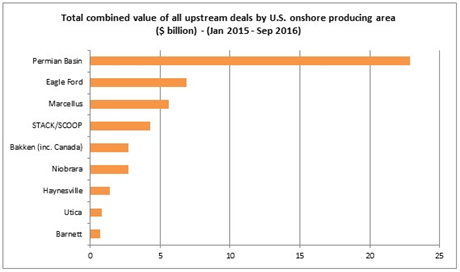

New data illustrates exactly how far the Permian basin is outstripping its rivals in terms of investor interest and deal flow.

The stark reality is that M&A activity focused on the Permian has hit a total of almost $23 billion over the past 21 months – around $16 billion more than its nearest rival, according to our new Evaluate Energy (https://info.evaluateenergy.com/evaluate-energy-ma-brochure) data. This trend of high spends in the Permian basin is also highlighted in our latest Q3 M&A report - 33% of all upstream deals worldwide in Q3 focused upon the Permian basin alone. Find out more (https://info.evaluateenergy.com/whitepapers/upstream_ma_deals_oil_gas_q32016-654744665e) .

Source: Evaluate Energy M&A Database (https://info.evaluateenergy.com/evaluate-energy-ma-brochure)

And this is not because of one mega-deal skewing our data. On the contrary, there were 37 deals over the 21 month period with individual values of over $100million, demonstrating higher levels of confidence in the Permian as a long-term investment option over other U.S. onshore producing regions.

Source: Evaluate Energy M&A Database (https://info.evaluateenergy.com/evaluate-energy-ma-brochure) – To download our latest quarterly review of global M&A deals, which includes a detailed look at Q3 activity in the Permian basin, click here (https://info.evaluateenergy.com/whitepapers/upstream_ma_deals_oil_gas_q32016-654744665e) .

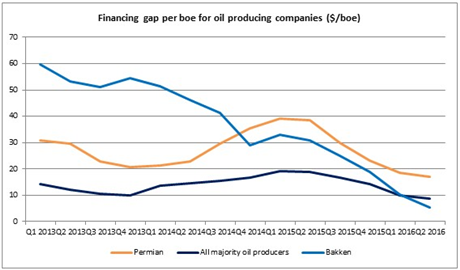

This confidence in the Permian compared to other oil-heavy regions – and the Bakken in particular – is not only illustrated in M&A activity but also in how much companies are currently willing to invest in their own future.

In Q2 2016, the internal financing gap – that is, the difference between capex and operating cash flow – was far greater for the Permian than all other oil-producing U.S. regions we examined in our latest study. Permian companies recorded an average financing gap per boe of $17/boe in Q2 2016, the highest regional average in the United States. This used to be how we’d describe the Bakken, but that picture has changed dramatically since commodity prices crashed; in Q2 2016, Bakken companies recorded a financing gap per boe of only $5/boe.

Source: Evaluate Energy U.S. Cash Flow Study 2016 (https://info.evaluateenergy.com/whitepapers/us-oil-gas-cash-flow-capex-2016-676w6ww1) . See notes for details on calculations and company selection.

The large financing gap in the Permian is driven primarily by extremely robust capex spends. For, while total spending has fallen in the Permian over time, it has done so at a dramatically slower rate than other U.S. oil producing areas. This tells us how confident the operators must be feeling.

To reinforce this narrative, in our latest U.S. cash flow study (https://info.evaluateenergy.com/whitepapers/us-oil-gas-cash-flow-capex-2016-676w6ww1) , we used current financing gaps to calculate what oil producers across the country needed the benchmark WTI price to be in order to cover the entirety of their capex spends using only operating cash flow.

In the case of the Permian, the companies would need a $71 WTI price to do this in Q2 2016. For the Bakken, that price is only $52. In Q2 2016, WTI only averaged $44.86. Our latest cash flow study (https://info.evaluateenergy.com/whitepapers/us-oil-gas-cash-flow-capex-2016-676w6ww1) delves into this calculation in far greater detail.

This figure should not be considered a break-even number, not least because capex spending is optional, for the most part. Rather, it’s a barometer of operators’ confidence in their own long-term prospects.

Source: Evaluate Energy U.S. Cash Flow Study 2016 (https://info.evaluateenergy.com/whitepapers/us-oil-gas-cash-flow-capex-2016-676w6ww1) , see notes for more details on calculations and company selection

Clearly, capex plans are lower and less bullish than a year before, as low prices continued to bite. But Permian operators are undoubtedly still displaying a greater level of confidence in being able to fund robust capex spends than their rivals.

Notes

* Company selection – In the U.S. Cash Flow Study (https://info.evaluateenergy.com/whitepapers/us-oil-gas-cash-flow-capex-2016-676w6ww1) referred to throughout this piece, we took 68 representative U.S. oil and gas producers for analysis. They were divided up into peer groups, depending on the size of their production and how much oil each company produced compared to natural gas. A handful of the 68 companies were also taken as representative of a specific region’s cash flow trends, because all or the overwhelming majority of the company’s operations was located in one particular area. Ten such companies were identified for the Permian Basin and six for the Bakken. The peer group named “All majority oil producers” included both of these regional groups, as well as every other company in the overall group of 68 that produced more oil than it did gas (i.e. over 50%) in Q2 2016.

* Calculations:

1. The financing gap was calculated by subtracting operating cash flow (including the non-cash effect of changes in working capital) from total capital expenditures.

2. Financing gap per boe was calculated by taking this figure for all relevant companies and dividing it by the total volume of oil and gas produced over the requisite timeframe, to aid comparability across different regions, regardless of overall production size.

3. The figures are all calculated on a rolling 12 month basis, i.e. each quarterly figure is the average financing gap per boe over the previous 12 months. This method of calculation diminishes the likelihood of anomalous quarters for individual companies within a peer group skewing the data set.

4. The WTI price required for operating cash flow to cover the entirety of capex spending was calculated assuming that the only changing variable was the WTI price itself, i.e. all items such as spending, costs, gas prices etc. remained constant.