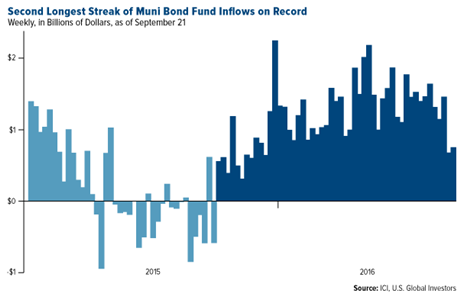

It appears there’s no shortage of investor love for municipal bond funds. September 28 was the 52nd straight week of inflows into state and local government debt, marking the second longest streak on record, according to the Investment Company Institute (ICI). Year-to-date, munis have attracted more than $48 billion in new cash.

Although I can’t say how long this rally will last, the drivers for the $3.7 trillion muni market remain the same now compared to a year ago: stock market volatility; a thirst for tax-free income and capital preservation; and a need for safety in a world beset by perceived threats, from geopolitical uncertainty in the European Union to the upcoming U.S. presidential election, the most divisive and controversial in modern history.

And it isn’t just American investors who favor munis. With government debt still yielding negative rates in Japan, Germany, Switzerland and elsewhere, foreign investors continue to add to their muni holdings, even though they’re ineligible to receive the securities’ U.S. tax benefit.

According to Bloomberg, foreign buyers held close to $90 billion in munis as of June 30, up from $74 billion during the same period in 2013.

Senators: Munis Are “High Quality Liquid Assets”

For these reasons and more, a group of U.S. senators introduced a bipartisan bill last week that would promote munis to the highest quality of assets.

The “high quality liquid assets” category currently includes cash, Treasuries and debt issued by government agencies such as Fannie Mae and Freddie Mac. The new bill, if passed and turned into law, would elevate municipal debt to this easiest-to-trade group.

This would give banks more reserve options, as they’re required by law to hold enough highly liquid assets to last them at least 30 days in the event of an economic crisis.

A similar bill has already passed the House. The Senate bill is sponsored by Mike Rounds (R., S.D.), Charles Schumer (D., N.Y.) and Mark Warner (D., Va.).

A Ringing Endorsement

I agree with the senators’ position on munis’ liquidity and comparative stability. In fact, it’s a wonder why this hasn’t happened before now. Moving munis into the “high liquidity” category would serve as sterling confirmation of what so many investors, from individuals to mutual funds to banks, already know about them.

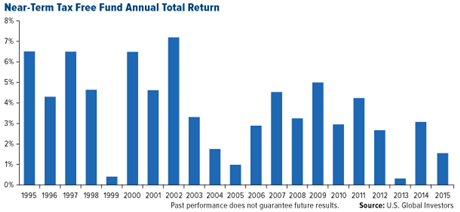

Take our

Near-Term Tax Free Fund (NEARX), which invests primarily in shorter term, high quality bonds. It’s delivered an incredible 21 straight years of positive returns, in various interest rate environments as well as equity bull markets and bear markets. According to Morningstar, out of more than 31,000 equity and bond mutual funds, only 39 have had positive returns every year during this time. NEARX is one of them.

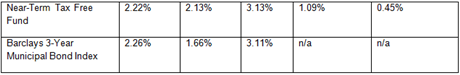

What’s more, NEARX has edged out its benchmark, the Barclays 3-Year Municipal Bond Index, for the one-year, five-year and 10-year periods, as of August 31.

It’s unclear at the moment when the Senate bill might be put to a vote, but I’m hoping for a victory and that the president will sign it. When new details surface, I’ll let you know.

In the meantime, be sure to

visit our Near-Term Tax Free Fund page.

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by visiting www.usfunds.com or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Foreside Fund Services, LLC, Distributor. U.S. Global Investors is the investment adviser.

Total Annualized Returns as of 6/30/2016

Expense ratio as stated in the most recent prospectus. The expense cap is a contractual limit through April 30, 2017, for the Near-Term Tax Free Fund, on total fund operating expenses (exclusive of acquired fund fees and expenses, extraordinary expenses, taxes, brokerage commissions and interest). Performance data quoted above is historical. Past performance is no guarantee of future results. Results reflect the reinvestment of dividends and other earnings. For a portion of periods, the fund had expense limitations, without which returns would have been lower. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance does not include the effect of any direct fees described in the fund’s prospectus which, if applicable, would lower your total returns. Performance quoted for periods of one year or less is cumulative and not annualized. Obtain performance data current to the most recent month-end at www.usfunds.com or 1-800-US-FUNDS.

Expense ratio as stated in the most recent prospectus. The expense cap is a contractual limit through April 30, 2017, for the Near-Term Tax Free Fund, on total fund operating expenses (exclusive of acquired fund fees and expenses, extraordinary expenses, taxes, brokerage commissions and interest). Performance data quoted above is historical. Past performance is no guarantee of future results. Results reflect the reinvestment of dividends and other earnings. For a portion of periods, the fund had expense limitations, without which returns would have been lower. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance does not include the effect of any direct fees described in the fund’s prospectus which, if applicable, would lower your total returns. Performance quoted for periods of one year or less is cumulative and not annualized. Obtain performance data current to the most recent month-end at www.usfunds.com or 1-800-US-FUNDS.

Past performance does not guarantee future results.

Bond funds are subject to interest-rate risk, as their value declines as interest rates rise. They are also subject to default risks, and information about financial problems that affect the bond’s issuer has not always been readily available to investors. The current market value of municipal bond may be hard to determine because many municipal bonds trade infrequently. A bond's market value may change for reasons having nothing to do with the financial condition of the issuer, such as a change in interest rates. Though the Near-Term Tax Free Fund seeks minimal fluctuations in share price, it is subject to the risk that the credit quality of a portfolio holding could decline, as well as risk related to changes in the economic conditions of a state, region or issuer. These risks could cause the fund’s share price to decline. Tax-exempt income is federal income tax free. A portion of this income may be subject to state and local taxes and at times the alternative minimum tax. The Near-Term Tax Free Fund may invest up to 20% of its assets in securities that pay taxable interest. Income or fund distributions attributable to capital gains are usually subject to both state and federal income taxes.

The Barclays 3-Year Municipal Bond Index is a total return benchmark designed for short-term municipal assets. The index includes bonds with a minimum credit rating BAA3, are issued as part of a deal of at least $50 million, have an amount outstanding of at least $5 million and have a maturity of 2 to 4 years.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission ("SEC"). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product.

Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.