Source: Kevin Michael Grace of

The Gold Report (11/5/15)

https://www.theaureport.com/pub/na/with-ksm-permits-in-hand-seabridge-is-now-set-to-leverage-the-coming-bull-market-in-gold

With Proven and Probable reserves of 38 million ounces of gold and 10 billion pounds of copper, the potential of Seabridge Gold's KSM project in British Columbia has long been sky-high. In this interview with The Gold Report, Chairman/CEO Rudi Fronk explains that his company has always maximized its leverage to the price of gold. So now, with KSM fully permitted and greatly enhanced by the discovery of higher-grade gold and copper, and a bull market in gold now on the way, the recent strong gains made by investors in his company are likely only the beginning.

Management Q&A: View From the Top

The Gold Report: You cofounded

Seabridge Gold Inc. (SEA:TSX; SA:NYSE.MKT) in 1999. What is the key lesson this company has taught you over the last 16 years?

Rudi Fronk: The importance of clear and consistent messaging to our shareholders. We accomplish this with a self-imposed report card. In each annual report we clearly lay out the objectives for the upcoming year. Then in the following year's annual report we state how we did against those objectives and announce new objectives for the upcoming year. This policy provides our shareholders with a firm understanding of where we are heading and allows them to ascertain whether we are staying the course. As a result, we have maintained a long-standing and consistently loyal shareholder base.

TGR: Seabridge has a very tight share structure, correct?

RF: Yes, we have only 52 million (52M) shares outstanding. Our largest shareholder is Albert Friedberg, the head of Friedberg Mercantile Group in Toronto, who through parties controlled by him, owns 18.7% of Seabridge outright and has a financial instrument through a swapping arrangement of another 4.6M shares. Insiders of the company, officers, directors, employees and people close to the company own another 10% or so of the company.

TGR: Tell us about Seabridge's projects and its resources.

RF: We have two major projects, both in Western Canada. KSM, our flagship project in northwest British Columbia, is the largest undeveloped gold-copper project in the world as measured by reserves. It boasts Proven and Probable (P&P) reserves of 38.2 million ounces (Moz) gold, 9.9 billion pounds (Blb) copper, 191 Moz silver and 213 million pounds (Mlb) molybdenum. We have spent over $200M to make KSM shovel ready.

KSM map courtesy of Seabridge Gold

KSM map courtesy of Seabridge Gold

Our second major project is Courageous Lake in the Northwest Territories. It has P&P gold reserves of 6.5 Moz with tremendous exploration upside.

In addition to the 44.7 Moz P&P at KSM and Courageous Lake, we have another 14 Moz gold in the Measured and Indicated categories, plus another 32 Moz Inferred. We believe that most of these resources can be converted to reserves with additional work.

TGR: You have declared Seabridge's strategy to be "maximizing gold ownership per share." What do you mean by this, and what's the thinking behind this objective?

RF: Our business plan is very different from the traditional business plans of most gold companies. We measure our success by ounces of gold per common share. We raise money through equity issuances and then spend that money to find gold. Our goal is to offset our equity dilution with ever-increasing ounces of gold per share. We call this modern-day alchemy: turning cash into gold. The traditional gold industry seems hell bent on converting gold into cash. They find or buy gold deposits, build the mines, dig the gold out of the ground and then sell that gold for cash.

We believe that investors invest in gold stocks for leverage to the gold price. Seabridge has been designed to do just that. Converting gold to cash eliminates that leverage, and so we do just the opposite. We now provide 5 to 10 times more in-the-ground gold ownership per share than any other company in our space. You can think of Seabridge common shares as un-expiring call options on gold.

TGR:

TGR: Seabridge has a $6 enterprise value per ounce of gold reserves. What's the importance of this?

RF: It means that on a valuation basis Seabridge shares are quite cheap. I've sold companies in the past with similar assets to KSM's for more than $80 per reserve ounce in the ground. Over the past 4+ years, we have had to contend with highly discouraging gold and gold equity markets, which have resulted in very low valuations. We strongly believe that the price of gold will move significantly higher as we move forward and that when it does Seabridge will outperform other equities, as it has in the past.

TGR: You have described your Deep Kerr deposit as one of the best discoveries in Canada in the last decade. What is Deep Kerr, and why do you rate it so highly?

RF: Deep Kerr is a zone we found in 2013 underneath our open-pit Kerr deposit. This happened after we had defined 38.2 Moz P&P gold at KSM. The first two years of Deep Kerr drilling have quantified 780 million tons of new resources that have yet to be implemented into KSM's mine plan. Drilling continues there, and we expect further significant increases to the Deep Kerr resource.

Most important, Deep Kerr has about twice the contained metal value per ton compared to the KSM reserve. It will make an already robust project that much more attractive economically and because it will be mined as a block cave, has the potential to significantly reduce KSM's environmental footprint.

TGR: Even after the tailings disaster at Imperial Metals Corp.'s (III:TSX) Mount Polley mine and the second rejection of Taseko Mines Ltd.'s (TKO:TSX; TGB:NYSE.MKT) Prosperity mine, Seabridge managed to get KSM fully permitted by both the British Columbia government and by Ottawa. How did you achieve this?

