First, the good news and taking a moment to celebrate the recent unstoppable rally in both gold and silver where, as has been expected, silver is outperforming gold. While we have stayed clear of paper futures from the long side, over the past few years, almost each and every week we have continued our mantra of buying and accumulating the physical metal. It is beginning to pay off, especially for purchases made throughout last year and this one.

This is not yet a victory lap, for the market remains in its transitioning phase, but the faithful, for what has always been considered the only true form of money: gold and silver, can relax more and shed the deer-in-the-headlights look after seeing both pummeled to the downside so relentlessly over the past several years by the money changers.

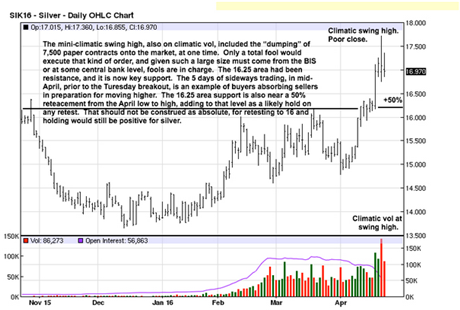

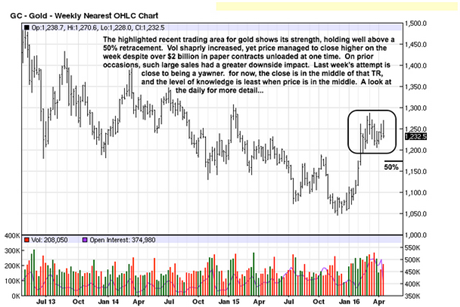

In the battle being waged between Truth [physical gold and silver] and Lies [all paper contracts], the indestructible PMs will always prevail, and the time is nearing. On Thursday, at the peak of the rally, and during yet another Draghi lie called a press conference, “someone” dumped over $2 billion in paper gold onto the market. That is 16,000 paper contracts, with emphasis on paper contracts for it sure was not physical gold that was being dumped. For silver, around 7,500 contracts were sold at the same time.

How much more blatant can the central bankers be? How much more will be the effect of such stupidity? Holders of the physical know very well what is being “sold” is useless paper, not the real metal, and as with QE-t0-infinity, bankers have pretty much run out of “fixes.” These are definite signs of the end game for PMs suppression.

While the Less Is More philosophy works well in the real world, more dumping of central bank paper is having less effect on the real market. Where the drinking of kool aid by the Jones cult led to the death of all 900 followers in Jonestown in 1978, those who currently continue to follow and “swallow” the globalist’s paper kool aid currency will also die a financial death, of sorts.

The relative few who have always held to the Truth of intrinsic value in physical gold and silver will not only survive the slings and arrows aimed at them, over the years, but will actually prosper when prices rise to reflect the reality of the lies lived by central bankers and their ilk regarding gold. Silver has been considered money for much longer than gold.

Now the bad news. The worse it gets, the better it is for silver and gold prices. The elites have created an untenable financial crises on a global scale. To be sure, the directed chaos has always been with but one objective in mind, the global New World Order, even more unstoppable than the recent PMs rally.

The Rothschilds, the Rockerfellers, the Bilderbergers and all of their minions so dutifully meeting every year, the duplicitous likes of the Kissingers and Soros’, and the sycophant leaders of the Western world countries have all done everything possible to rid the globe of freedom in favor of the yolk of servitude to those that yield power. This will not end well for the people, and we have seen exactly how for those in Greece, the Middle East and elsewhere as financial stability has been replaced with IMF-directed instability.

The US has wrought more war and destruction everywhere it goes as it strip-mines other country’s natural resources, especially oil, harvesting drugs as the world’s largest narcotic dealer, demanding compliance in support of its fiat currency at the barrel of so many guns and used so readily to ensure compliance. Unfortunately, this sad state of affairs has not yet ended, and if Neocon Hillary Clinton is elected president of the corporate federal government, expect the worst of times to follow.

