Major Advanced PGE-Nickel-Copper Deposit in Finland acquired by Nickel One

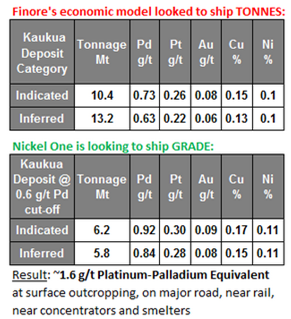

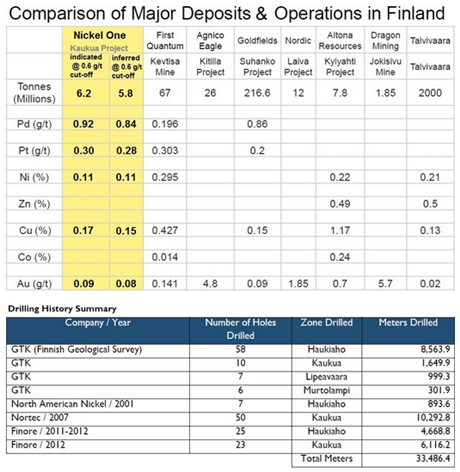

With a market capitalization of $2 million CAD, Nickel One Resources Inc. today announced the acquisition of the advanced stage Läntinen Koillismaa (“LK”) Project in Finland, where over 33 km of drilling delineated a large indicated and inferred resource: 46 million tonnes with palladium, platinum, gold, nickel and copper grades similar to operating mines and advanced projects in Finland. This NI43-101-compliant resource estimate was prepared in 2013, at a time when metal prices were slumping dramatically.

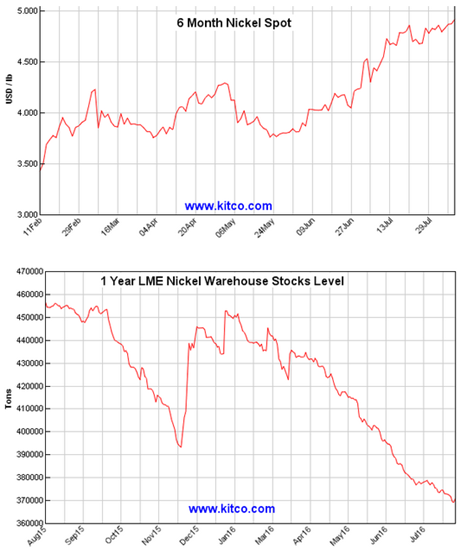

Now – with metal prices on the rise again – Nickel One intends to advance this project in a new way; amongst others applying a higher cut-off grade in order to increase grades and shrink to be mined tonnage to 12 million t initially. That’s how to potentially make this project viable within today’s market conditions.

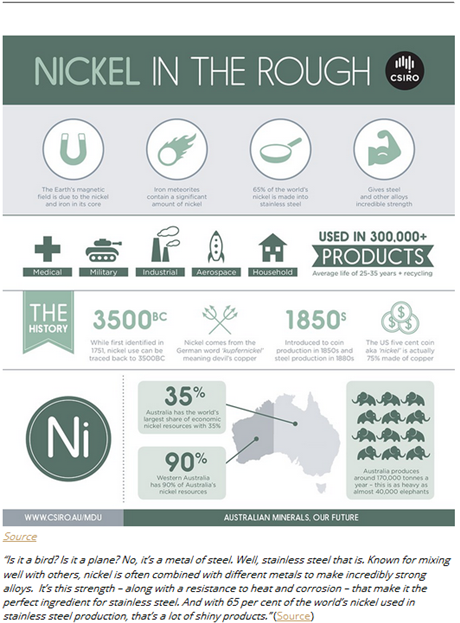

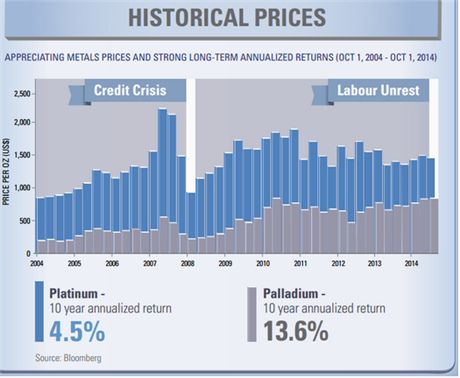

Prevalent labour issues in South Africa have been creating supply problems for PGE (“Platinum Group Elements”) commodities; as many as 75,000 workers have gone on permanent strike over the last years. Recent upturn in sales for the global automotive industry and strong forecasts for future automotive production are benefiting PGE prices; increased M&A activity may start to accelerate again. Reports are in circulation that the Russian government has completely depleted its palladium stockpiles, strongly pressurizing global supply. The global trend for improving environmental standards in widespread products and engineering methods, particularly those in the automotive sector, is likely to support robust PGE demand for the long haul.

