Gold has experienced a brutal sell-off in the past two weeks, down nearly $100 in that timeframe. The metal is now poised to retest its July and August lows, and unless the price stabilizes quickly, gold could be headed for another leg down, with the possibility of breaching the psychologically important level of $1,000.

The current bear market cycle has been among the harshest of the past few decades, and also one of the longest. Almost all mining equities, with the exception of a few royalty and streaming companies, have seen a precipitous decline in their valuations since 2011. Most large cap miners, as typified by Barrick Gold (ABX) and Newmont Mining (NEM), have experienced at least a 75% decline in their share prices. Mid-tier producers, like IAMGold (IAG) and New Gold (NGD), have seen their market caps plummet even further, and of course, the situation for junior exploration companies is the bleakest of all. Many juniors face not just extreme difficulties, but the threat of extinction.

Exploiting Optionality

Amidst this backdrop of doom and gloom, I want to discuss the concept of optionality and explore the tremendous upside it can offer in a beaten down market like we face today. At its core, optionality is a strategy that provides leveraged upside to the price of gold. The idea is to identify companies that own large-scale projects, with a lot of proven resources in the ground, which are not economic at today’s depressed gold prices.

At this point, most investors have completely written these projects off, even projects that have the potential to one day join the ranks of the biggest operating mines in the world. Investors are fleeing towards the safety of companies that have projects with low cash costs, low capital expenditures, and positive cash flows. The idea of sinking money into projects that require a higher gold price, as well as a large initial capex commitment, is completely anathema to the zeitgeist of the moment.

Large-scale projects, previously valued in the hundreds of millions or even billions, are now worth pennies on the dollar. Once treated like exalted royalty, these projects are now eyed as if they are sickly, destitute paupers. The rationale behind optionality, like the plot in Mark Twain’s famous 1882 book, is that the prince, transformed into a lowly pauper, is one day destined to retake his rightful position as royalty.

Dirt Cheap Optionality Plays

There are a whole host of optionality plays in the mining sector today, but I am most interested in identifying and studying large, pure optionality plays. Chesapeake Gold (CHPGF, TSX:CKG), Exeter Resource Corporation (XRA, TSX:XRC), International Tower Hill Mines (THM, TSX:ITH), and Midas Gold (MDRPF, TSX:MAX) are among the names that I am following most closely.

Chesapeake Gold, Exeter Resource Corporation, International Tower Hill Mines, and Midas Gold have all declined by more than 90% in the past 5 years. Each of these companies has been punished brutally by a low gold price environment, despite controlling projects with vast resources and reserves. Chesapeake Gold’s 100% owned Metates Project, for example, contains reserves of 18.5M ounces of gold, 526M ounces of silver, and 4.2B pounds of zinc. The stock traded above $10 per share for much of 2011 and 2012, and briefly peaked above $17 per share, but it is now hovering under $2 per share.

The company has completed a pre-feasibility study (PFS) at Metates, assuming a gold price of $1350/oz., a silver price of $25/oz., and a zinc price of $1/lb. The project’s after-tax net-present value (NPV), assuming a 5% discount rate, is a whopping $4.5 billion. Meanwhile, Chesapeake Gold’s market capitalization is stuck below $100M CAD.

For me, there is a serious disconnect between the underlying value of the Metates Project and how Chesapeake Gold is being valued today. Gold could easily move back to a price level of $1350 in the next couple of years, but sentiment is so bad right now that market participants have completely dismissed that possibility. The notion of getting a project like Metates funded, which has a $1.5B initial capex, even under a staged development scenario, is viewed as preposterous.

Developing Metates right now would be unwise, but it is important to remember that bear markets do not last forever. While it is true that large cap miners face huge holes in their balance sheets today, and are decidedly in a retrenchment phase, the tide will turn. Finding a joint venture partner or a potential buyout party for a project like Metates might be an impossibility now, but in the near future the large cap miners will have to make deals to replace their falling production and dwindling reserves.

The reality is that new discoveries of gold deposits are becoming fewer and farther between with every passing year. Most easier-to-find deposits have likely already been discovered, and the gold deposits that are being found today are smaller in scale and lower in grade. Proven, large-scale gold deposits in good jurisdictions, like Chesapeake Gold’s Metates Project in Mexico and Exeter Resource Corporation’s Caspiche Project in Chile, are very rare commodities.

|

|

Chesapeake Gold |

Midas Gold |

International Tower Hill Mines |

Exeter Resource Corporation |

|

Ticker Symbol |

CHPGF, TSX:CKG |

MDRPF, TSX:MAX |

THM, TSX:ITH |

XRA, TSX:XRC |

|

Market Cap (Nov. 16/15) |

$79.5M CAD |

$42.6M CAD |

$38.4M CAD |

$35.4M CAD |

|

Flagship Project |

Metates |

Stibnite |

Livengood |

Caspiche |

|

M&I Resource (Au oz.) |

19.0M |

5.5M |

15.7M |

39.6M |

Both International Tower Hill Mines and Midas Gold have their flagship assets located in the United States. By any reliable metric, International Tower Hill’s Livengood Project and Midas Gold’s Stibnite Project are among the largest undeveloped gold projects in North America today. According to U.S. Geological Survey (USGS) data from 2012, Livengood contains the 6

th largest Measured and Indicated gold resource in the United States; Stibnite ranks as the 13

th largest.

The potential scale of these projects is massive, but what makes an asset like the Stibnite Project especially intriguing is the grade of its ore. Boasting an average grade of 1.63 g/t gold across its three deposits, the Stibnite Project would immediately become one of the highest-grade open pit mines in the Western Hemisphere. If Stibnite were operational today, it would rank as the 4

th highest-grade open pit mine in the United States.

