NOVAGOLD's third quarter financial results show a balance sheet that should be sufficient to complete permitting of the Donlin Gold project in Alaska, according to National Bank Financial.

NOVAGOLD (NG:TSX; NG:NYSE.MKT) this week released its financial results for the quarter and nine months ended Aug. 31 and provided updates for its 50%-owned Donlin Gold project in Alaska and its 50%-owned Galore Creek copper-gold-silver project in British Columbia.

NOVAGOLD reported cash and term deposits of $108 million at the end of the quarter, which analyst Raj Ray of National Bank Financial said is "expected to be more than sufficient to complete permitting of Donlin Gold." He noted that "NG continues to maintain a strong financial position," and "the strong cash balance also provides optionality protection over the next few years."

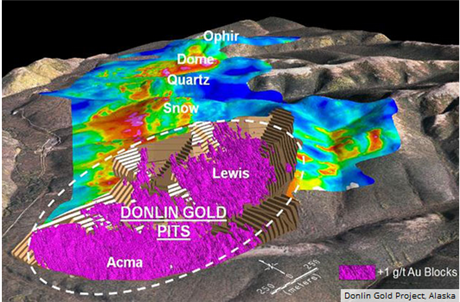

Ray noted, "Permitting activities for its Donlin Gold project (50% NG, 50% Barrick) in Alaska continue to move forward with the completion of the comment period on the draft environmental impact statement (EIS) at the end of August 2016." On permitting, Ray wrote that NOVAGOLD "is currently awaiting to hear from U.S. Army Corps of Engineers (USACE) regarding the potential timeline for review of the comments and filing of the final EIS. Management currently expects filing of the final EIS by early 2017."

"The argument for investing in a project like Donlin Gold lies in 'optionality' exposure, large scale and stable mining jurisdiction," noted Ray. Senior gold producers could see production declines in 2017–2018. "There is a scarcity value attached to large-scale gold deposits that have the capacity to move the production needle for the senior producers. We believe this is due to two reasons: a) dearth of large gold projects currently under development, and b) significant increase in development timeline from discovery to production (~15–20 years) of new gold projects," wrote Ray.

Ray wrote that while the "current gold price environment is still not conducive for funding a project of Donlin Gold's size," the company's "strong cash position provides it with the ability to protect the optionality over an extended period of weak gold prices."

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Patrice Fusillo compiled this article for Streetwise Reports LLC. and provides services to Streetwise Reports as an employee. She owns, or members of her immediate household or family own, shares of the following companies mentioned in this article: None. She is, or members of her immediate household or family are, paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: NOVAGOLD. The companies mentioned in this article were not involved in any aspect of the article preparation. Streetwise Reports does not accept stock in exchange for its services. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview or article until after it publishes.

Additional Disclosures for this Content

National Bank Financial, NOVAGOLD, Oct. 4, 2016

The Research Analyst(s) who prepare these reports certify that their respective report accurately reflects his or her personal opinion and that no part of his/her compensation was, is, or will be directly or indirectly related to the specific recommendations or views as to the securities or companies.

NBF compensates its Research Analysts from a variety of sources. The Research Department is a cost centre and is funded by the business activities of NBF including, Institutional Equity Sales and Trading, Retail Sales, the correspondent clearing business, and Corporate and Investment Banking. Since the revenues from these businesses vary, the funds for research compensation vary. No one business line has a greater influence than any other for Research Analyst compensation.