Source: Thibaut Lepouttre of

Caesars Report Exclusively for Streetwise Reports (2/4/16)

https://www.streetwisereports.com/pub/na/senior-gold-producer-goldcorp-takes-large-stake-in-nevadas-gold-standard-ventures

When Gold Standard Ventures announced on February 1 that Goldcorp would be investing CA$16.1 million for 9.9% of the junior's shares, industry watchers took notice. In this analysis written exclusively for

Streetwise Reports, Thibaut Lepouttre, editor of

Caesars Report, speculates on why the major acted when and where it did, and what it might mean for the future.

Good news travels fast, and whenever a gold exploration company is able to raise a decent amount of cash in the current market circumstances, the market's ears usually perk up. Enter

Gold Standard Ventures Corp. (GSV:TSX.V; GSV:NYSE). Not only was this Nevada-focused gold explorer able to attract CA$16.1 million (CA$16.1M) in new funding, this placement was also conducted at a premium to the market price (16% above the 20 day Volume Weighted Average Price [VWAP]) and allowed senior producer

Goldcorp Inc. (G:TSX; GG:NYSE) to initiate a relatively large stake in Gold Standard.

I would like to take a moment to explain the importance of not just being able to raise cash at a premium, but raising it from one of the industry's most respected companies. Goldcorp usually has a conservative investment approach and the company most definitely isn't acquiring stakes in companies on a daily basis. In fact, Goldcorp has been selling some non-core assets in the recent past, but now seems to be in buying mode again.

So what exactly attracted Goldcorp to make this investment?

First, one could immediately point to the flight towards safety-paradigm as several larger producers are falling back on North American assets to reduce the exposure to geopolitical risk. However, those companies usually start by consolidating assets in the regions where they already have a presence, and as Goldcorp has no activities in Nevada, one cannot consider the stake in Gold Standard to be just a minor event.

Goldcorp historically isn't interested in remaining a passive investor, and we have the impression this investment in Gold Standard Ventures is just a first step to maneuvering itself into a better position to perhaps take full control of Gold Standard and its Railroad-Pinion project.

Secondly, Goldcorp isn't the first company to recognize the potential of the Dark Star zone at Railroad-Pinion, as in the second quarter of last year, Gold Standard attracted

OceanaGold Corp. (OGC:TSX; OGC:ASX) as another strategic shareholder. In fact, Gold Standard's two most recent private placements were with two existing producers, as both mid-tier producer OceanaGold and now senior producer Goldcorp invested approximately CA$32M in Gold Standard Ventures. What better way to show validation of the project than to get two sizable investments from such credible companies all while increasing shareholder value as the two investments were done at $0.65/share and $1/share, reflecting a significant increase in share price. . .impressive.

And finally, the most recent drill results at the Dark Star deposit were real eye-openers, as the drill bit intersected long intervals of oxide rock with an above-average gold grade, indicating Gold Standard Ventures might have an elephant by its tail.

Two is company, three is a crowd? Not in Gold Standard

Two is company, three is a crowd? Not in Gold Standard'

s case!

With OceanaGold and Goldcorp now being large shareholders of Gold Standard, one would think this might reduce the appetite of any other potential strategic investor, but don't be too sure about that. Down the road from Dark Star is

Newmont Mining Corp.'s (NEM:NYSE) Emigrant mine and as the synergies between the Dark Star and Emigrant mine could be enormous, we would expect Newmont to be very interested in exploring its options.

That is perhaps the most interesting feature of Gold Standard, as not only will it be able to play out two companies against each other further down the road, a third company might be invited to the party as well. Or, well, it could invite itself to the dance.

Gold Standard will now have CA$25–40M in the bank.

Once this financing deal with Goldcorp closes, Gold Standard Ventures will see its cash position increase to at least CA$25M (assuming OceanaGold does not exercise any of its anti-dilution rights) and up to CA$40M (assuming OceanaGold increases its stake to 19.9%, which it is allowed to do).