The lap-dog European Union, led by fools like Draghi, a product of the Goldman Sachs Business School of Financial Thieves, where the EU has evolved in its tapeworm fashion to consume the previously sovereign individual European nations under a single umbrella, the EU has been a massive failure, especially for everyday people, enabled by each country’s leaders-turned-traitors to their own constituents, all in service to the globalists.

Well, for those who have held steadfast against the tide of the globalist power grab, the holders of physical gold and silver can extend a golden middle finger on one hand, and a silver middle finger on the other, and say in their best MC Hammer-esque way, “You can’t touch this!” True money, gold and silver, equates to financial independence from the tyranny of the elites. Roosevelt’s calling in of all gold held by citizens in the US was expressly for that purpose: the removal of the ability to remain independent of the federal government.

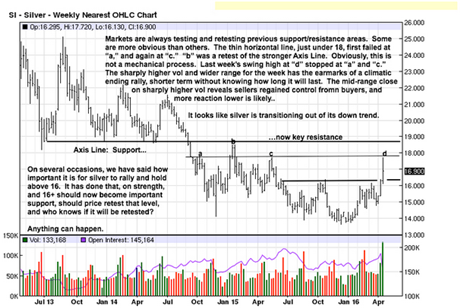

We start with silver this week because it has acted stronger relative to gold, as we have been anticipating, as silver tends to lead gold in up markets. It cannot be said that both PMs are definitively in up trends, but they are pointing in that direction.

The mid-range close for last week suggests sellers regained control from buyers, at least for now, otherwise, the close would have been higher. By deduction, one would reasonably expect to see some kind of corrective activity, in response.

The important 16+ level has been surpassed and has held. Chart comments explain why

there can be more reactive retesting, but if it unfolds in a weak manner and holds 16+ or higher, it will be additional feedback that higher prices are on the immediate horizon.

The mini-climatic action from last Thursday’s dumping of 7,500 paper contracts is laughable, both for its blatant attempt at manipulation to stop the rally, and also for the lack of downside follow-through evident from prior massive selling to suppress price. The ability to withstand such a central banker onslaught speaks to changes that are becoming more apparent in developing market activity.

Worth mentioning is the gold:silver ratio. A few weeks back it hit 82+:1. Last week, it touched 71+:1, intra day. We expect to see that ratio favoring silver more and more, looking for it to reach under 40:1, possibly under 30:1. A few weeks ago, we mentioned switching out of some gold for silver as a gold/silver ratio play, exchanging at a net ratio of 75:1.

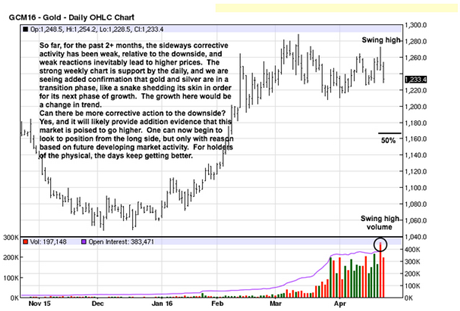

The weak correction since the 1280+ high, staying well above a half-way retracement, augurs well for gold. Some retesting of the low of the developed TR is expected, even

possibly going under 1200, briefly. What any kind of correction will do is provide some valuable feedback regarding the health of a transitioning trend to the upside.

Last week’s close near the bottom of the weekly range could lead to further weakness, and for that, we look to the daily chart for more detail.

While the swing high has the potential to be a mini-climatic temporary top, one has to be impressed with how gold has maintained the gains from the November/December 2015 lows. Such development is more typical of a strong up trending market and not one that is just beginning to transition out of a protracted down trend.

We have to wonder if this reflects the fact that the Shanghai Gold Exchange will now be

reporting the price for gold, and the LMBA has lost its “fixed” monopoly. The Chinese are in a position to have a much greater influence in pricing for gold and silver, so it gets “interestinger” and “interestinger.”

Good news, bad news, both are favorable for gold and silver. About time.