RF: By honest and open dialogue with provincial, federal and U.S. regulators, as well as with Treaty and First Nations. KSM's environmental assessment process (EAP) began in 2008. Over the next six years, we had more than 30 working group sessions with regulators and Treaty and First Nations. We listened to their concerns and made significant design changes where appropriate. By 2014, we had letters of support from all Treaty and First Nations stakeholders.

TGR: Despite the fact that KSM is only the second mine of its type to have received both provincial and federal approval in the last five years, there is a campaign to stop it led by Earthworks, a group cofounded by the former chairman of the Sierra Club. How do you plan to fight back against the claims made by this group?

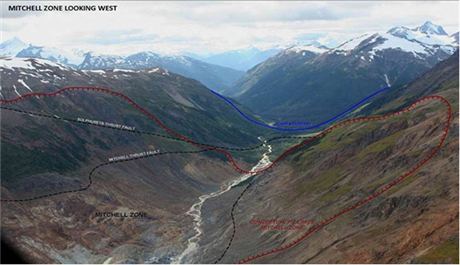

RF: In my 35 years in this business I have yet to see a permitted mine without NGO opposition. Although not required, we invited the U.S. Environmental Protection Agency (EPA) and Alaska's Department of Natural Resources into the six-year EAP, and they both publicly endorsed the project. The EPA admitted at a town hall meeting in Ketchikan that since the water now coming out of the KSM valley down into Alaska is highly polluted due to its contact with an exposed porphyry deposit at the Mitchell Zone, mining this would actually mitigate the environmental degradation because whatever water we touch must be remediated. In other words, once KSM begins production, the water that reaches Alaska will be of higher quality than it is currently.

TGR:

TGR: KSM contains 2.2 billion tons (2.2 Bt) at 0.55 grams per ton gold and 0.21% copper. Mining it would go against the recent trend of small high-grade projects with low capital expenditures (capexes). Why do you believe that KSM is economically viable?

RF: Because KSM's all-in projected sustaining costs (AISCs) are well below $800 per ounce ($800/oz), compared to today's industry average of about $1,000/oz. Our AISCs are low because we have some of the world's cheapest power readily available, we have extremely good metallurgy, and we have a year-round port nearby. Not only is KSM economically viable from an AISC standpoint, but it is also capital efficient. Based on our projections, initial capital recoupment happens after about 6 years, with another 50 years of operating life still in front of KSM.

There's no question that over the past few years the market has rewarded the higher-grade, low-capex projects. But the large mining companies need big projects in safe jurisdictions. Their pipelines now are now running dry, and most of their pipeline projects are in some pretty scary places.

We believe that as metals prices move higher, the major mining companies will once again gravitate to large projects that are, like KSM, both capital efficient and situated in secure jurisdictions.

TGR: Do you have any thoughts on where the gold price is going?

RF: We actually write about gold from the macro perspective on our

website—on our home page, pull down the Investor tab and select

"The Case For Gold." Gold has been out of favor for several years, with most of the hot money flowing into financial assets, like stocks and bonds. We think that run is soon coming to an end and that investor money will look for the safe haven that gold provides. So the price of gold will move higher. Remember: gold always makes a new high, and it will again.

I read a recent interview of

John Hathaway of Tocqueville Gold Fund in

The Gold Report. He made the excellent point that investors must differentiate the paper gold market from the physical gold market. In the short term, the paper market can move the gold price pretty dramatically, as we have seen on a number of occasions over the past few years. Over the longer term, however, it's physical demand that dictates price, and we believe that the upward movement in gold will be strong as Western investors once again have an appetite for gold. The market seems to be convinced that higher interest rates will be bad for gold. Actually, in the last four tightening cycles, the price of gold moved higher as the Federal Reserve raised interest rates.

TGR: Even though KSM is the world's largest undeveloped gold-copper project, Seabridge continues to explore aggressively. Why?

RF: Not because we are simply adding more of the same material we have already as reserves. Adding mine life at the same grade as our existing resource beyond our projected 55-year operating horizon would make no difference to our economic projections.

What our recent exploration has achieved is the addition of nearly 1 Bt at Deep Kerr and Lower Iron Cap containing over 11 Moz gold and 10 Blb copper at grades 50–100% higher than our existing reserves. This new material will allow us to modify the KSM mine plan by bringing forward higher-grade material, improving the economics and making KSM that much more attractive to a suitable partner.

TGR: How much working capital does Seabridge have and how much debt, if any?

RF: We have no debt. Seabridge is debt adverse. We recently announced a $14.6M non-brokered financing, which was taken up by two of our largest shareholders. That will increase our working capital to over $20M, enough to carry us well into 2017.

Many juniors worry about their ability to finance. Because we've stayed on message and on course with our shareholders over such a long period of time, we've always been able to raise money when needed to fund operations and exploration.

TGR: What are your plans for Courageous Lake? How far is that project from a feasibility study?

RF: We completed a prefeasibility on Courageous Lake in 2012 showing a robust project at higher gold prices. The gold price since then has fallen dramatically, so we recognized that KSM was the better project to advance first. That said, Courageous Lake holds 6.5 Moz P&P on only 2 kilometers within a 52-kilometer greenstone belt. There are known gold showings up and down its entirety, and there are two historic mines on the property that produced at better than one ounce per ton.