That's a lot of money for an exploration company and we expect Gold Standard to design a very aggressive drill program at Railroad-Pinion for 2016. No definitive plans have been made just yet, but we would expect the company to spend quite a few million dollars on the 2016 exploration campaign. It wouldn't surprise me to see Gold Standard kicking off a 40,000+ meter drill program that could be expanded if there is a need to do so. As the average cost per drilled meter has come down considerably in the past few quarters, Gold Standard could actually complete such a drill program at a cost of less than CA$7.5M.

It would make a lot of sense to focus on the targets towards the eastern side of the currently known mineralization as this would be the most efficient way to test the size of the project and to quickly build an inventory of gold ounces in the ground.

Conclusion

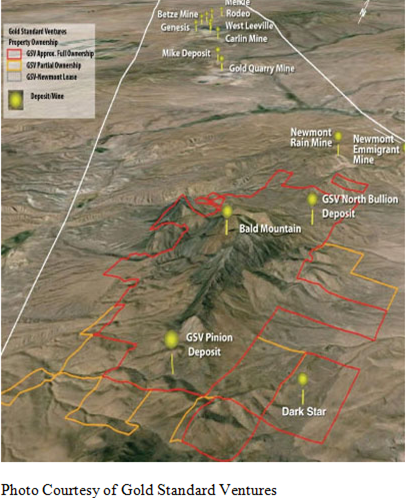

With a mid-tier and a senior gold producer having taken strategic stakes in Gold Standard Ventures in the past few quarters, the project continues to be derisked and Gold Standard Ventures now has ample cash to drill quite a lot of meters. Gold Standard has spent years putting together the second largest continuous land package in the Carlin Trend after Newmont Mining, which sets up the possibility for a meaningful size discovery.

2016 will be a very important year for Gold Standard as a new large drill program will increase the company's understanding of the mineralized zone. And even after drilling 40,000–50,000 meters, Gold Standard should still end the year with in excess of CA$15M in the treasury (assuming OceanaGold does not exercise its anti-dilution rights), which makes this company stand out from the crowd.

Thibaut Lepouttre is the editor of the Caesars Report,

a newsletter and mining portal based in Belgium that covers several junior mining companies with a special focus on precious metals and base metals. Lepouttre has a Bachelor of Law degree and two economics masters degrees that have forged his analytical approach to the mining sector. Considered a number cruncher, Lepouttre focuses on the valuations of companies and is consistently on the lookout for the next undervalued mining company.

Want to read more

Gold Report interviews like this?

Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our

Streetwise Interviews page.

DISCLOSURE:

1) Thibaut Lepouttre wrote this article for Streetwise Reports, publisher of

The Gold Report, The Energy Report and

The Life Sciences Report.

2) The following companies mentioned in the interview are sponsors of Streetwise Reports: Gold Standard Ventures Corp. The companies mentioned in this interview were not involved in any aspect of the interview preparation or post-interview editing so the expert could speak independently about the sector. Streetwise Reports does not accept stock in exchange for its services.

3) Thibaut Lepouttre: I own, or my family owns, shares of the following companies mentioned in this interview: None. I personally am, or my family is, paid by the following companies mentioned in this interview: None. My company has a financial relationship with the following companies mentioned in this interview: None. I was not paid by Streetwise Reports for participating in this interview. Comments and opinions expressed are my own comments and opinions. I determined and had final say over which companies would be included in the interview based on my research, understanding of the sector and interview theme. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

4) Interviews are edited for clarity. Streetwise Reports does not make editorial comments or change experts' statements without their consent.

5) The interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal

disclaimer.

6) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.

Streetwise -

The Gold Report is Copyright © 2014 by Streetwise Reports LLC. All rights are reserved. Streetwise Reports LLC hereby grants an unrestricted license to use or disseminate this copyrighted material (i) only in whole (and always including this disclaimer), but (ii) never in part.

Streetwise Reports LLC does not guarantee the accuracy or thoroughness of the information reported.

Streetwise Reports LLC receives a fee from companies that are listed on the home page in the In This Issue section. Their sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

Participating companies provide the logos used in

The Gold Report. These logos are trademarks and are the property of the individual companies.

101 Second St., Suite 110

Petaluma, CA 94952

Tel.: (707) 981-8999

Fax: (707) 981-8998

Email:

jluther@streetwisereports.com