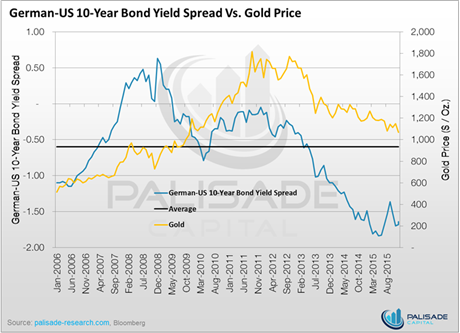

The German-US yield spread is often used as a leading indicator of gold prices. In fact, one could argue that no indicator has been more accurate in signalling an impending rally in gold and gold stocks over the past ten years! Whenever the spread becomes negative, history dictates that a gold rally is on the horizon.

Using monthly data for 10-year treasuries, one significant bottom occurred in May 2006 which ignited a gold rally that ended 23 months later and saw gold prices increase by from $638 per ounce to $969, a 52% gain!

The subsequent bottom occurred in April 2010 and saw gold prices rally from $1,116 per ounce to 1,816 in just 18 months, for a 63% gain.

When the German-US yield becomes negative, there is a disconnect between the monetary policies of the United States and the Eurozone. In this case, it is Yellen finally tightening the reigns while the Eurozone continues to ease. Intuitively, this sort of divergence is negative for gold, however, since the market is always pricing for the future, the art is in interpreting the graph and the next steps by the bank.

It appears that the German-US yield spread has reached another bottom, and if this is the case, 2016 and onward will finally see a sustained gold rally.

We expect at some point the United States will need to get on the same page as European Central Bank or Europe will face massive inflation. Furthermore, the US is entering 2016 precariously and will eventually be forced to lower rates as managed numbers are finally unveiled. All signs point to the spread increasing again and a rally in gold prices.

Get ready for an exciting 2016, and remember to protect yourself with gold.