The Weight Of The Evidence

Looking at the stock market in isolation last week, it appeared “risk-on” was back in a big way. However, a peek behind the bull/bear curtain, painted a very different picture. From The Wall Street Journal:

After Lehman Brothers fell over in September 2008, equities slumped, then rallied back to their previous levels within a week. Brexit isn’t Lehman, but the stock market is behaving similarly…In 2008, shareholders made an epic mistake: They assumed Lehman would be manageable. This time the assumption is that central banks will ride to the rescue and corral any problems. Investors expect global easy money, adding yet another central-bank prop to the stockade protecting shares from weak economic growth. The result is some unusual, and worrying, behavior in the bond market. Since the Brexit vote, Treasury yields have tumbled, and they kept falling even as shares recovered.

Two Charts That Say A Lot About Confidence

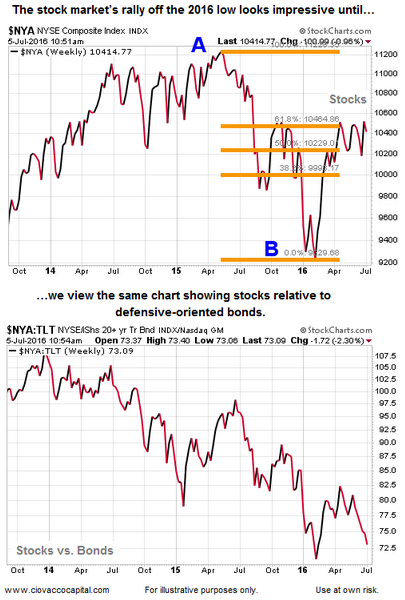

During the financial crisis, demand for defensive Treasuries soared as economic and systemic concerns started to pile up. How have bonds performed relative to stocks since the Federal Reserve did an about face on interest rates in early 2016? The answer can be found in the two charts below.

Central Banks vs. Slowing Global Growth

This week’s stock market video takes a deeper look into asset class behavior during the Brexit rally in stocks. How did the inflation trade hold up relative to defensive assets? Did European banks participate in the risk-on rally? Why did stocks rally? What could derail the rally?

After you click play, use the button in the lower-right corner of the video player to view in

full-screen mode. Hit Esc to exit full-screen mode.

Equity Leadership During The Brexit Rally

Not only did bonds outperform stocks last week, but leadership on the equity side of the ledger was decidedly defensive as well. From The Wall Street Journal:

Last week’s divergence of bonds and equities isn’t healthy. Bond markets are screaming that the world economy is slowing, and shareholders have their fingers in their ears singing “la-la-la I can’t hear you.” Stocks are no longer about growth, but about a desperate search for safe alternatives to low-yielding bonds. Since Brexit, the bond-driven nature of the stock market has been particularly stark. Four sectors in the S&P 500 are now higher than they were on the eve of the British vote, and none are a bet on the American economy’s underlying strengths. Utilities, consumer staples, health care and telecommunications sell stuff people need even in bad times; this is a defensive rally, not a dash for growth.

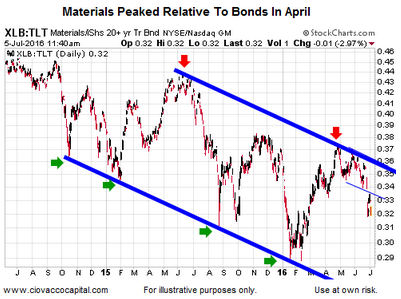

Inflation Trade Lags

Prior to the Brexit vote, we noted a concerning stall in inflation-friendly assets. The inflation-related trend continued during last week’s Brexit rally in stocks. From Bloomberg:

Inflation expectations derived from U.S. bonds are falling at precisely the same time that stocks have jumped, suggesting a “dangerous disconnect” between interest rates and equities, according to analysts at TD Securities Inc. “We believe that the equity market is complacent about the growth spillover from the uncertainty shock caused by Brexit, but is still pricing in monetary policy easing.”

This entry was posted on Tuesday, July 5th, 2016 at 11:07 am and is filed under Stocks - U.S.. You can follow any responses to this entry through the RSS 2.0 feed. Both comments and pings are currently closed.

Copyright © 2016 Ciovacco Capital Management, LLC. All Rights Reserved. Chris Ciovacco is the Chief Investment Officer for Ciovacco Capital Management, LLC (CCM). Terms of Use. This article contains the current opinions of the author but not necessarily those of CCM. The opinions are subject to change without notice. This article is distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. The charts and comments are not recommendations to buy or sell any security. Market sectors and related ETFs are selected based on his opinion as to their importance in providing the viewer a comprehensive summary of market conditions for the featured period. Chart annotations are not predictive of any future market action rather they only demonstrate the opinion of the author as to a range of possibilities going forward. All material presented herein is believed to be reliable but we cannot attest to its accuracy. The information contained herein (including historical prices or values) has been obtained from sources that Ciovacco Capital Management (CCM) considers to be reliable; however, CCM makes no representation as to, or accepts any responsibility or liability for, the accuracy or completeness of the information contained herein or any decision made or action taken by you or any third party in reliance upon the data. Some results are derived using historical estimations from available data. Investment recommendations may change and readers are urged to check with tax and investment advisors before making any investment decisions. Opinions expressed in these reports may change without prior notice. This memorandum is based on information available to the public. No representation is made that it is accurate or complete. This memorandum is not an offer to buy or sell or a solicitation of an offer to buy or sell the securities mentioned. The investments discussed in this report may be unsuitable for investors depending on their specific investment objectives and financial position. Past performance is not necessarily a guide to future performance. The price or value of the investments to which this report relates, either directly or indirectly, may fall or rise against the interest of investors. All prices and yields contained in this report are subject to change without notice. This information is based on hypothetical assumptions and is intended for illustrative purposes only. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS. CCM would like to thank StockCharts.com for helping Short Takes create great looking charts Short Takes is proudly powered by WordPress . Entries (RSS)