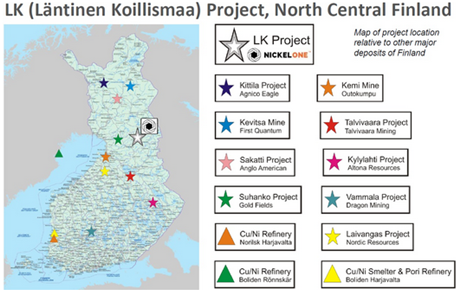

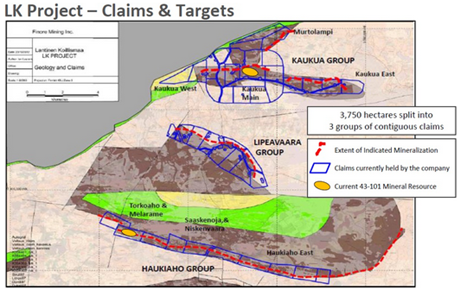

The Läntinen Koillismaa (LK) property is located in north-central Finland and has outstanding location and infrastructure advantages. Power is available in the property area as there is a history of mining in the region. The elements

platinum, palladium, gold, copper, cobalt and

nickel are known to be present and have been analysed in drilling and surface sampling on the property, resulting in a NI43-101 compliant resource. The LK property is divided into 4 target areas:

Haukiaho, Kaukua, Murtolampi and

Lipeavaara.

LK Project Highlights

• Finland is a low-risk, mining-friendly country with active companies such as Agnico Eagle, First Quantum, and Gold Fields; ranked as world’s best mining jurisdiction (Fraser Institute’s World Survey 2012/13).

• The project offers access to PGE commodities without the geopolitical risks associated with South Africa and Russia (these 2 nations produce 85% of the world’s platinum and 79% of palladium; according to US Platinum Summary 2012).

• Finland offers lower operating costs compared to North America (the 3rd largest platinum and palladium supplier).

• The project has strong support from the regional chamber of commerce and local community.

• Excellent proximity to infrastructure and smelters: Only 40 km north of existing rail network; existing all weather road directly to project site; maintenance of road up to property boundary undertaken by local government; 160 km west by rail to the major port of Oulu.

• A NI43-101 Report was completed in 2013, showing an indicated and inferred resource of 46 million tonnes with palldium, platinum, gold, nickel and copper grades similar to operating mines and advanced projects in Finland.

• The 46 million t resource outlined to date is potentially amenable to low-cost open-pit mining, as employed at the Lac des Iles Project in Canada when it first commenced operation.

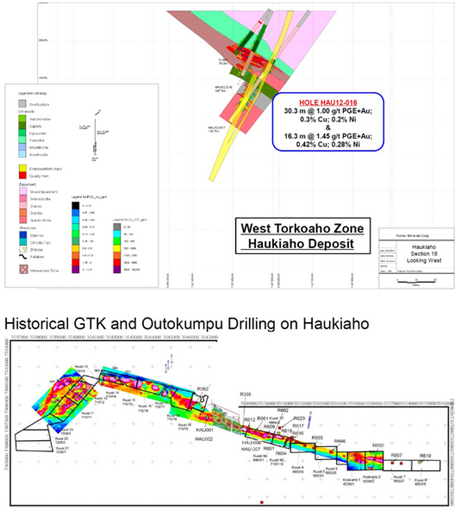

• A test mine pit exists at Haukiaho (operated by Outokumpu Oy in 1960s). The minerals mined here were brought to a concentrator 7 km south. Several trenches made by Outokumpu (1960-1990) exist on the property.

• Metallurgical test work (conventional rougher flotation) yields greater than 80% recovery of PGE + gold, 93% for copper and 51% for nickel.

• Concentrate produced (16% copper + nickel and 60 g/t PGE + Gold with low 4% MgO) is likely marketable to smelters located in Finland and Sweden. Metallurgical testwork indicates suitability of LK concentrate to a number of smelters including the Boliden smelter located in Harjavalta, Finland.

• Based on latest testwork: A 12% copper, 4% nickel, 50 g/t PGE concentrate is believed to be marketable to up to 7 of the world’s 18 major smelting facilities. The anticipated conventional milling and flotation process demonstrated a saleable 26% copper concentrate and a 6% nickel concentrate with >50 g/t PGE + gold (likely to be marketable, but value would improve substantially at higher grades).

