Matt Geiger February 4, 2016

Almadex Minerals (TSXV:AMZ) Almadex Minerals is a prospect generator and royalty company. The company has a large footprint across Mexico, Nevada, and British Columbia – with over 20 properties that are either fully or jointly owned. Almadex also owns over a dozen royalties. Three of these are on properties that have already seen a PEA. Management has decades of collective experience in these very jurisdictions.

Despite this, Almadex’s market capitalization is currently equal to the company’s working capital position. They have no debt. This tells me that AMZ shares currently offer exceptional upside over the next 2-3 years with surprisingly little risk. These are the two characteristics seen in classic value investments.

In this Featured Investment piece, I start by providing a background on the “prospect generator” business model.

I then present my investment thesis for Almadex Minerals, covering the company’s history, management team, current assets, expected milestones, and upside as an investment.

I conclude with a comment on the company’s Margin of Safety. (Hint: Ben Graham would approve of this investment.)

What is a Prospect Generator?

In past Featured Investments, I would at this point detail the supply/demand dynamics of the commodity most relevant to the investment. However, since Almadex is a prospect generator and the owner of multiple royalty interests, the company has exposure to different metals over dozens of properties (with the three most significant metals being silver, gold, and copper). Instead of detailing the fundamentals for each of these three metals, I will instead explain the prospect generation business model for those unfamiliar with mineral exploration.

Many mineral explorers will stake a single promising mineral property and then drill exploratory holes until one of two things happen: (1) they get lucky and hit a discovery hole or (2) the company runs out of cash. This is great news for those that get lucky, but it’s well documented that less than 1% of true grassroots explorers will ever come across an economic mineral deposit. These are long odds to say the least

There is another approach however and that is the prospect generator model. In short, prospect generators maintain a large portfolio of grassroots properties and then create joint venture partnerships with other firms. These 3rd party firms (who are usually larger and more established than the prospect generator) then spend their own money and time advancing the project in exchange for a majority ownership position. Below you will find the basic process that successful prospect generators follow:

- Stake prospective mineral licenses (or acquire early stage projects for pennies on the dollar, particularly in times like these).

- Partake in early stage exploration work, sometimes without drilling a single hole (drilling is expensive after all).

- Package/market your projects to larger players that may be interested in (a) the jurisdiction, (b) the target commodity, or (c) the geological story.

- Sit back and watch the partner spend money on your behalf.

In a best-case scenario, the project reaches production over the next 5-10 years and you get to keep a chunk of the proceeds to yourself.

In a worst-case scenario, the partner spends millions of their own money only to decide that they are no longer interested in the JV partnership. They then return the project to you, which can be explored further or optioned to another party.

- Reinvest working capital into new grassroots properties and repeat the process.

Courtesy of Sprott’s Mishka Vom Dorp, you will find below four benefits that prospect generators enjoy relative to their “single-story” counterparts:

- The risks are spread across multiple projects.

- The lower “burn rate” can mean less dilution. More specifically, the company’s G&A expenses are spread over dozens of projects versus only 1.

- This model relies on intellectual capital, which gains value with time. In essence, prospect generation is all about “leveraging intellectual capital with other people’s money.”

- There are past success stories to lean on. Generally these types of companies will see less upside in the euphoric stage of bull markets, but much more staying power/preservation of value when the going gets tough.

There is really only 1 downside to the prospect generator model – you don’t get to keep the entire project to yourself! (Generally if you sign a JV and the partner finds something that ends up turning into a mine, you will only get to keep 10-30% of the project that you once fully owned.) That said, mineral deposits can be worth hundreds of millions if not billions of dollars. Even a small sliver of ownership in a sizeable deposit can result in a tenfold return for early shareholders.

