Metanor Resources Inc. (TSX-V: MTO) (US Listing: MEAOF) (Frankfurt: M3R) is a successful commercial junior gold producer at its 100%-owned Bachelor Gold Mill in stable, mining-friendly, Quebec, with gold recovery >96%, and having produced >40,000 ounces of gold in 2015. With a current market capitalization near-$35 million Canadian (trading at only ~8 cents), MTO.V presents a significant opportunity for shareholders as its primary asset, the Bachelor Mill, has a replacement value of several times the Company's current market cap and is increasingly being viewed as a coveted strategic asset being the only mill within 200km in a gold-rich district. Metanor's total infrastructure is valued (estimated replacement value) at between CDN$150M to $200M. Of note,

Eric Sprott recently increased his equity position in MTO.V, last purchasing shares on the open market 'above' the current trading price, and there is strong potential for MTO.V to excel near-term as the Company exhibits enhanced attractiveness as a potential take-over candidate in an area undergoing consolidation. The math on the inherent asset value seems to indicate Metanor is substantially undervalued and apt to trade higher, especially as the Company affirms the serious potential for production on a second front; possibly even totally supplanting Bachelor ore, beginning in Summer-2017 from a new 347,000 oz Au In-Pit resource (in all categories) at the Company's 100%-owned Barry deposit (located ~116 km by road from the Bachelor mill) under an improved higher-grade (2+ g/T) model.

Barry is a game-changer as it will allow Metanor to process ore at its Bachelor Mill that is NOT subject to a streaming agreement. The Company is rapidly advancing toward reopening mining its nearby Barry open-pit, having received a positive preliminary economic assessment study (PEA) this September-2017 with NPV of $53.5M, IRR of 198% before taxes, and all-in production cost of $1,114/oz (US $891/oz).

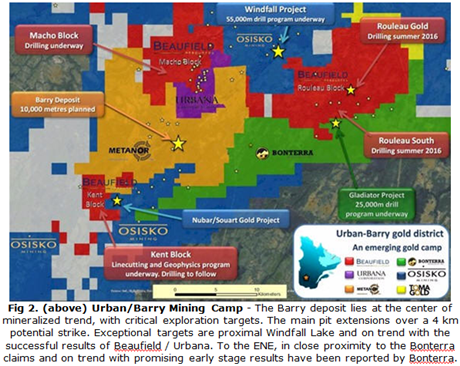

Urban/Barry mining camp undergoing consolidation, Metanor holds key assets:

Urban/Barry mining camp undergoing consolidation, Metanor holds key assets:

On

September 22, 2016 Metanor announced a positive PEA on Barry. Metanor's Barry project now appears destined to become the first to achieve a steady gold production scenario amongst a handful of players (include Osisko Mining Inc.'s prolific Windfall Property, Bonterra Resources' Gladiator Deposit, Beaufield Resources' Macho claims, and Urbana) whose gold system collectively is part of a new mining camp in the Barry-Urban township of Quebec.

Significant cash flow without high development costs at Barry open pit:

Significant cash flow without high development costs at Barry open pit:

With open-pit production pegged to begin in Summer-2017 and ramp-up expected to attain 37,573 ounces/annum for year two, Metanor will become a cash flow machine at Barry with all-in production cost projected at only $1,114/oz (US $891/oz) -- the estimate was made with all manner of assumptions conservatively (as proper PEA's ought to be) considered, including dilution and using a gold price of only C$1,560/oz -- the financial analysis using higher gold prices of C$1,710/oz would generate a NPV at $78.07 million with

an IRR of 246% before taxes. Spot gold is currently (as of October 6, 2016) near C$1,660, and many believe substantially higher gold prices are in the cards. Under the base PEA we are looking possibly C$15M+ in positive cash flow per annum from Barry, under current gold prices we are looking closer to C$23M+ per annum in positive cash flow. Important to note is that Metanor will pay no taxes for at least the first 2 - 3 years with its loss carry forward on the books, plus there is no streaming agreement on the Barry project.

