Source:

The Life Sciences Report (9/8/16)

https://www.thelifesciencesreport.com/cs/user/print/na/17093

With a trifecta of share-moving milestones anticipated in Q4/16, including possible FDA approval of abuse-resistant opioid Remoxy, Laidlaw & Co. Analyst Jim Molloy sees blue sky ahead for DURECT Corp.

In an Aug. 29 research report reiterating Laidlaw's investment thesis for the company, Molloy outlined imminent catalysts for three candidates in

DURECT Corp.'s (DRRX:NASDAQ) pipeline.

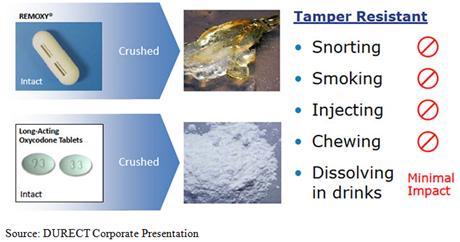

The PDUFA (Prescription Drug User Fee Act) date for Remoxy is up first, with Molloy calling the drug "[a] former greenkeeper, now, about to become the Masters champion." Though the abuse-resistant formulation of oxycodone has been "circling FDA approval for two putts, we believe Remoxy is on track to finally get the tap in on the third go at FDA approval this September 25th," the analyst wrote.

"Recent FDA approvals and positive AdCom votes for competitor[s'] abuse deterrent (AD) drugs show the FDA appears to be more accepting of approving AD opioids," Molloy added. Abuse of highly addictive opioids such as oxycodone has been called epidemic in the media and has garnered the attention of political candidates in the 2016 election.

Remoxy is partnered with Pain Therapeutics Inc. (PTIE:NASDAQ), and Molloy notes that "PTIE has clearly signaled their intention to out-license Remoxy rather than try to self-launch this drug." Potential matches include Mallinckrodt Pharmaceuticals (MNK:NYSE) and Endo International (ENDP:NASDAQ), according to the analyst.

A second DURECT candidate, Posimir, is in position to attract a partnership that would "help defray development costs of the ongoing Phase 3 trials (data due 2H17)," Molloy wrote. Posimir is a "non-opioid, locally acting analgesic designed to provide 3 days of continuous pain relief after surgery," according to the company website.

"We believe there is good reason to think that [Posimir] will show statistically significant separation" against bupivacaine in the ongoing Phase 3 PERSIST trial, which has started dosing, Molloy stated.

"We should also see Phase 1 data and IND [investigational new drug] filings for DUR-928 (a new class of steroid that regulates lipid homeostasis) in two separate clinical indications (chronic NASH & acute kidney injury)," Molloy wrote.

"DUR-928 remains an upside wildcard at DRRX with two Phase 1 PK [pharmacokinetics] trials reading out and two INDs expected to be filed by YE16 in acute kidney injury and chronic NASH [nonalcoholic steatohepatitis] conditions," Molloy stated. If the Phase 1 readouts for DUR-928 are positive, Molloy believes that "could drive a sharp value inflection."

Read what other experts are saying about:

Like this article? Sign-up to receive the newsletter

Newsletter Sign-Up Newsletter Sign-Up |

|

|

Bottom of Form

Disclosures:

1) Tracy Salcedo compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. She owns, or members of her immediate household or family own, shares of the following companies mentioned in this article: None. She is, or members of her immediate household or family are, paid by the following companies mentioned in this article: None.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: DURECT Corp. The companies mentioned in this article were not involved in any aspect of the article preparation. Streetwise Reports does not accept stock in exchange for its services. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Comments and opinions expressed are those of the specific analysts and not of Streetwise Reports or its officers.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal

disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview or article until after it publishes.

Additional Disclosures for this Content

Laidlaw & Company, Durect Corp., Aug. 29, 2016

The analyst responsible for the content of this report hereby certifies that the views expressed regarding the company or companies and their securities accurately represent his personal views and that no direct or indirect compensation is to be received by the analyst for any specific recommendation or views contained in this report. Neither the author of this report nor any member of his immediate family or household maintains a position in the securities mentioned in this report.

As of the date of this report, neither the author of this report nor any member of his immediate family or household maintains an ownership position in the securities of the company (ies) mentioned in this report.

Laidlaw & Co (UK) Ltd. has not provided any investment banking services for the company (ies) mentioned in this report over the last 12 months.

Associated persons of Laidlaw & Co (UK), Ltd not involved in the preparation of this report may have investments in securities/instruments or derivatives of securities/instruments of companies mentioned herein and may trade them in ways different from those discussed in this report. While Laidlaw & Co (UK), Ltd., prohibits analysts from receiving any compensation. Bonus or incentive based on specific recommendations for, or view of, a particular company, investors should be aware that any or all of the foregoing, among other things, may give rise to real or potential conflicts of interest.

Streetwise –

The Life Sciences Report is Copyright © 2016 by Streetwise Reports LLC. All rights are reserved. Streetwise Reports LLC hereby grants an unrestricted license to use or disseminate this copyrighted material (i) only in whole (and always including this disclaimer), but (ii) never in part.

Streetwise Reports LLC does not guarantee the accuracy or thoroughness of the information reported.

Streetwise Reports LLC receives a fee from companies that are listed on the home page in the In This Issue section. Their sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

Participating companies provide the logos used in

The Life Sciences Report. These logos are trademarks and are the property of the individual companies.

101 Second St., Suite 110

Petaluma, CA 94952

Tel.: (707) 981-8999

Fax: (707) 773-5020

Email:

info@streetwisereports.com