Investment Thesis

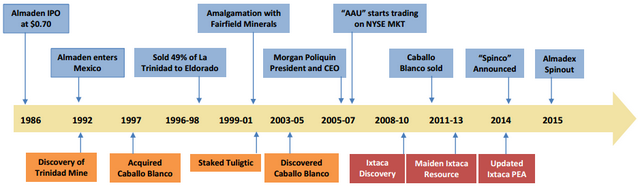

Almadex Minerals is a very recent spin off – the company itself has only been around since August 2015. However, this story begins decades before when Duane Poliquin (Almadex’s Founder and Chairman) launched a prospect generator by the name of Almaden Minerals in 1986. The trajectory of the Almaden outfit can be seen in the timeline below.

Source: Company Presentation

I’d like to highlight two of the above milestones that are particularly relevant to Almadex shareholders. The first is the involvement of Morgan Poliquin (Duane’s son) in Almaden’s operations – culminating with his promotion to President and CEO in 2006. Between the two of them, the Poliquins have an exceptionally rich background in grassroots mineral exploration and are respected across the industry. In fact, the pair recently won the 2014 Colin Spence Award for Excellence in Global Mineral Exploration from AME – BC.

The second major milestone is Almaden’s discovery of the Ixtaca Deposit (which has since seen the release of both a Maiden Resource and an economic PEA.) With both a modest initial capex and an impressive after-tax IRR using current gold/silver prices, Ixtaca is a promising project with near term production potential. Seeing this, in mid-2014 the Poliquin’s announced their decision to isolate Ixtaca within Almaden while spinning out all other properties into a second vehicle (Almadex). The reasoning for this was twofold: (1) isolating Ixtaca into its own vehicle facilitates future M&A and (2) investors can now buy either a pure play development project or a pure prospect generator, depending on their profile.

Sure enough, the spinoff of ALL ALMADEN ASSETS ASIDE FROM IXTACA was completed in Q3 of this year – with Morgan Poliquin taking the helm as Almadex’s CEO. This explains the company’s somewhat eclectic collection of grassroots properties, royalty interests, equity interests, gold bullion, and cash. Almadex even has 5-company owned drill rigs. These are the very assets that Duane/Morgan spent nearly three decades collecting on behalf of Almaden.

Source: Company Presentation

Provided above is an overview of Almadex’s various holdings across North America. As is the case with most mineral exploration experts, the Poliquins have made their living working in a distinct mineral jurisdiction (North America in this case). This is particularly true in Mexico –I can’t think of a single junior outfit currently working in Mexico with more collective experience than Almadex. As we know, mineral exploration has everything to do with Intellectual Property – and currently the market is valuing the Poliquin’s IP at zero. This does not make sense to me.

On top of this, the market is also assigning no value to Almadex’s collection of 20+ properties and a 12+ royalty interests. It is true that the majority of these properties and royalty interests WILL NOT end up creating any value for the company. That’s just the way things work in the grassroots exploration industry. That said, I’m willing to hazard a bet that somewhere within their portfolio there is another Ixtaca waiting to be found. Even if this took years, this would be a boon for shareholders as the current value of Ixtaca (approximated by Almaden’s Enterprise Value) is currently 10x the market cap of Almadex.

Even without the discovery of another “Ixtaca” (which sports an NPV close to $200m CAD), I expect Almadex to create value on multiple fronts going forward. Below you will find brief descriptions of their 5 most promising properties, followed by their 3 most significant royalty interests.

El Cobre Property – El Cobre is a large copper-gold porphyry system located in Veracruz State, Mexico. The company has already run Magnetic, IP, and soil surveys at El Cobre – yielding positive results. The company also has done some early stage exploratory drilling, which resulted in the following intercepts of note: 48.8m @ 1.2 g/t Au and 0.12% Cu, 80.0m @ 0.6 g/t Au and 0.24% Cu, 41.2m @ 0.4 g/t Au and 0.27% Cu. While I would hesitate calling these true “discovery holes”, additional drilling is absolutely justified. Villa Rica, the largest target on the property, has yet to be tested.

Los Venados Property – Los Venados is a prospective gold property located in Sonora State, Mexico. This could be defined as an area play – the land package is located in between two producing gold mines (Agnico Eagle’s La India and Alamos Gold’s Mulatos). Needless to say, the Los Venados land package exhibits the same high-sulphidation epithermal alterations found on the producing properties.