The next step for Metanor is to drill and complete a complete a feasibility study. Metanor has a 8,000 meter drill campaign on its Barry property underway. The objective is to increase the mineral resources around the pits at Barry and to increase their quality by converting mineral resources from the inferred category to the indicated category. To date geologists have identified a total in-pit resources of 347,350 ounces at 2.07 g/t in 5.24 million tonnes. The last compilation on the pit area showed that the resources are open in many areas. There is in excess of 1 million ounces identified in the published NI43-101 in all categories. The initial operation presented in the PEA is a small operation, however there is no shortage of gold at Barry and the operation is scalable for ounces.

MTO.V geologists are working under an updated interpretation of the orientation of the high-grade shoots at the Barry Mine. The old interpretation had two shoots dipping down, they are now viewed as three stacked shoots more horizontal than they are vertical. The old off-orientation interpretation resulted in the mixing of high-grade with low grade, lowering the high-grade and smearing the gold into lower grade, resulting in a lower average grade when estimating and block modeling. Now Metanor's geologists have collected and affirmed data under the new model that constrains the envelopes which contain the high-grade. On June 22, 2016 the Company announced a new Resource Estimate (see '

Metanor Increases Total Ounces in New Gold Resource Estimate at Barry Pit') totaling 1,351,000 oz gold in all categories* (see breakdown further below). From an immediate mining scenario point of view, the geologists identified a total in-pit resources of 347,350 ounces at 2.07 g/t in 5.24 million tonnes calculated using parameters for direct shipping of mineralized material to Bachelor Lake mill where 45% is in the measured and indicated category and 55% is in the inferred category.

Metanor originally mined ore from Barry when it first took the refurbished Bachelor Gold Mill online several years ago, while it was still prepping to access the high-grade underground ore at Bachelor mine, it poured a total of ~45,000 oz gold from Barry sourced ore during that initial interim period. Metanor is now eager to return to Barry; the mill is proven and the recoveries are higher, loan and streaming obligations that consumed cash flow are satisfied, the crews are experienced, and the price of gold is higher.

Highlights of PEA Barry (*) all in CAD dollars, include:

- Net present value (NPV) before taxes (at 6%) of $53.5 million;

- Internal rate of return (IRR) before taxes of 198%;

- NPV after taxes (at 6%) of $25.9 million;

- IRR after taxes of 94%;

- Capital startup of $8.5 million;

- Payback of 0.71 years with a gold price of $1,560 / oz;

- All-in production cost of $1,114 / oz (US $891 / oz);

- For the life of the mine, a production of 193,457 ounces of gold over 9 years;

- An average of 21,495 ounces of gold production with up to 37,573 ounces in year 2;

- Milling of 1,200 tonnes per day at the Bachelor plant, with an average grade of 1.75 g/t diluted for the life of the mine including the first 3 years at 2.61 g/t with a metallurgical recovery of 95%;

- Strip ratio mineralization of 2.17 to 1.

Mr Ghislain Morin, President and CEO of Metanor Resources Inc., declared, on behalf of the board of directors:

"This positive preliminary economic study is an important milestone for Metanor. We point out that the deposit is located on a Mining Lease previously granted, the deposit is ready to be exploited and it has the potential for expansion. Moreover, there are no streaming agreements covering the Barry project. We will be moving quickly with startup planned for the summer of 2017, following a feasibility study which will include current drilling results."

Metanor highly prospective for major high-grade discovery at Barry proximal Osisko's Windfall Project:

Metanor will also target for high-grade speculation outside the pit at the Moss showing, located 7 km north-east of the Barry pit and 4 km south-west of the Windfall deposit (belonging to Osisko Mining Inc.). The geological context and the structure controlling the Windfall deposit extend to this showing. Drill results from 2014 revealed the presence of gold anomalies near surface on a 3 km stretch extending to the south-west. The new drill holes, part of its 8,000 m campaign, will target the extensions of the gold anomalies.

