“You Can’t Lose Money On Tech Stocks”

If you have been involved with the markets for the last twenty years, you may recall hearing excessively-optimistic statements such as “you cannot lose money on internet stocks” in the late 1990s. Unfortunately, the excessive optimism was followed by painful losses in technology stocks.

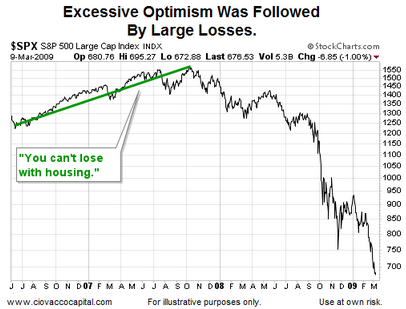

“Housing Has Changed The Markets”

Between 2004 and 2007, the excessive optimism was based on the theory that ever-increasing home values would allow for endless borrowing to fuel spending and investment.

Flight To Safety As Markets Break Out

As outlined in detail on July 25,August 1, and August 3, the recent breakouts from long-term consolidation patterns by the three major U.S. stock indexes are typically very bullish signs. From afar, it may seem like investors are once again in excessive-optimism territory. However, given actions speak louder than words, if anything, investors may be excessively pessimistic in 2016. As shown via the @ukarlewitz tweet and Wall Street Journal graphic below, instead of piling into optimistic and growth-oriented stocks, investors have been piling into conservative and defensive-oriented bonds.

What Do The Facts Say About The Prospects For Stocks?

This week’s video examines a rare bullish occurrence that historically has marked a good time to add to equity holdings, rather than reduce them. The video is based on objective data, allowing for a rational assessment of present day odds of good things happening vs. the odds of bad things happening. The results, from a probability perspective, do not support an overly defensive portfolio allocation looking out several months, or in many cases several years.

After you click play, use the button in the lower-right corner of the video player to view in

full-screen mode. Hit Esc to exit full-screen mode.

Investment Implications - The Weight Of The Evidence

The term odds implies uncertainty. Therefore, we are always open to a shift in the weight of the evidence. Right now, the longer-term weight of the evidence remains favorable for risk-on stocks.

This entry was posted on Monday, August 22nd, 2016 at 11:11 am and is filed under Stocks - U.S.. You can follow any responses to this entry through the RSS 2.0 feed. Both comments and pings are currently closed.

Copyright © 2016 Ciovacco Capital Management, LLC. All Rights Reserved. Chris Ciovacco is the Chief Investment Officer for Ciovacco Capital Management, LLC (CCM). Terms of Use. This article contains the current opinions of the author but not necessarily those of CCM. The opinions are subject to change without notice. This article is distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. The charts and comments are not recommendations to buy or sell any security. Market sectors and related ETFs are selected based on his opinion as to their importance in providing the viewer a comprehensive summary of market conditions for the featured period. Chart annotations are not predictive of any future market action rather they only demonstrate the opinion of the author as to a range of possibilities going forward. All material presented herein is believed to be reliable but we cannot attest to its accuracy. The information contained herein (including historical prices or values) has been obtained from sources that Ciovacco Capital Management (CCM) considers to be reliable; however, CCM makes no representation as to, or accepts any responsibility or liability for, the accuracy or completeness of the information contained herein or any decision made or action taken by you or any third party in reliance upon the data. Some results are derived using historical estimations from available data. Investment recommendations may change and readers are urged to check with tax and investment advisors before making any investment decisions. Opinions expressed in these reports may change without prior notice. This memorandum is based on information available to the public. No representation is made that it is accurate or complete. This memorandum is not an offer to buy or sell or a solicitation of an offer to buy or sell the securities mentioned. The investments discussed in this report may be unsuitable for investors depending on their specific investment objectives and financial position. Past performance is not necessarily a guide to future performance. The price or value of the investments to which this report relates, either directly or indirectly, may fall or rise against the interest of investors. All prices and yields contained in this report are subject to change without notice. This information is based on hypothetical assumptions and is intended for illustrative purposes only. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS. CCM would like to thank StockCharts.com for helping Short Takes create great looking charts Short Takes is proudly powered by WordPress . Entries (RSS)