Momentum Failure Can Be Positive

It is counterintuitive to think a “momentum failure” set-up in stocks could have bullish implications. In this case, the description from stockcharts.com is helpful:

Momentum Failure: The failure to move back into overbought or oversold territory signals a change in momentum that can foreshadow a significant price move. The ability to consistently move above -20 is a show of strength. After all, it takes buying pressure to push %R into overbought territory. Once a security shows strength by pushing into overbought territory more than once, a subsequent failure to exceed this level shows weakening momentum that can foreshadow a decline.

The present day weekly chart of the S&P 500 below shows an example of the case where momentum fails “to move back into oversold territory” (below -80). It is important to understand the difference between a set-up and a confirmed set-up. The chart below illustrates the first step or a set-up. In order for the set-up to be confirmed, the momentum indicator (Wm%R) needs to experience a weekly close above the center line (-50).

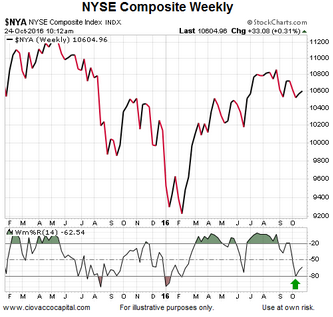

A similar set-up can be found on the chart of the NYSE Composite, telling us if the set-up is confirmed, it may have broad implications above and beyond the S&P 500.

Have Numerous ETFs Broken Below Important Retracements?

This week’s video puts some context around recent weakness in numerous ETFs, including technology (QQQ), metals (DBB), REITS (IYR), emerging markets (EEM), oil (USO), mid-caps (MDY), and dividend stocks (DVY).

After you click play, use the button in the lower-right corner of the video player to view in

full-screen mode. Hit Esc to exit full-screen mode.

Although the industrial sector (DIA) has been lagging the S&P 500 (IVV) for several months, the same potentially bullish set-up appears on the chart of the Dow Jones Industrial Average.

The set-up is broad and extends outside the United States, as illustrated with the weekly chart of global stocks (VT) below.

Set-ups mean very little until a confirmation is in place, something that may happen on either Friday, October 28 or Friday, November 4. However, this set-up aligns with information covered on October 10, September 6, and August 20.

This entry was posted on Monday, October 24th, 2016 at 10:28 am and is filed under Stocks - U.S.. You can follow any responses to this entry through the RSS 2.0 feed. Both comments and pings are currently closed.

Copyright © 2016 Ciovacco Capital Management, LLC. All Rights Reserved. Chris Ciovacco is the Chief Investment Officer for Ciovacco Capital Management, LLC (CCM). Terms of Use. This article contains the current opinions of the author but not necessarily those of CCM. The opinions are subject to change without notice. This article is distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. The charts and comments are not recommendations to buy or sell any security. Market sectors and related ETFs are selected based on his opinion as to their importance in providing the viewer a comprehensive summary of market conditions for the featured period. Chart annotations are not predictive of any future market action rather they only demonstrate the opinion of the author as to a range of possibilities going forward. All material presented herein is believed to be reliable but we cannot attest to its accuracy. The information contained herein (including historical prices or values) has been obtained from sources that Ciovacco Capital Management (CCM) considers to be reliable; however, CCM makes no representation as to, or accepts any responsibility or liability for, the accuracy or completeness of the information contained herein or any decision made or action taken by you or any third party in reliance upon the data. Some results are derived using historical estimations from available data. Investment recommendations may change and readers are urged to check with tax and investment advisors before making any investment decisions. Opinions expressed in these reports may change without prior notice. This memorandum is based on information available to the public. No representation is made that it is accurate or complete. This memorandum is not an offer to buy or sell or a solicitation of an offer to buy or sell the securities mentioned. The investments discussed in this report may be unsuitable for investors depending on their specific investment objectives and financial position. Past performance is not necessarily a guide to future performance. The price or value of the investments to which this report relates, either directly or indirectly, may fall or rise against the interest of investors. All prices and yields contained in this report are subject to change without notice. This information is based on hypothetical assumptions and is intended for illustrative purposes only. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS. CCM would like to thank StockCharts.com for helping Short Takes create great looking charts Short Takes is proudly powered by WordPress . Entries (RSS)