Willow Property – Willow is located within an established copper district in mining-friendly Nevada (Anaconda Copper’s historic Yerington Pit is located within 20 kilometers). The property has seen previous work, including sampling, geophysics, and even some drilling (by Conoco in the 1970’s). That said, previous geologists who worked at this property were looking for a flat-lying porphyry similar to Yerington. Almadex’s team has reinterpreted the model to be a preserved porphyry lithocap with the potential for economic copper, gold, and molybdenum mineralization.

Caldera/El Chato Properties – These two properties are in close proximity to each other in Puebla State, Mexico. Both projects are new Caballo Blanco-like gold systems located 150km west of Caballo Blanco. (For some quick context, the Poliquins discovered Caballo Blanco in 2004. This project will be discussed in more detail shortly, as Almadex owns a royalty interest on Caballo.) Both Caldera and El Chato have defined targets ready to be drilled, as IP and soil surveys have been conducted on both properties.

El Encuentro Property – El Encuentro is located 10km from McEwen Mining’s El Gallo Mine in Sinaloa State, Mexico. The project saw significant precious metal values from surface sampling conducted in the mid -1990’s, but no follow up work was pursued.

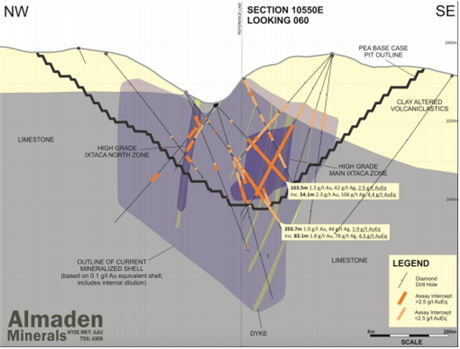

2% NSR Royalty @ Ixtaca Project – Despite the fact that Almaden kept full ownership of the Ixtaca Project after the spin out, Almadex holds a 2% NSR Royalty on future Ixtaca production. This is by far Almadex’s most promising royalty interest. (For those unfamiliar with royalties, “NSR” means net revenue minus transportation/refining costs. A 2% NSR royalty means that Almadex is entitled to 2% of Ixtaca’s future net revenue, if/when that occurs.) In December 2015, Almaden announced a promising Ixtaca PEA. The PEA looks economic, even at current metal prices, as (a) post-tax NPV > initial capex, (b) after-tax IRR is 30%, and (c) project payback is less than 3 years. These numbers tell me that Ixtaca will reach commercial production in the medium term, potentially before 2020. Once this occurs, Almadex’s NSR Royalty will in essence become an annuity that lasts for a minimum of 13 years. This certainly is not factored into the share price at current. A cross-section of Ixtaca can be seen below; note the 203m intercept @ 1.9 g/t AuEq.

Source: Company Presentation

1.5% NSR @ Caballo Blanco Project – Almadex holds a royalty interest on the Caballo Blanco Project, which has also seen a PEA. This is an open pit, heap leach gold project currently owned by Timmins Gold. Despite the fact that a 2012 PEA estimated Caballo Blanco to have a 37.5% IRR @ $1200 Au, I consider this to be a marginal deposit that won’t be put into production until gold is north of ~$1500. This is ok considering that Almadex’s assets aren’t being assigned any value by the market anyway; investors should view the Caballo Blanco NSR as a free call option on higher gold prices.

2% NSR @ Elk Project – Almadex also holds a royalty interest on the small Elk Project based in southern British Columbia. This project also saw a PEA in the recent past – detailing a $17m USD mine with a pre-tax IRR of 44% at $1200 Au. Even with the impressive IRR, I view the Elk Project similarly to Caballo Blanco – this mine will not likely be built until gold is above $1500 for a sustained period of time.

