Peter Epstein, CFA, MBA epstein.peter4@gmail.comEpstein Research @peterepstein2

The following interview was conducted by phone and email in the 6 day period ended February 29th. As can be gleaned from her answers, Dr. Hickson is excited about the near-term prospects for lithium exploration in Argentina. She is a Director at

Dajin Resources Corp. (TSX-V: DJI) (OTC: DJIFF) (Frankfurt: A1XF20) a lithium junior that has 100% controlling interest in 100,000 hectares through

concessions or concession applications in Jujuy Province, Argentina. Currently the brine lithium center of the world, Argentina and Chile are huge players in the sector, while Boliva holds long-term promise. Companies with operations in the, “

Lithium Triangle” include

FMC Corp, Albemarle Corp., SQM,

Orocobre Ltd. & a project owned by

Western Lithium.

[Dajin’s

Corporate Presentation]

Dr. Catherine Hickson, Director, Dajin Resources Corp., is an exploration geologist / science manager with extensive global experience. A volcanologist, regional mapper, geothermal geologist & community communication specialist, she served with the Geological Survey of Canada as a research scientist and senior manager. During her distinguished 25 year career, she managed large multidisciplinary global teams doing regional mapping, geophysical & geochemical surveys as well as hazard and risk assessments in South America. Since 2008 she has been working in the field of geothermal resources and more recently, Lithium brine exploration. She is a registered Professional Geoscientist, British Columbia Association of Professional Engineers & Geoscientists.

Please explain your background and current role at Dajin Resources S.A.?

My volcano logical and geothermal background, as well as experience in Latin America, has been a perfect segue into the realm of Lithium brine exploration. Lithium brines occur in the same geological environments, and are closely associated with, volcanic deposits and geothermal systems. Similar geological and geophysical techniques are used to explore for the brines, so the many years I have spent studying these kinds of systems has been time well spent. I have been able to use my contacts to bring an experienced team of explorers & project managers to Dajin Resources S.A. (“Dajin”), helping the Company move projects forward in both the U.S. & Argentina. [Prior

Dajin articles from ER]

How big a deal is the new ruling power in Argentina?

The new government is entire different from previous socialist regimes. The new and improved Argentina, under President Mauricio Macri, is without question open for business again. In fact, Macri ran his presidential campaign on a business-oriented, investor-friendly platform. And, it’s not just me saying this, there are numerous reports that collaborate my observations. So, I see this as a very positive development. [Recent

Video Interview]

What is the Status of Dajin’s mineral concessions?

It’s an exciting time for Dajin in Argentina. Literally within weeks of Macri’s victory, we were able to convene an essential meeting (UGAMP), on our San Jose and Navidad concessions located on the Salinas Grandes salar in Jujuy Province. This meeting, which brought together ourselves, government representatives and delegates from local communities, was one we had patiently waited years for. The main goal was to review and ratify proposed exploration plans put forth by the Company. This meeting was a vital step towards Dajin being awarded an exploration license.

NOTE: Dajin’s 100% controlling interest is via

concessions or concession applications in Jujuy Province, Argentina.

Has the management and Board mapped out near-term objectives in Argentina?

Myself and Jujuy based team of Dr. Beatrice Coira and Ing. Gabriel Blasco are formalizing a surface sampling and drilling program. Work will begin (probably in May/June), subject to obtaining our permit and contingent upon weather conditions. We met with newly appointed provincial Secretary of Mines, Dr. Miguel Solar, and found him to be very interested & motivated in increasing mining investment in Jujuy Province.

How large a land package of mineral concessions is 100,000 hectares?

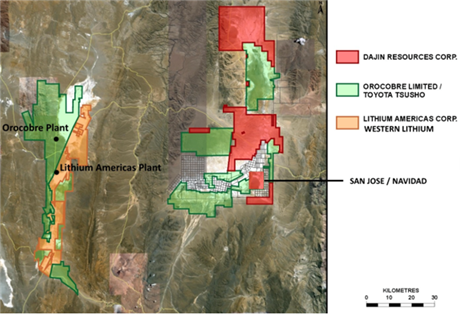

Good question. 100,000 hectares is a substantial portion of the Salinas Grandes salar. Dajin’s 100% controlled, 100,000 hectare land position compares to Orocobre Ltd’s 88,000 hectares in Salinas Olaroz & Western Lithium’s 83,000 hectares in Jujuy Province. To be clear, that’s not meant as an apples to apples comparison, just an observation. Our concessions in Salinas Grandes lie east of Orocobre’s producing brine lithium operations. Their property sits atop some very high concentration lithium brines, with good chemistry.

This is encouraging, but of course we have to conduct our own exploration. It’s our opinion that lithium-bearing brines are present throughout Salinas Grandes, but we need to confirm that thesis and assess the grades, depth, chemistry and other metrics of the prospective deposit. NOTE: Dajin’s 100% controlling interest is via

concessions or concession applications in Jujuy Province, Argentina.

