Does Volume Complement or Contradict Bullish Analysis?

An August 19 analysis outlined a long-term bullish signal for stocks that has occurred only ten other times in the last thirty-five years. Have we seen any other long-term signals in recent weeks? The answer is yes.

A Trend Change in Up/Down Volume?

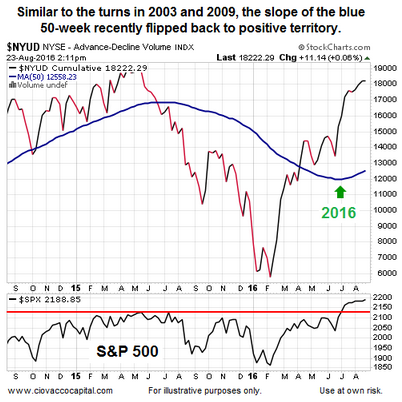

The chart below shows up/down volume (1996-2010) for the NYSE Composite Stock Index, along with its 50-week moving average (thick blue line).

Notice how all-things-being equal, the probability of bad things happening increases when the 50-week moving average is flat or negative (see orange and red arrows below). Conversely, the probability of good things happening increases when the 50-week moving average turns back up in a bullish manner (see green arrows below). The S&P 500 is shown at the bottom of the image below for reference purposes.

Has The Line Turned Back Up In A Bullish Manner?

The answer to the question above is yes. In simplified terms, it appears as if volume patterns have shifted from favoring declining issues earlier in 2016 to favoring rising issues currently.

A Foolproof Signal?

Since there is no such thing as a foolproof indicator or signal in the financial markets, the recent bullish shift in up/down volume assists us with probabilities. As long as the slope of the 50-week remains positive, the odds of good things happening will be higher. With Yellen’s Jackson Hole speech coming Friday, the market will be processing some important new information in the coming days.

Long-Term Means Long-Term

Both the moving average analysis covered in a recent video and the analysis above relate to longer-term outcomes, meaning weeks, months, and years. Therefore, even if the bullish signals prove to be helpful, stocks could experience a fairly significant pullback before resuming the current bullish trend. Said another way, for these signals to be used effectively we must have realistic expectations about normal volatility within the context of a rising trend.

This entry was posted on Wednesday, August 24th, 2016 at 9:09 am and is filed under Stocks - U.S.. You can follow any responses to this entry through the RSS 2.0 feed. Both comments and pings are currently closed.

Copyright © 2016 Ciovacco Capital Management, LLC. All Rights Reserved. Chris Ciovacco is the Chief Investment Officer for Ciovacco Capital Management, LLC (CCM). Terms of Use. This article contains the current opinions of the author but not necessarily those of CCM. The opinions are subject to change without notice. This article is distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. The charts and comments are not recommendations to buy or sell any security. Market sectors and related ETFs are selected based on his opinion as to their importance in providing the viewer a comprehensive summary of market conditions for the featured period. Chart annotations are not predictive of any future market action rather they only demonstrate the opinion of the author as to a range of possibilities going forward. All material presented herein is believed to be reliable but we cannot attest to its accuracy. The information contained herein (including historical prices or values) has been obtained from sources that Ciovacco Capital Management (CCM) considers to be reliable; however, CCM makes no representation as to, or accepts any responsibility or liability for, the accuracy or completeness of the information contained herein or any decision made or action taken by you or any third party in reliance upon the data. Some results are derived using historical estimations from available data. Investment recommendations may change and readers are urged to check with tax and investment advisors before making any investment decisions. Opinions expressed in these reports may change without prior notice. This memorandum is based on information available to the public. No representation is made that it is accurate or complete. This memorandum is not an offer to buy or sell or a solicitation of an offer to buy or sell the securities mentioned. The investments discussed in this report may be unsuitable for investors depending on their specific investment objectives and financial position. Past performance is not necessarily a guide to future performance. The price or value of the investments to which this report relates, either directly or indirectly, may fall or rise against the interest of investors. All prices and yields contained in this report are subject to change without notice. This information is based on hypothetical assumptions and is intended for illustrative purposes only. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS. CCM would like to thank StockCharts.com for helping Short Takes create great looking charts Short Takes is proudly powered by WordPress . Entries (RSS)