• A total of 33,486 m of core drilling has been completed, including over 1,000 m on strike on the Kaukua zone with 83 holes and 1,800 m on the Haukiaho zone with 90 holes.

• The Koillismaa Ultramafic Layered Complex (KULC) is exposed along a mapped 38 km strike length on the Kaukua, Haukiaho, Lipeavaara and Murtolampi zones. Only 3 km have been drilled on the Kaukua and Haukiaho zones. Approximately 35 km of the KULC has been prospect drilled by the Geological Survey of Finland, outlining many anomalous Pd/Pt/Au/Ni/Cu targets.

• “Blue sky” exploration potential: Only 10% of identified mineralization is included in the current resource estimate, whereas an considerable area (identified by geophysics and historical drilling) remains unexplored. Exploration has identified 3 other targets not included in current resource estimate: Haukiaho East, Lipeävaara and Murtolampi.

Bottom-line: The advanced staged LK Project needs to be looked at again with metal prices on the rise again, whereas the 2013 resource should be updated again using different metrics, first and foremost a higher cut-off grade in order to increase average grades while decreasing tonnage to make this deposit viable and attractive for today’s markets. And LK is open to expansion through shallow drilling on strike of the exisiting resource.

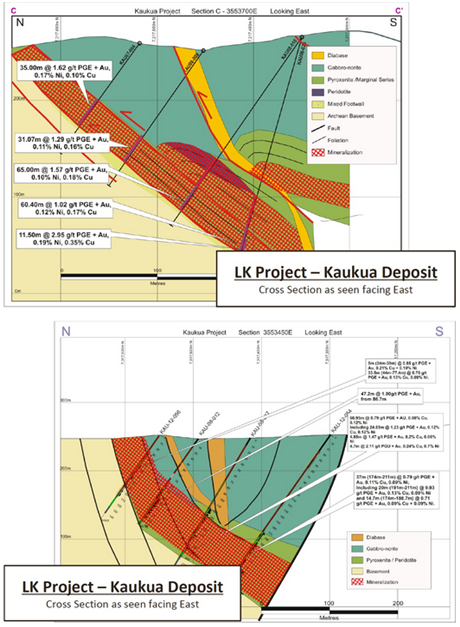

Latest drilling at Kaukua further extended the known mineralized strike length; intercepts include:

• 58 m @ 1.28 g/t PGE + Au, 0.17% Cu, 0.13% Ni

• 31 m @ 2.30 g/t PGE + Au, 0.12% Cu, 0.21% Ni

• 65 m @ 1.57 g/t PGE + Au, 0.18% Cu, 0.10% Ni

• 37.6 m @ 1.25 g/t PGE + Au, 0.18% Cu, 0.12% Ni

• 3.4 m @ 5.24 g/t PGE + Au, 0.84% Cu, 0.35% Ni

• 49.5 m @ 1.10 g/t PGE + Au, 0.15% Cu, 0.10% Ni

• 47 m @ 1.21 g/t PGE + Au, 0.16% Cu, 0.12% Ni

• 18.8 m @ 1.85 g/t PGE + Au, 0.23% Cu, 0.14% Ni

Click on below charts to view 15 min. delayed:

Nickel One Resources Inc. is a new base metal (copper, nickel) and precious metal (platinum, palladium, gold) exploration and development company evaluating the Tyko Property near Marathon, Ontario, Canada, as well as the newly acquired LK Project in Finland, hosting significant grades of palladium, platinum, gold, nickel and copper. Nickel One’s objective is to efficiently advance both projects hrough exploration and development. The company intends to build additional shareholder value through accretive acquisition of additional promising assets.

Management & Directors

Vance Loeber

CEO, President & Director

Loeber is President of Tydewell Consulting Inc. and has +30 years of international business experience. Loeber has been involved in the financing of early stage through to production level resource companies for +20 years. Loeber was one of the founders of U.S. Silver Corp. (TSX: USA), currently the largest pure silver mine in the US. He was also one of the founders of Sandspring Resources Ltd. (TSX.V: SSP), which raised over $60 million CAD and took the Toro Paru Gold Deposit in British Guyana to +6 million ounces. Loeber was also one of the founders of Carlisle Goldfields Ltd., recently bought by Alamos Gold Inc. (TSX: AGI). His extensive network is focused on Europe, Asia and North America, where he matches these investors with the capital requirements of public companies.

Abraham P. Drost (P.Geo.)