From a volcanologist, (exploration & geothermal) geologist’s point of view, what features of Dajin’s concessions in the Salinas Grandes make the property look promising?

Salinas Grandes, is exactly what the name implies, a huge closed basin full of salt. The surface is white from precipitated NaCl deposits that are actually used for table salt. There are thick layers of volcanic rocks in the area and the water draining into Salinas Grandes stays there and evaporates (

the definition of a closed basin, playa in Spanish). This includes Lithium-rich water from Volcan Tugzle along the southern margins. The playa has been in existence for several hundred thousand years, so there’s been plenty of time to concentrate Lithium in the brines. [See Dajin’s

Concessions in Argentina]

How would you characterize the head start over lithium juniors that Dajin has in Argentina?

Thank you, that’s an important topic to convey to your readers. I’ve been working in Argentina for over 2 decades. Dajin’s head start is substantial. Boots on the ground is a prerequisite to getting anything done in the country. Not boots on the ground for weeks or months, I’m talking about a year or more. Partnering with a local entity is fraught with risk and entails giving up a portion of one’s economics. We control 100% of our concessions. Dajin has invested the time and resources necessary to move forward in a meaningful way. We think that exploration results in June/July could serve to draw attention to the land package we control.

Receiving exploration permits is a painstaking exercise. It’s not a Province by Province process, it’s concession by concession. That means meetings with all stakeholders, meetings such as the UGAMP I mentioned earlier. To be clear, there are a number of other important meetings, applications and approvals required as well.

You mentioned that partnering with others is fraught with risk and necessitates giving up a portion of the concessions. Presumably though, Dajin is having discussions with parties potentially interested in partnering in Jujuy. Can you comment?

Again, boots on the ground makes all the difference in the world. Over time, one figures out what style of negotiations work best. One learns which parties are important and which less so. One learns about permitting and environmental hoops to jump through. Even traveling around the country efficiently and retaining strong in-country technical people to help conduct exploration is a challenge for anyone new to the region.

To answer your question, yes we are taking with several parties about a range of possible collaborations. We’ve not moved forward because we believe we will have better leverage to negotiate later this year after sampling results come through. Even then, no assurances can be made by me, or anyone at the Company, that a strategic or financial arrangement will transpire.

Which Province is considered the best to be in, the sweet spot of Argentina?

The Salinas Grandes salar is located on the east side of the Puna (high plain) region in the provinces of Jujuy & Salta, in NW Argentina. Indications are that parts per million (ppm) concentrations of brine are spread throughout Salinas Grandes in Jujuy and Salta provinces. Importantly, we can leverage off of Orocobre’s publicly filed 43-101 technical report completed when they were carrying out exploration in Salinas Grandes a few years ago. So, we know where they found the best concentrations, the depths of the deposit and the chemistry. [Dajin’s

Corporate Presentation]

Can you please comment on infrastructure, or lack there of, in Northwestern Argentina?

Can you please comment on infrastructure, or lack there of, in Northwestern Argentina?

Again, we can turn to Orocobre’s technical study for indications and the knowledge of our team. There’s a paved highway to the border with Chile, crossing the salar. A gas pipeline passes between the Salinas Grandes and Guayatayoc salars and a railway crossing from northern Argentina to Chile passes approximately 80 km south of the project. This suggests that decent infrastructure is in place, but Dajin has not sought access to this infrastructure to date.

What are the most important takeaways for readers to consider?

++ Argentina is open for business again,

++ In Argentina, Dajin has scale (

100,000 hectares), close proximity to brine producer Orocrobre and a meaningful head start,

++ Like in any foreign countries, new entrants can’t simply stake ground and be off to the races,

++ Boots on the ground, time & resources invested, and an understanding of the people, local government / Provinces, and applicable government agencies are vitally important to progressing in a prudent, efficient manner.

NOTE: Dajin’s 100% controlling interest is via

concessions or concession applications in Jujuy Province, Argentina.

Thank you for your considerable time and your meaningful answers to my questions about Dajin Resources Corp. (TSX-V: DJI) (OTC: DJIFF) (Frankfurt: A1XF20)

Disclosures: Dajin Resources has a small market cap. Stocks with small market caps are highly speculative, not suitable for all investors. I, Peter Epstein, own shares of ticker: DJI.V. Mr. Epstein is not a licensed financial advisor. Readers should take that fact into careful consideration before buying or selling any stocks mentioned. Readers are highly encouraged to consult with their own investment advisors before buying or selling any stocks, especially speculative ones.

At the time that this article was posted, Dajin Resources was a sponsor of: https://EpsteinResearch.com. Please consider visiting: https://EpsteinResearch.com for free updates on Dajin Resources and others across a range of industry sectors. While there please enter an email for instant delivery of my work. Thank you for supporting my articles & interviews.