First, it needs to be understood that, officially, the FED has a dual mandate: reduce unemployment, and control inflation. The former seems to have been accomplished—even if the data is suspect--, but the latter mandate is proving to be insurmountable, ironically because of the FED’s own actions.

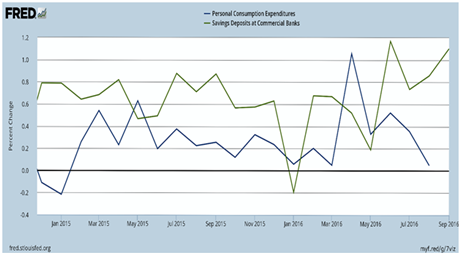

In order to work on its dual mandate, the FED has two tools: control of short-term inter-bank rates, and asset purchases (quantitative easing). The former tool is now spent since interest rates cannot go much lower; real rate of return on savings is negative. These low rates were supposed to discourage saving and increase expenditure of capital on productive economic ventures. The graph below shows that exactly the opposite is happening; savings are up, and consumption expenditures are down.

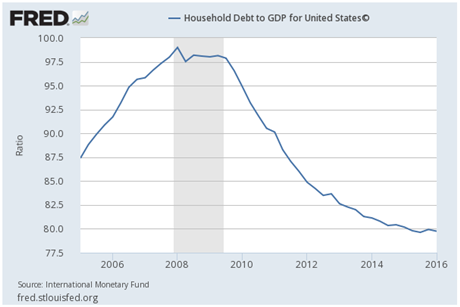

Rates at these historically low levels are a policy for times of emergency. The consumer has heard the message loud and clear and has reduced their leverage. Fearful of being caught in another debt-trap, consumes have reduced their debt and their spending (chart below).

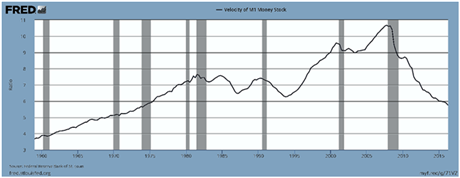

The over-all economic effect has been one of stagnation. The velocity of money, the M1, has not been this low since 1974, which tells us that economic activity is at the same level as it was in the mid 1970’s even though the population has increased by 50% since then (chart below).

The second tool that the FED has, is asset purchases (QE). This tool was used to purchase toxic mortgage-backed securities from the banks in order to ensure that the “too big to fail” financial institutions did not go bankrupt. The same curtesy was not afforded to home-owners who went on to lose their biggest asset-- they were not considered “too big to fail”. As a result, all of this newly minted money stayed in the hands of the financial industry which proceeded on a quest for yield. Since rates were so low, the financial industry did not see a favorable risk/reward ratio in lending their money in the economy. Instead, they parked it at the bond and equity casinos where it remains to this day.

The FED, along with the other major central banks, responded to this lack of lending by lowering interest rates even further (into negative territory in many places) to try and discourage saving and encourage spending, but which ironically resulted in the negative feed-back loop of lower rates leading to lower spending.

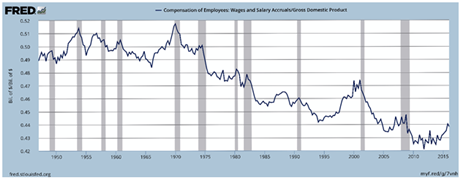

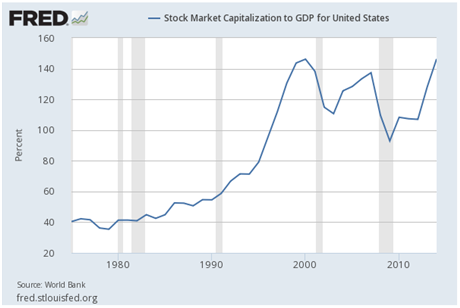

The macro effect of all of this has been to magnify economic inequality. As Briefing.com pointed out, since 50% of households do not own stock, while nearly 70% of households own a savings account, a greater percentage of U.S. households are being penalized by the low-rate policy than are helped. The share of GDP that goes to the consumer has steadily gone down, while the value of stock to GDP has reached historic highs (two charts below).

In response to this situation, the various Central Banks have been buying stock market assets such as ETFs, and this week the FED trial-ballooned the possibility that it may start to buy equities out-rite. This would make the FED the guaranteed buyer of equities and lower the risk of losing at the equity casino. Why would a financial institution risk money making low interest loans, when they can park it in the stock market and have the FED back-stop any drop in asset prices?

The bottom line is that no one is spending, and until spending appears, inflation will not become a problem. Last week we hypothesized that after the U.S. election, the government (whoever forms it) will use fiscal stimulus to try and ignite the business cycle which should increase inflation to a healthier level.

What has the FED accomplished since the great recession besides lower spending, higher saving, and increased economic inequality?

At this point, as investors, we have to hedge our stock holdings against the possibility that the market will wake-up to the fact that the lofty valuations are not supported by fundamental reality. As soon as the financial industry sees higher yields in funding the business cycle, the money will leave the equity casino and PE ratios will revert to the mean.