Source: Clive Maund for

The Gold Report (8/26/16)

https://www.streetwisereports.com/pub/na/17078

Technical analyst Clive Maund reflects on how Federal Reserve statements may affect markets, and explains why he thinks the precious metals markets are due for a correction.

While the Fed is almost powerless these days, as it has succeeded in "painting itself into a corner," the markets still seem to think that its utterances are important and react, sometimes violently, to its apparent stance, or implied stance. For this reason we have to treat Fed statements as important, even though they really aren't. Today we have the Fed making pronouncements and the markets can be expected to gyrate around and react as usual.

In general they are not expected to "rock the boat." Powerful vested interests—what may be described as the status quo—want Hillary Clinton as the next President, as she will serve as their marionette and do their bidding. Trump can talk a lot, but even if he gets in won’t make much difference for two reasons. One is that he is the candidate for the Republican Party, and the same plutocrats control the Republican Party that control the Democrats—they are two sides of the same coin. So if elected Trump will have to buckle down and do as he is told. If he tries to seriously take on the military-industrial complex that runs the U.S. he will end up like JFK. In any event, he has already indicated that he will yield and comply, by talking about "beefing up our great military" and by paying homage to "our great friend in the region (Mid-East) Israel."

So whoever gets in, the outlook for the ordinary American citizen remains hopeless, despite all the mindless pre-election hype and razzmatazz. Of the two candidates the powerful vested interests, of course, prefer Hillary, so we can expect the Fed to do as little as possible to upset the markets ahead of the elections (i.e., nothing of any consequence). This being so, today's Fed remarks might be greeted with a sigh of relief and spark another up-leg in the broad market, which is now supported by a gigantic slush fund.

Although at first sight it looks like we are being presented with a buying opportunity in the precious metals sector, which has reacted back over the past couple of weeks, we have to careful here. There has been no major correction in this sector all this year, which is inflated after months of rallying, and we will look at some evidence here that the correction may have considerably further to go, in points terms if not in time terms.

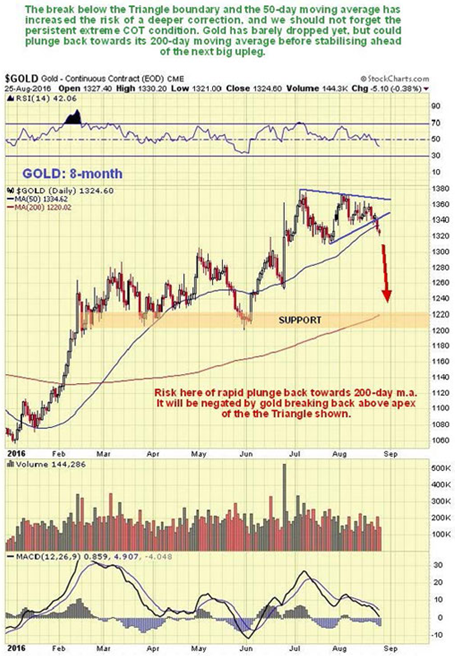

We will start by looking at the eight-month gold chart. As we can see, although stocks have been slammed over the past couple of weeks, gold has barely dropped yet, although it has broken down from a Triangle as predicted at the start of the week in

Gold and Silver Probable Short-term Scenario. If the dollar rallies, gold could get whacked back to the vicinity of its 200-day moving average, now at about $1,220. Such a drop would lead to further heavy losses in PM stocks over a short-term time frame, and would be expected to be followed by a reversal to the upside, and thus present a MAJOR buying opportunity.

The latest gold Hedgers chart (a form of COT chart, shown at the top of the article) shows an extremely lopsided situation that normally calls for a significant drop, and it has contributed to our cautious stance of recent weeks…

On the latest 8-month chart for GDX the sector looks like it is at another buy spot. It may be, depending on how markets react to the Fed later, but other factors such as the gold chart above, and sentiment readings that we will look at in a moment, urge caution and suggest that instead the sector could break down into a short-term plunge that sees GDX correct back to the vicinity of its 200-day moving average. If the sector reacts positively after the Fed, it will be in order to buy it, but prudent to set quite close stops.

.png)

After the latest retreat the Gold Miners Bullish Percent Index is still at an uncomfortably high reading of

75% bullish, which increases the risk that this correction is not done yet and could end with a nasty flushout that will also throw up a great buying opportunity.

One thing worth pointing out here is that it looks like a breakout by Treasuries is imminent, and it may well be triggered by the Fed's remarks today. On the 8-month chart for Treasury proxy TLT we see that the neat Symmetrical Triangle that has been forming in recent weeks is now closing up. Various factors suggest an upside breakout, although the gap between the moving averages is now large, so the opposite outcome is possible, depending on the market's interpretation of the Fed. . .

So let's see how the markets react after the Fed later today.

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years' experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.

Want to read more

Gold Report interviews like this?

Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see recent interviews with industry analysts and commentators, visit our

Streetwise Interviews page.

Disclosures:

1) Statements and opinions expressed are the opinions of Clive Maund and not of Streetwise Reports or its officers. Clive Maund is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the content preparation or editing so the author could speak independently about the sector. Clive Maund was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal

disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.

Charts provided by Clive Maund

Streetwise -

The Gold Report is Copyright © 2016 by Streetwise Reports LLC. All rights are reserved. Streetwise Reports LLC hereby grants an unrestricted license to use or disseminate this copyrighted material (i) only in whole (and always including this disclaimer), but (ii) never in part.

Streetwise Reports LLC does not guarantee the accuracy or thoroughness of the information reported.

Streetwise Reports LLC receives a fee from companies that are listed on the home page in the In This Issue section. Their sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

Participating companies provide the logos used in

The Gold Report. These logos are trademarks and are the property of the individual companies.

101 Second St., Suite 110

Petaluma, CA 94952

Tel.: (707) 981-8999

Fax: (707) 773-5020

Email:

info@streetwisereports.com