We will begin to advance Courageous Lake after it becomes clear that the gold market is again moving into a bull market.

TGR: You mentioned a potential joint venture (JV) partner to help with KSM's $5.3 billion capex. How is this search progressing?

RF: Slowly. We have been upfront about the fact that KSM is too large for Seabridge alone from both the technical and financial aspects, especially considering that since 2011, the market environment has not been kind to large projects, both on the precious metals and base metal sides.

KSM, however, has now received its environmental approvals and has added a significant higher-grade resource. These advances have strengthened our position considerably. About 10 of the world's largest gold and base metal miners are now conducting due diligence on KSM under confidentiality agreements. If we can achieve the objectives we seek in a JV, we'll do a deal. If that proves impossible in the current depressed environment, we will continue to derisk and await improved market conditions. We have no doubt, however, that KSM will be developed as the largest mining project ever built in Canada.

TGR: You already have an option agreement with Royal Gold Inc. (RGLD:NASDAQ; RGL:TSX).

RF: Yes. Royal Gold invested $48M in Seabridge with the purchase of 2M shares at an average price of about $24 per share, a 15% premium to the then market price. We then invested that cash to advance KSM. Royal now holds an option to buy a 2% royalty on KSM's gold and silver, not its copper or molybdenum. To exercise that option, Royal would have to pay Seabridge $160M in cash.

TGR: Are you considering any streaming arrangements?

RF: Not at this time. Should we sign a JV with a gold miner, we could use the copper under an offtake agreement or perhaps even a stream to help fund a good portion of the upfront capex to build the mine. Under such an arrangement, Seabridge and its JV partner would keep the entire gold exposure. Alternatively, should we sign a JV with a base metals miner, it might be realistic for Seabridge's retained interest in KSM to be in the form of a stream on the gold produced there. That would allow us to put up no capital going forward and buy physical gold from KSM at a meaningful discount to the prevailing spot gold price.

TGR: At a time when so many gold juniors are hitting 52-week lows, Seabridge hit a 52-week high Oct. 28. How much growth remains in Seabridge shares?

RF: As someone who has more than 90% of his net worth tied up in Seabridge shares, I believe a great upside still exists. I also believe we will continue to see insider purchases. During the last two upcycles in gold, Seabridge common shares reached nearly $40, significantly outperforming most other gold equities.

Since the last gold upcycle, Seabridge has added many more ounces at higher grades, and we've received our environmental approvals. We're now trading at about $10 per ounce of reserve or $5 per ounce of resource. In the bull market we are moving into, a much higher valuation is not unrealistic.

Seabridge is now getting some of the recognition it deserves. For example,

Seeking Alpha recently published a column citing us as one of the companies "starting to show signs of [gold's] famous upside potential."

TGR: Where do you see your company in three years?

RF: Three years is a long time. What I would hope to see by then is, first, a JV partner working with us to advance KSM to an operating mine. Second, that we're back to working in earnest at Courageous Lake. Third, and most important, that we're continuing to improve our shareholders' leverage to the gold price.

TGR: Rudi, thank you for your time and your insights.

Rudi P. Fronk, chairman, chief executive officer and cofounder of Seabridge Gold, has over 30 years of experience in the gold business, primarily as a senior officer and director of publicly traded companies. He previously held senior management positions with Greenstone Resources, Columbia Resources, Behre Dolbear & Company, Riverside Associates, Phibro-Salomon, Amax and DRX. He is a graduate of Columbia University, which awarded him a Bachelor of Science in mining engineering and a Master of Science in mineral economics.

Want to read more

Gold Report interviews like this?

Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our

Streetwise Interviews page.

DISCLOSURE:

1) Kevin Michael Grace conducted this interview for Streetwise Reports LLC, publisher of

The Gold Report, The Energy Report and

The Life Sciences Report, and provides services to Streetwise Reports as an independent contractor. He owns, or his family owns, shares of the following companies mentioned in this interview: None.

2) Seabridge Gold Inc. is a banner sponsor of Streetwise Reports.

3) Rudi Fronk had final approval of the content and is wholly responsible for the validity of the statements. Opinions expressed are the opinions of Rudi Fronk and not of Streetwise Reports or its officers.

4) The interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal

disclaimer.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.

Streetwise -

The Gold Report is Copyright © 2014 by Streetwise Reports LLC. All rights are reserved. Streetwise Reports LLC hereby grants an unrestricted license to use or disseminate this copyrighted material (i) only in whole (and always including this disclaimer), but (ii) never in part.

Streetwise Reports LLC does not guarantee the accuracy or thoroughness of the information reported.

Streetwise Reports LLC receives a fee from companies that are listed on the home page in the In This Issue section. Their sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

Participating companies provide the logos used in

The Gold Report. These logos are trademarks and are the property of the individual companies.

101 Second St., Suite 110

Petaluma, CA 94952

Tel.: (707) 981-8999

Fax: (707) 981-8998

Email:

jluther@streetwisereports.com