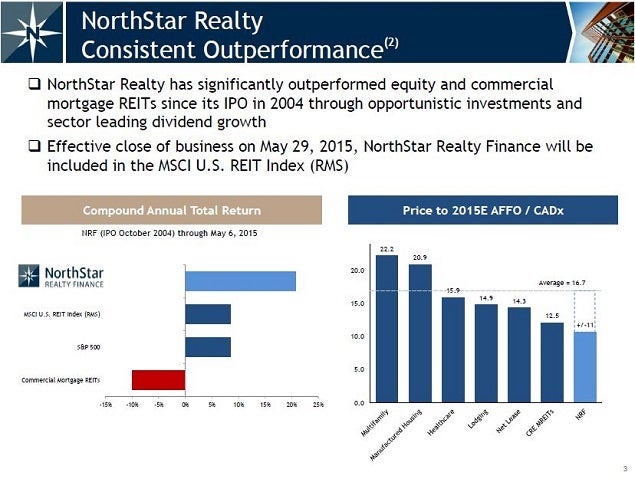

In addition to outstanding NRF share price appreciation, the total return from owning NRF shares has actually been much higher due its competitive dividend, currently yielding just over 9 percent.

The Vanguard REIT Index ETF (NYSE: VNQ) tracks the MSCI REIT Index (RMZ) a good proxy for equity REIT performance.

Northstar Outperformance vs Broader Markets

Northstar Realty was recently added ...

/www.benzinga.com/trading-ideas/long-ideas/15/06/5592339/northstar-realty-finance-presentation-highlights-from-reitwee alt=Northstar Realty Finance Presentation Highlights From REITWeek 2015>Full story available on Benzinga.com

More...

More...