‘Caution Is Appropriate’

And with those dovish words, the dollar tumbled and gold rock and rolled.

We will not go into too much detail on why we are bullish on gold – after all, if you are reading this you are too! However, there are some key points we would like to highlight before we delve into stocks.

The Global Economy will face incredible hardships moving forward.

Debt levels continue to increase with every major government running a deficit and the United States is leading the pack. Regarded as the world’s strongest economy, the United States has seen its debt increase 89% since 2008 to a staggering $17 trillion. Furthermore, the credit markets are signalling that the debt-fuelled expansion which began in 2010 is showing major signs of weakness. Credit spreads are widening and low-grade corporate bonds are rapidly declining in value, especially high-yield energy and real estate debt. Europe and Japan both have negative interest rates, and we believe the United States will follow, which will lead to a great deleveraging.

Money is being printed at an unprecedented rate and the reckless expansion of money supply is debasing our currencies. This is accompanied by rising taxes, which hurts baby boomers and investors while helping to prop up egregious debtors. The population is aging, but pensions and healthcare remain unfunded. According to Rocklinc Investment Partners, Governments have committed over $225 trillion to its citizens, however, have almost no money set aside to fulfill these promises…

We maintain that 2016 will be a banner year for gold. After five long hard years of a bear market, we look at gold like a slingshot pointed to the moon. This also means 2016 will be a banner year for gold stocks, and more capital is finding its way back to the production and exploration of the yellow metal.

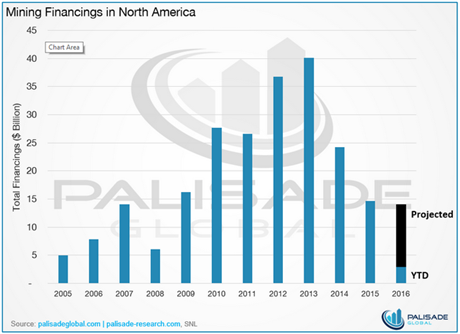

In fact, the beginning of 2016 saw the return of some “mega financings”, with Franco-Nevada Corp. Silver Wheaton Corp., and Kinross Gold Corp., raising $1.7 billion in aggregate. While the figure may seem like a lot, it’s just scratching the surface of capital flow in mining.

Endeavour Mining (TSX:EDV) – Eating And Growing – Full Steam Ahead

Original Write-Up Here

Current Price: C$14.05

Shares Outstanding: 59.0 million

Net Debt: US$125 million

Target Price: C$18.00

Total Return to Target: 28%

52-Week Range: C$4.35 – C$14.45

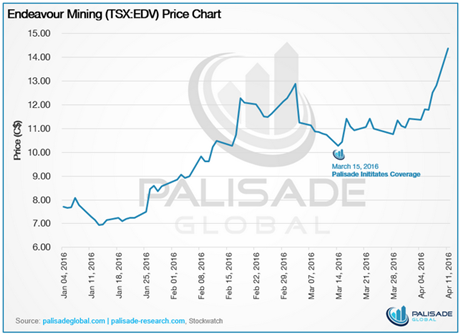

We are raising our price target for Endeavour Mining from C$15.30 to C$18.00. The increase reflects the green-light or de-risking of Houndé and the lower than expected AISC. With the acquisition of True Gold expected to close in the near future, Endeavour’s production profile has changed drastically since we began coverage just last month. We have already seen a great return since we initiated coverage (March 15, 2016 at C$10.43), however, we believe there is still plenty of room to run.

Just last month, Houndé was fully permitted and awaiting an investment decision, which was scheduled for H1 2016. Upfront capital was expected to be $325 million, and would provide Endeavour with 190 koz gold per year for over 10 years at an expected mine-level AISC cost of less than $720 per ounce.

The lower AISC of $709 per ounce will lower EDV’s overall AISC guidance from $870-920 per ounce to ~$850. What is most impressive with the construction of Houndé is that it will be financed almost all with cash. EDV’s total existing sources of capital, excluding 2016-2017 cash flow is $352 million, well above the estimated initial capital expenditure of $328 million.

By 2018, Endeavour expects to produce 900 koz per year, and lower its average AISC to below $800 per ounce. Our forecast is not as aggressive, projecting Endeavour will be an 890 koz producer by 2018, (737 koz attributable to Endeavour), with AISC remaining around the current $850 per ounce.

To achieve the lower AISC, we expect EDV is actively marketing Nzema, which is expected to incur an AISC of $970-$1,020 per ounce this year. Once that dead weight is shed, Endeavour will be on the hunt for another acquisition.

Moving forward, EDV will be the consolidator of West Africa, and we have some guesses on its next target. Furthest down the list we have Roxgold (TSXV:ROG, Mkt Cap: C$ 353.3M), who owns the Yaramoko project in familiar Burkina Faso. Yaramoko expects to pour its first gold in June 2016 and will produce on average 99,500 ounces per year for 7.4 years. Did we forget to mention an average AISC of $590 per ounce? Our only doubt about Roxgold is that it does not really fit EDV’s project profile; Yaramoko will be a high-grade underground mine, while Endeavour’s bread and butter has been open-pit with a significant oxide component.

That is why Orezone Gold Corp. (TSXV:ORE, Mkt Cap: C$82.8M) seems like the more intuitive play. Orezone’s flagship asset is the Bomboré project, also located in Burkina Faso. It is the largest undeveloped gold deposit in the region, and can be built in stages to reduce initial capital expenditures, an attractive feature as the mine comes with a $250 million price tag. Bomboré fits EDV’s project mold, an oxide resource, a production profile for first eight years of 135 koz per annum, and an attractive AISC of $687 per ounce. 2016 will be a momentous year for Orezone as it plans to update its resource through 50,000 meters of additional drilling, but more importantly, it expects approval of its mining permits.