Unlike many of its peers, Almadex has ambitious plans to advance its portfolio of properties in 2016. Almadex can initiate exploration drilling quickly and cheaply – the company has a full technical team in-house and owns five drill rigs. Below you will find expected company milestones for the coming 12 months:

- First drill results @ El Cobre in Q1 2016

- Release of PFS @ Ixtaca in Q2 2016

- Release of FS @ Ixtaca in Q4 2016

- First drill results for at least 2 of the following properties in Q4 2016:

- Los Venados

- Willow

- Caldera/El Chato

- El Encuentro

This is a lot of work. But the more impressive part is that, even with the busy year outlined above, Morgan Poliquin has assured me that the company will not burn through more than $1.5m CAD in 2016. Some junior companies continue to spend more than this on an annual basis solely on G&A! If the company is able to stick to this number, it will be a special display of both capital discipline and efficiency.

The market is currently assigning zero value to (a) Almadex’s grassroots assets, (b) Almadex’s royalty collection, and (c) the IP that the Poliquin’s have developed through decades of exploration, particularly in Mexico. This doesn’t make any sense to me, which is why I’m buying the stock. The Poliquin’s clearly disagree with this assessment as well; otherwise they wouldn’t be embarking on the aggressive 2016 exploration program outlined above.

At the moment, it is nearly impossible to predict the appropriate “fair value” for Almadex shares. We know that in a best case scenario the company is sitting on another Ixtaca. If this were indeed the case, shares would be worth at least 10x more than they are at current. This can be inferred simply by looking at Almaden’s current Enterprise Value of ~$60m CAD (remember that Ixtaca is Almaden’s only asset).

But even without this ideal outcome, the company has a tremendous opportunity to create value across its portfolio of assets. And considering that the stock is priced for a worst-case scenario, any unexpected value creation over the coming years equals pure upside for shareholders.

Remember, mineral exploration is a very risky business with potentially massive rewards. In this case however, you can participate in the upside while knowing that your risk is limited at current share prices. This combination of low risk/high reward is available only in the very depths of bear markets –I don’t expect it to remain this way for long.

Margin of Safety

Almadex has roughly $6.5m CAD in working capital – through an assortment of cash, gold bullion, and equity investments. More precisely, the company owns:

~$3m CAD in cash

~$1m CAD in equity investments (Gold Mountain Mining Corp + Alianza Minerals)

~$2.5m CAD in gold bullion (1597 ounces)

Given Almadex’s current share price, the ratio between working capital and market capitalization is nearly 1:1. This implies that downside is severely limited as it is very rare for a debt-free company to trade below its working capital balance. Particularly if you want to preserve capital, you can’t go wrong as an investor buying well-managed companies trading at these levels.

There is an additional aspect of safety for Almadex shareholders. One of the many pernicious “bear market evils” is excessive dilution, where companies are forced to raise capital at dramatically lower valuations. If one can at all help it, equity raises should be avoided at all costs in the depths of bear markets.

Fortunately, in the case of Almadex, the company has a runway of over 48 months at their current burn rate ($1.5m CAD annually). While I do expect the company to raise money sometime during these upcoming four years, management won’t be forced to do so until the AMZ share price is substantially higher. This is a huge advantage over the vast majority of Almadex’s peers, who either have a negative working capital balance or a runway of less than 12 months. Almadex will be able to conduct future raises on its own terms

As a final point, the Poliquins are mineral exploration experts who have persisted through multiple bear cycles (including 1988-1992, 1998-2002, and 2008-2009). They understand just as well as anyone that there is no better time to be searching for minerals than when (a) competition is at a minimum and (b) expenses are low. Given this experience, I trust that Almadex will be able to produce tangible progress on a project-level over the remainder of this down cycle.

Matt Geiger has a diverse set of skills pertaining to early stage ventures – both in the world of natural resources and tech. He is currently General Partner of MJG Capital – a resource-focused investment partnership with 20+ LPs. He is also Cofounder/President of a venture-backed technology business with $10m in cumulative funding. Known for his exhaustive security analysis and intuitive grasp of contrarian investing, Matt is a rising star in the junior resource field.

Disclosure: MJG Capital is LONG Almadex