------ ------ ------ ------ ------ ------

Operationally - Pouring Gold: The Bachelor Lake mill has a capacity of 1,200 tpd but is currently running at a rate of ~800 tpd, with an effective rate of ~700 tpd with periodic routine downtime for maintenance. When Barry open pit ore comes back online as a second front (or possibly totally supplanting Bachelor/Hewfran ore), we expect Metanor to maintain a high ounce output, and any reduction in output (if any) would be offset 'net-positive to the bottom line' with savings from operations at Bachelor (reduced development costs; open pit Barry is significantly cheaper on labor), and not having to pay Sandstorm on Barry ore. Additionally, Barry ore is softer and the mill can be ran at near-1,200TPD (50% higher) without upgrades when processing Barry ore. Metanor is positioned to increase the TPD with a nominal capital outlay when the time is right now that a new Hydro Quebec substation has been completed.

Metanor also benefits from foreign exchange, receiving

a >$400/oz price differential (as of October 6, 2016) for gold in Canadian dollars over US dollars.

Metanor currently has two permitted mines:

1) Bachelor Mine: Bachelor is a rich underground mine with grades upwards of 26 g/t gold with an average grade of 7.38 g/t gold (fully diluted using long hole). Recent drilling results continue to demonstrate, in-part, Metanor's ability to readily extend the mineable life of Bachelor, similar to how other successful area miners have operated (and several continue to this date) -- typically lining up a couple years of initial quality mineralized material but remaining operational for many decades, adding as they go. MTO is able to sell 80% of its Bachelor Mine sourced gold at spot prices with the balance sold to Sandstorm as per gold participation agreement (Note: this arrangement is only on Bachelor-area sourced material, Metanor's mill is a separate asset that is 100%-owned by the Company and the mill may be used to process material sourced from outside Bachelor without restriction (for Metanor's sole-benefit) as long as it meets minimum covenants to Sandstorm -- covenants Metanor has been more than able to satisfy to date, the most onerous covenant was a minimum cash flow guarantee and that has since been 100% retired). The Company is building serious new ounces at Bachelor (e.g. see latest October 6, 2016 news release entitled "

Metanor Intersects 12.0 g/t Au Over 3.9 M in a New Sector of the Bachelor Mine") and in a new gold system adjacent the mill (called Moroy).

2) Barry Gold Project, Quebec (located ~65 km from Bachelor):

The 100% owned Barry property is neighbor to Oban Mining's Windfall Lake Deposit (formerly owned by Eagle Hill). The resource estimate at Barry now (as of June 22, 2016) sits at 305,000 oz Gold of Measured & Indicated Resources (8,420,000 t at 1.13 g/t Au) and 1,046,000 oz gold of Inferred Resources (31,919,500 t at 1.02 g/t Au) and is wide open for large resource growth expansion. The current 1km strike at Barry is potentially 13km, there are in excess of 150 anomalies outside the pit area. The Barry deposit is a potential multimillion ounce target; the independent international professional geological firm SGS Geostat has identified Metanor’s Barry deposit as comparable in potential to rival other multi-million ounce deposits such as Canadian Malartic gold deposit (formerly owned by Osisko, now owned by Yamana and Agnico-Eagle) & Detour Gold's Detour deposit.

Additional related insight on the Metanor Resources Inc. and it’s potential may be viewed at

https://miningmarketwatch.net/mto.htm online.

James O’Rourke

James is a freelance information services professional for various media relation firms and consultant to several publicly traded entities. He monitors and invests in the resource, technology, consumer staples, healthcare, agriculture, financial, energy, utilities, and biotechnology/pharmaceutical sectors and is the managing

director of Mining MarketWatch Journal. His articles have been published on over 400 websites, including: Yahoo Finance, Market Intelligence Center, MarketWatch, WallStreetJournal, USAToday, FinancialPost, BayStreet, Financial Content, Ibtimes, Oil&GasJournal, Moneytalks, SeekingAlpha.

***

Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. The author has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. The author makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of the author only and are subject to change without notice. The author assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Technical mining terms used by the writer may be used/expressed in simplified layman terms and should not be relied upon as appropriate for making investment decisions unless the reader contacts the company directly for independent verification. The author assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report. James does not currently own shares of Metanor Resources Inc. – MTO.V however intends to accumulate.