Chairman & Director

Drost is a registered Professional Geoscientist (Ontario). He obtained the B.SC. in Earth Sciences from the University of Waterloo in 1984 and the M.Sc. in Mineral Exploration from Queen’s University in 1987. He has +30 years experience in the Canadian mining industry. Until recently, Drost was CEO, President and a Director of Carlisle Goldfields Ltd. (TSX: CGJ), is currently a Director of Mega Precious Metals Inc. (TSXV: MGP), former CEO of Premier Royalty Inc. (TSX: NSR) which was bought by Sandstorm Gpold Ltd. (TSX: SSL), former President of Sandspring Resources Inc., former President of Sabina Gold and Silver Corp. and a former Director of Tyko Resources Inc., a private Ontario corporation and party to the recent transaction.

Scott Jobin-Bevans (Ph.D., PMP, P.Geo.)

Director

Jobin-Bevans is a Co-Founder of Caracle Creek International Consulting and was Managing Director from 2001 to 2008 and Director of Corporate Development since April 2011. In 2008, Scott stepped down as MD and to be a co-founder of TSX listed Treasury Metals Inc., where he served as President, CEO & Director until April 2011. Dr. Jobin-Bevans has +20 years in mineral exploration with public company experience as a director, officer and technical advisor. Scott is a member of the board of directors for a number of public and private companies and holds the volunteer positions of President and Director of the Prospectors and Developers Association of Canada.

Raymond Strafehl

Director

Strafehl has +30 years’ experience in the investment and venture capital finance industry in Canada; and in corporate relations for public mining companies. He is a registered Commodity Trading Advisor with the National Futures Association in Canada (since 1998); and founded Venture BC in 1998. He is a co-founder of International Liaison for the International Institute for Sustainable Regional Economies. Strafehl is currently CEO of Redline Resources and has previously served as a director of a number of public companies in Canada.

Roderick W. Johansen

Director

Johansen is a lawyer with Johansen Law Firm of Thunder Bay. He practices exclusively in Corporate Commercial matters including transactions and litigation. He holds a Honours Bachelor of Science from Lakehead University and a Law Degree from McGill University. He regularly provides advice to public companies on transactions, financing and other matters.

Robert J. Scott (CPA, CA, CFA)

CFO

Scott is a chartered accountant with +20 years of professional experience in corporate finance, accounting, merchant and commercial banking. He has served in management and on the boards of a number of Canadian companies. He is currently CFO of Riverside Resources (TSXV: RRI) and Northair Silver (TSXV: INM). Scott is a co-founder and a director of Pan American Hydro Corp., a private company involved in developing small hydro projects in Latin America. Scott earned his CA designation in 1998, his CFA designation in 2002 and has a B.Sc. from the University of British Columbia.

Glenn J. Mullan (P.Geo.)

Advisory Board

Mullan holds a B.Sc. (Geology) from Concordia University and has +35 years of experience in the mining and exploration industries. Mullan is also the President, CEO, and Chairman of Golden Valley Mines. As an independent prospector, Mullan has assembled and acquired many mining prospects ranging from grass-roots ventures through advanced-stage projects. Glenn also is a member of the Board of the Prospectors and Developers Association of Canada (PDAC).

Company Details

Nickel One Resources Inc.

Suite 1110 - 1111 West Georgia Street

Vancouver, BC, V6E 4M3 Canada

Phone: +1 604 805 3530

Email: info@nickeloneinc.com

Web: www.nickeloneinc.com

Shares Issued & Outstanding: 27,302,596

Canadian Symbol (TSX.V): NNN

Current Price: $0.08 CAD (August 10, 2016)

Market Capitalization: $2 million CAD

German Symbol / WKN (Frankfurt): 7N1 / A2AD3E

Current Price: €0.05 EUR (August 10, 2016)

Market Capitalization: €1 million EUR

Previous Coverage

Research #5 “Nickel One strikes pay dirt with new drill results“ (June 8, 2016)

Research #4 “Calandra is buying Nickel One as management may hit pay dirt again“ (June 2, 2016)

Research #3 “Nickel One discovers potentially significant nickel deposit near surface in Ontario“ (April 12, 2016)

Research #2 “Early Report on Nickel One: Drill Results Imminent“ (March 22, 2016)

Research #1 “Nickel One starts trading and acquires the Tyklo Nickel-Copper Project near Hemlo in Ontario“ (February 29, 2016)

Chris Berry “A Closer Look at Nickel: An Unsustainable Current Reality” (October 20, 2015)

Disclaimer: Please read the full disclaimer within the full research report as a PDF (here) as fundamental risks and conflicts of interest exist.

For Android smartphones, an APP is available from Rockstone Research in the GooglePlayStore.