Manufacturing activity in the eurozone strengthened sharply in October, beating expectations, according to “flash,” or preliminary, purchasing manager’s index (PMI) data. The region is growing at its fastest pace so far this year, having climbed to its highest reading since April 2014.

The news follows positive September readings in emerging European countries that we track closely, an encouraging sign that the continent’s economy might finally be picking up steam after an extended period of sluggish growth.

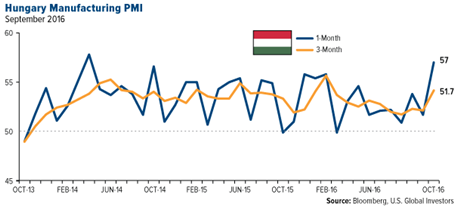

Hungary, volatile as always, was the largest gainer last month, leaping ahead 5.3 points to a nearly three-year high. Historically, the Central European country has bumped up when the transport sector, which represents a big share of production, gets a new large order.

I’ve written numerous times on

why we monitor PMI. Unlike gross domestic product (GDP), which is a backward-looking indicator, PMI gives us a foreshadowing of manufacturing activity three and six months out. This is important for investors because as manufacturing accelerates, so too does demand for commodities and natural resources, helping to support prices.

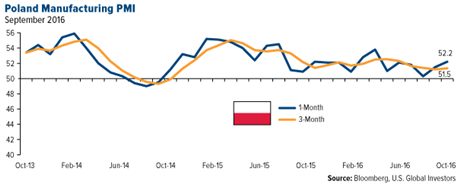

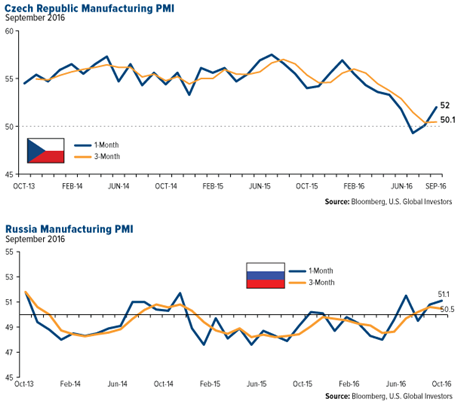

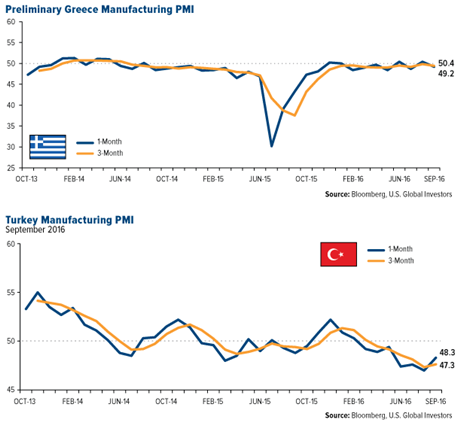

Not only do we like to see the monthly reading come in above 50—the threshold separating industry expansion from contraction—but it’s exceptionally positive when the reading appears above its three-month moving average.

This was the case for all countries except Greece and Turkey, both of which shrank slightly in September.

All in all, I’m encouraged by the eurozone’s positive October PMI, even if it is preliminary. Whether you like it or not, ours is a global economy, and it’s impossible for any country, even one as strong as the U.S., to do all the heavy lifting alone.

What we need now is synchronized global growth, and this is definitely a step in the right direction.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission ("SEC"). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product.

Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.