Lastly, on more of a project level, we believe Perseus Mining (TSX:PRU, Mkt Cap: C$227.6M)’s Sissingue Gold Project in Cote d’Ivoire almost fits the mold, albeit it is on the small side . The project’s feasibility plans on 75 koz per year for the first five years with an AISC of $632 per ounce.

Argonaut Gold (TSX:AR) – No Debt, Good Cash Flow, Great Optionality

Original Write-Up Here

Current Price: C$2.35

Shares Outstanding: 156.8 million

Cash: US$45.9 million

Target Price: C$3.00

Total Return to Target: 28%+

52-Week Range: C$0.78 – C$2.38

Our initial coverage of Argonaut Gold began back in November 2015, when an illegal blockade disrupted operations at El Castillo, a mine that is currently winding down production. We pulled the trigger after a dip and are holding long-term.

Many other investors are still on the sidelines due to the delay in permits that will lead to an investment decision for San Agustin; however, through our research we believe construction permits will be granted any day, and a construction decision will finally be made. The addition of San Agustin within the El Castillo Complex will add 10 years of mine life to Argonaut’s production profile, and will be its key asset once production reaches full ramp-up. With a price tag $43 million, Argonaut will remain debt-free and will have many options once San Antonio requires funding.

Argonaut has run-up with other mid-tier producers, however, comes with incredible optionality in San Antonio and Magino, projects we are currently giving minimal value. Like San Agustin, San Antonio has had some problems with permitting, and this is something management is currently addressing. The huge apprehension of Magino is the significant capital requirements it comes with; an updated PFS pegs initial capital costs at $540 million. When we last spoke to Argonaut, they understood this uncertainty but maintained Magino will move forward, most likely with a partner or alternative funding solution.

Our current price target for Argonaut is C$3.00, or a 28% gain from the current share price. San Antonio and Magino provide a small backstop to Argonaut’s share price, but more importantly, offer extreme optionality when gold prices really start running. San Antonio is already a viable project in today’s market, and as Argonaut continues to de-risk, it will be reflected in the share price. The next tier arises when Argonaut finds a partner for Magino, or gold prices increase to a point where Argonaut can move it forward themselves.

Perseus Mining (TSX:PRU) – Still Flying

Original Write-Up Here

Current Price: C$0.43

Shares Outstanding: 529.3 million

Cash: C$92.7 million

Target Price: C$0.60

Total Return to Target: 40%

52-Week Range: C$0.26 – C$0.48

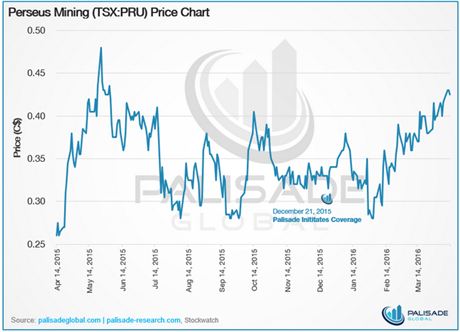

Since initiation, Perseus Mining is up 30%, and like the other mid-tier producers, has major room to climb. Perseus’ performance has somewhat lagged behind its peers, however, its flagship Edikan gold mine in Ghana appears to finally be operating in-line with management expectations. The lower grades and higher AISC may be of some concern, nonetheless, we believe management is being overly conservative in its guidance. More importantly, the stock is still undervalued even utilizing the higher operating costs.

As mentioned earlier, Sissingué is Perseus’ next project in line, and according to management’s last update, will require less than $100 million for development. PRU is sitting on almost $100 million in cash and no debt so has good options for funding. We still imagine the management team taking on debt for the majority of the financing. Sissingué has an updated feasibility study that was released in April 2015 and early work has already commenced in preparation for construction. We will revise PRU’s price target accordingly as Sissingué advances and de-risks accordingly.

In late February, Perseus announced the friendly takeover of Amara Mining which adds the advanced stage Yaoure project in Cote d’Ivoire to the company’s pipeline. Yaoure comes with a PFS, which was completed in Q1 2016 and sets to deliver 203,000 ounces of gold annually over 15 years at average AISC of $667 per ounce. Total upfront capital cost is expected to be $334 milion, and touts a post-tax NPV of $555 million at $1,200 gold.

While the takeover of Amara does not bring any immediate production to the table, Perseus’ attributable proved & probable ore reserve increases by 160% to 7.3 million ounces, and M&I resources increase by 112% to 14 million ounces. Not to sound like a broken record, the pro-forma portfolio has incredible optionality moving forward.

This year Perseus will continue to optimize operations and decrease operating costs at Edikan. In the background we expect Sissingué or Yaoure to be sold, but some additional work may be needed to make the assets more attractive to potential suitors. We expect it will be Sissingué up for sale, and the company will dedicate the bulk of its growth efforts fine-tuning the more costly Yaoure. Either way, Perseus has good production to rely on for cash flow with a proven management team that can get things done regardless of the markets. We are excited with upcoming updates as we expect the grades to become higher and the costs to become lower.

Disclaimer:

Palisade Global Investments Limited and/or its employees holds shares of EDV, AR, and PRU. The information contained in such write-ups is not intended as individual investment advice and is not designed to meet your personal financial situation. Information contained in this report is obtained from sources we believe to be reliable, but its accuracy cannot be guaranteed. The opinions expressed in this report are those of Palisade Global Investments and are subject to change without notice. The information in this report may become outdated and there is no obligation to update any such information.