The U.K.’s recent vote to leave the EU has shed some additional light on existing weak spots in the European economy. One of those weak spots is Italian banks. From The Wall Street Journal:

Britain’s vote to leave the EU has produced dire predictions for the U.K. economy. The damage to the rest of Europe could be more immediate and potentially more serious. Nowhere is the risk concentrated more heavily than in the Italian banking sector. In Italy, 17% of banks’ loans are sour. That is nearly 10 times the level in the U.S., where, even at the worst of the 2008-09 financial crisis, it was only 5%. Among publicly traded banks in the eurozone, Italian lenders account for nearly half of total bad loans.

Some Calling For More Bailouts

The EU has formal dos and don’ts when it comes to assisting financial institutions. A dialog is taking place about those rules. From Bloomberg:

Italy’s banking crisis could spread to the rest of Europe, and rules limiting state aid to lenders should be reconsidered to prevent greater upheaval, Societe Generale SA Chairman Lorenzo Bini Smaghi said. “The whole banking market is under pressure,” the former European Central Bank executive board member said in an interview with Bloomberg Television on Wednesday. “We adopted rules on public money; these rules must be assessed in a market that has a potential crisis to decide whether some suspension needs to be applied.”

The term “backstop” is the politically correct way of saying bailout, something that may not be welcomed by taxpayers, especially given the current tone of the electorate. From Bloomberg:

Bini Smaghi said on Bloomberg TV that Europe’s banking market faces the risk of a systemic crisis unless governments accept the idea of taxpayer money as the ultimate recourse. Any intervention should be as swift as possible, he said. Both Italy and Germany have too many banks that are not profitable and more consolidation is needed, he said. Italy must do more to deal with non-performing loans, and Prime Minister Matteo Renzi will have to take politically unpopular steps, including encouraging mergers that will lead to job cuts, Bini Smaghi said. “What’s needed is a European solution,” he said. “So far, we’ve had national solutions. We need a clear backstop.”

Brexit Brings More Uncertainty

The fact that Italian banks are carrying an alarming amount of non-performing loans on their books is not particularly new. However, Brexit exacerbates concerns related to future economic outcomes. From CNBC:

“The U.K.’s Brexit referendum has injected greater uncertainty into European growth forecasts, including Italy’s. That in turn has created worries about higher loan losses at the country’s banks, coupled with falling government bond yields that further hurt financial institutions’ margins. taly’s banking system is considered to be one of the most vulnerable in the euro zone with a high level of non-performing loans (NPLs) — estimated to total 360 billion euros ($400.7 billion) — overshadowing the sector.

Fears Of Brexit Contagion

Discussions concerning the possibility of “backstopping” Italian banks could lead to increasing questions about the benefits of staying in the EU. From CNN:

An Italian banking crisis, together with the Brexit vote, could inflame anti-European sentiment. Italians are already losing faith in the euro, and the clamor for a referendum on the currency is getting louder. Prime Minister Matteo Renzi is at risk of losing a vote this fall on constitutional reform. If he does, he may be forced to resign, leading to new elections at a time when Italy’s anti-euro party, the Five Star Movement, is gaining ground. “The traditionally very pro-European country has become more euro-sceptic after years of economic stagnation and painful fiscal repair,” wrote Holger Schmieding at Berenberg bank. “The risk of domino effects across the eurozone looms larger than before.”

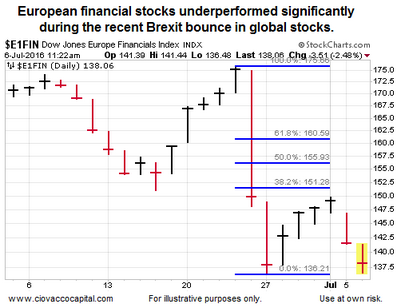

During a recent visit to EU Parliament, George Soros expressed concerns about Europe’s entire banking system, which is one of the reasons asset class behavior had a decidedly defensive bias during last week’s rally in risk assets.

This entry was posted on Wednesday, July 6th, 2016 at 11:21 am and is filed under Stocks - U.S.. You can follow any responses to this entry through the RSS 2.0 feed. Both comments and pings are currently closed.

Copyright © 2016 Ciovacco Capital Management, LLC. All Rights Reserved. Chris Ciovacco is the Chief Investment Officer for Ciovacco Capital Management, LLC (CCM). Terms of Use. This article contains the current opinions of the author but not necessarily those of CCM. The opinions are subject to change without notice. This article is distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. The charts and comments are not recommendations to buy or sell any security. Market sectors and related ETFs are selected based on his opinion as to their importance in providing the viewer a comprehensive summary of market conditions for the featured period. Chart annotations are not predictive of any future market action rather they only demonstrate the opinion of the author as to a range of possibilities going forward. All material presented herein is believed to be reliable but we cannot attest to its accuracy. The information contained herein (including historical prices or values) has been obtained from sources that Ciovacco Capital Management (CCM) considers to be reliable; however, CCM makes no representation as to, or accepts any responsibility or liability for, the accuracy or completeness of the information contained herein or any decision made or action taken by you or any third party in reliance upon the data. Some results are derived using historical estimations from available data. Investment recommendations may change and readers are urged to check with tax and investment advisors before making any investment decisions. Opinions expressed in these reports may change without prior notice. This memorandum is based on information available to the public. No representation is made that it is accurate or complete. This memorandum is not an offer to buy or sell or a solicitation of an offer to buy or sell the securities mentioned. The investments discussed in this report may be unsuitable for investors depending on their specific investment objectives and financial position. Past performance is not necessarily a guide to future performance. The price or value of the investments to which this report relates, either directly or indirectly, may fall or rise against the interest of investors. All prices and yields contained in this report are subject to change without notice. This information is based on hypothetical assumptions and is intended for illustrative purposes only. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS. CCM would like to thank StockCharts.com for helping Short Takes create great looking charts Short Takes is proudly powered by WordPress . Entries (RSS)