There’s no magic formula to succeeding in the gold exploration business.

But one of the surest strategies is to take a small, under-developed deposit and upgrade it to a much larger asset within close proximity to other gold mines.

It’s even better if this can be done in a politically stable, mining-friendly jurisdiction with robust mining infrastructure already in-place, such as Quebec or Ontario.

This way there are good odds in favour of getting bought-out by a large-cap gold miner with deep pockets.

Take Probe Mines for instance. Last year, this junior exploration company was acquired by Goldcorp Inc. for the princely sum of $526 million. The deal was focused on the two-million-ounce-plus Borden gold deposit, which is located in southwestern Ontario in the fabled Abitibi Greenstone Gold Belt. This is where nearly 200 million ounces of gold been mined over the past century.

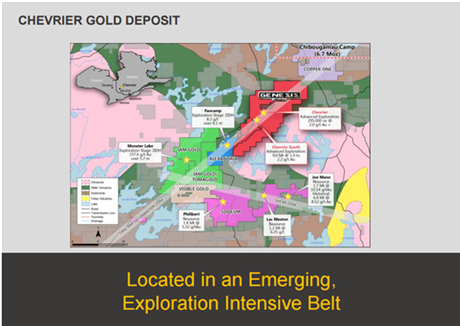

What’s particularly interesting about this headline-grabbing deal is that Borden is in the same lustrous Abitibi gold fields as the under-developed Chevrier gold deposit, which is owned outright by

Genesis Metals Corp. (TSX.V: GIS).

Located to the northeast of Borden in neighbouring Quebec, the Chevrier deposit is strategically situated within the same lustrous Abitibi gold fields. It’s also surrounded by several sizeable gold mines and other mines-in-the-making.

With this in mind, it’s not hard to see how the still-emerging Chevrier deposit may have the potential to grow big enough to become a “company maker” mineral asset – one that may eventually get acquired by a major gold producer.

How Genesis is Gearing-Up to Scale-Up

Presently, close to 300,000 inferred ounces of gold averaging 2 grams per tonne (g/t) have already been outlined at Chevrier’s so-called Main Zone.

Furthermore, a past project operator drilled enough holes in the 1990s to suggest that there’s at least 650,000 ounces of high-grade gold at Chevrier averaging 5.4 g/t.

(Nonetheless, this figure cannot yet be considered reliable simply because this calculation pre-dates more recent government-mandated reporting standards for a mineral resource.) So this outdated resource estimate should only be used for reference purposes.

That said, Genesis intends to undertake a drill program in January that will “twin” (duplicate) some of the 53 drill holes that were used to determine the original 650,000-ounce estimate.

This will give the company the opportunity to corroborate this historic information and thereby more than double the deposit’s mineral base in accordance with NI 43-101 reporting standards. It will also give Genesis a better understanding of the deposit’s structural controls. This should offer valuable insights into determining where best to conduct step-out drilling.

Furthermore, the deposit’s gold mineralization is “open” (continuous) at depth and to the north. This means that it offers additional scope for expansion below the 400-metre mark. This is where limited drilling has already encountered rich gold grades.

The Big Picture

The Big Picture

Plans to at least double the size of the Main Zone in the near-term may yet become a springboard to eventual success on a much larger scale. In fact, mineralization appears continuous along a 2.7-kilometre “strike length” (the length and direction of a rock formation when measured on a horizontal plane).

This includes the so-called South Zone, which has a target potential of around nine million tonnes grading around 2 g/t, according to the latest NI 43-101 report for Chevrier.

In fact, previous near-surface trenching work at the South Zone and elsewhere has revealed bonanza grades in excess of 10 g/t, according to historical records.

Additional trenching will be undertaken in the coming weeks to identify further high-priority targets for step-out drilling beyond the known parameters of the Chevrier deposit.

Moreover, there’s still plenty of opportunity to make additional “company-maker” discoveries within Genesis’ expansive land holdings at the heart of a geologically-fertile region – much of which hasn’t been well-explored to date.

On this note, it’s worth mentioning that the company’s claims span the Fancamp deformation zone. This is a structural weakness in the earth’s crust into which gold has migrated from much greater depths.

Of particular encouragement is the presence along the Fancamp gold trend of other significant discoveries. They include the proximal high-grade Monster Lake gold discovery to the southwest of the Chevrier deposit and the 6.7-million-ounce Chibougamau gold camp to the northeast.

The Lure of Low-Hanging Fruit

The Lure of Low-Hanging Fruit

Here’s why Genesis’ scalable deposit doesn’t necessarily have to become significantly larger to attract suitors: When shopping for acquisitions in North America, big mining companies tend to favour the quality of the asset over the size of the metal inventory in the ground.

For instance, it didn’t matter to Goldcorp that Probe’s discovery was only about two million ounces in size. What did matter was that this high-grade deposit can be mined relatively cheaply. This is thanks to the abundance of robust regional mining infrastructure that’s already in-place.

To put this into perspective, the world’s dominant gold miners are now placing an overriding emphasis on reducing their capital and operating costs. And the key to doing this is to acquire new assets that are complementary to their existing mines and are inexpensive to develop.

Investment Summary

The still-emerging Chevrier deposit constitutes a tangible asset that provides a solid underpinning for Genesis’ share price.

Meanwhile, the so-called sizzle in the steak is clearly represented by two key value drivers: First, it’s the opportunity to significantly increase the size of Chevrier. Second, it’s the “blue sky” exploration potential of the company’s almost 300 square kilometres of land holdings at the heart of a richly-mineralized gold belt.

Additionally, the company has an accomplished management team with a proven track record for success in the mineral exploration and development business. Several directors were also founders of Underworld Resources, which was acquired by Kinross Gold for $140 million dollars in 2010. This involved a 1.6-million-ounce discovery in the Yukon named White Gold.

They include Rob McLeod, Chairman of Genesis, and Adrian Fleming, Executive Director. These are the same geologists who were instrumental in Underworld’s company-maker discovery.

Their decision to acquire Chevrier and other geologically prospective land holdings in one of the world’s best mining jurisdictions attests to their vision and shrewd business acumen.

In other words, management believes that Genesis is already a success story in-the-making. And this promises to eventually make the company a likely takeover target. Such a scenario promises to offer a home-run win for patient investors.

On a technical note, Genesis has a relatively tight share structure with about 40.4million shares outstanding (53.6 million fully diluted). This reality, matched with positive news flow, typically acts as a catalyst to higher share price valuations.

All told, the advent of plenty of exploration results in the coming months should continue to build considerable intrinsic value into Genesis’ market capitalization.

Assuming this news flow continues to be positive, this should give the company’s share price plenty of upside for the foreseeable future -- especially in response to any encouraging drill results in early 2017.