Midas Gold is sitting on a true treasure. It is rare to find gold deposits the size of Stibnite; it is even more rare to find prospective open-pit gold mines that have grades exceeding 1 g/t. This is a project that would produce an estimated 400,000 ounces of gold annually during the first 4 years of its mine life, at all-in sustaining costs of just $506/oz. While the initial capex at Stibnite is quite large, and the project does face some serious permitting challenges, in my view Stibnite’s cash flow potential is simply too immense to ignore.

Investing money in optionality plays is inherently risky, but the potential payoffs can be enormous. International Tower Hill Mines has witnessed a decline in its share price from over $10 into a neighborhood of just $0.20 - $0.30 per share. The company’s Livengood Project still has the same huge resource as before, 15.7M ounces of gold in the Measured and Indicated categories, but the project economics are not feasible at the present price of gold.

If International Tower Hill Mines can be disciplined, keeping its operating expenditures low and successfully attracting the necessary financing to survive, the company will be in a position to thrive in a recovering gold price environment. At a gold price of $1500, the Livengood Project should be economic to develop and would be capable of supporting nearly 600,000 ounces of annual gold production.

There is no certainty that International Tower Hill Mines or any other optionality play will survive. These companies do not currently generate any cash flow and are dependent on raising enough funds in private placements to survive. For that reason, it is critically important to examine the balance sheets of these companies in depth. It is important to answer the following questions. How much cash does the company have on hand? How long approximately can the company fund itself via existing cash reserves? How much is the company spending on general and administrative expenses? Does the company have backing from strong institutional investors? Does the company face any large upcoming debt payments?

Trying to guarantee that an optionality play will remain solvent is a futile effort, but answering the above questions will go a long way to reducing your risk exposure. The key is to find several optionality plays, ideally between 3 and 5, that you are comfortable putting some money into. Spreading your risk around between several optionality plays de-risks your portfolio and shields you from too much damage if one of your holdings goes bust.

It is also important to remember that optionality plays are high-risk and high-reward. I would recommend investing only a small percentage of your portfolio into optionality plays. If gold re-enters a bull market, these optionality plays will generate fantastic windfall profits for you, even if they only constitute 5% or 10% of your investment portfolio. Alternatively, if gold continues to lag, your exposure to these companies will be limited and as a result your potential losses should be manageable.

Rick Rule On Optionality

Legendary resource investor Rick Rule has spoken extensively about optionality and the tremendous leveraged upside it can provide. He has described optionality as a strategy of buying into deposits that are currently out of the money, but that are likely to be worth many multiples in a higher commodity price environment.

Rick has been wildly successful using this strategy throughout his career. In the late 1990s, in the midst of a prolonged bear market, Rick was brave enough to sink money into several unloved, beaten down optionality plays; his conviction that the price of copper, the price of silver, and the price of uranium would all rise substantially in the years ahead led him to invest in Lumina Copper, Pan American Silver, and Paladin Energy respectively.

Rick’s decision to invest in these optionality plays paid off handsomely. Pan American Silver peaked at more than $40 per share in early 2008, rising from a price of less than $3 per share in 2000. Lumina Copper, a company that industry heavyweight Ross Beaty formed in the late 1990s, as a way to capitalize on what he viewed as unsustainably low copper prices, ended up giving shareholders approximately an 80-fold return over a decade. As Rick has pointed out in interviews, he did not hold Lumina’s shares long enough to earn that level of return, but he still no doubt pocketed a tremendous profit.

Finally, there is the case of Paladin Energy. In 1998, Rick realized that uranium was an exceptional contrarian investment opportunity; he decided that Paladin would be an ideal speculative bet for his thesis on uranium. He bought into Paladin at a price of $0.10; the stock eventually dropped as low as a penny, but Rick had the courage and patience to stick with the trade. Within a few years, the price of uranium had soared and Paladin had rocketed from 1 cent all the way up to $10 per share.

As Rick Rule and many others have pointed out, there are a lot of parallels between the current bear market and the bear market of the late 1990s. In an interview last fall for

Sprott’s Thoughts, Rick stated, “When you think about the ‘good old days’ of 1998 to 2000, you’ll find they have a lot in common with today’s predicament.”

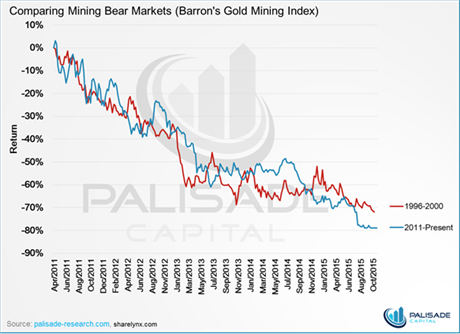

Using the Barron’s Gold Mining Index as a benchmark, the overall decline of the current bear market has now surpassed that of the 1996-2000 bear market. Our analysis also finds that the 1996-2000 bear market lasted for a total of 236 weeks, while the current bear market has now hit 240 weeks and counting.

Even if we have not quite hit the bottom of the market yet, as the above chart demonstrates, we are likely getting very close. Now is an ideal time to begin positioning yourself for the next bull market in mining stocks; there is no better way to leverage yourself to the coming recovery than by adding some high quality optionality plays to your portfolio.

Disclosure: The author of this article is long International Tower Hill Mines (THM, TSX:ITH)

Palisade Capital was not paid by any of these companies to write this report, but the author stands to benefit from any volume this report stands to generate. The information contained in such publications is not intended as individual investment advice and is not designed to meet your personal financial situation.

Information contained in this report is obtained from sources we believe to be reliable, but its accuracy cannot be guaranteed. The opinions expressed in this report are those of Palisade Capital and are subject to change without notice. The information in this report may become outdated and there is no obligation to update any such information.