Today, Emerita Resources Corp. has announced that the Provincial Court of Seville has ruled in favour of Emerita in its appeal in relation to the original charges pertaining to the occurrence of prevarication with respect to the Aznalcóllar Project tender process.

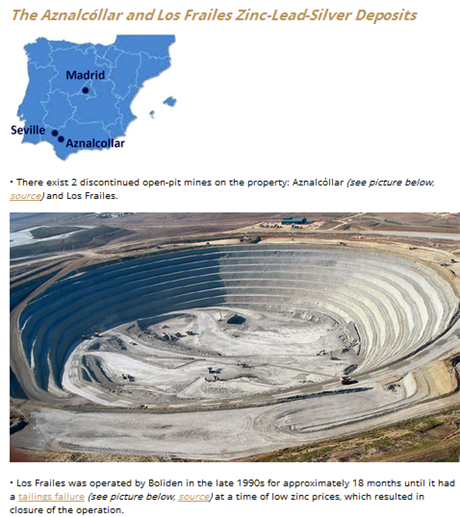

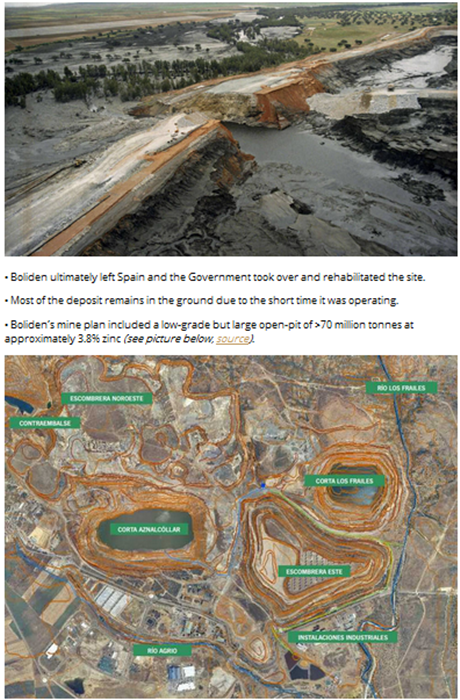

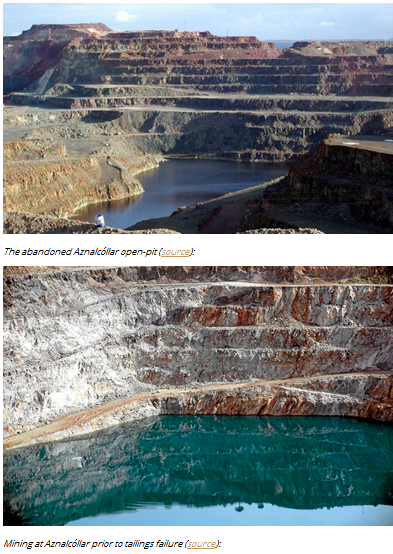

Emerita participated in a Public Tender process to acquire the Aznalcóllar Project in Andalusia Region of Spain. Aznalcóllar is a past producing zinc-lead-silver mine that operated in the 1990s and was closed due to a combination of low metal prices and a tailings failure. The government subsequently rehabilitated the site and, due to the demands of the community for employment, initiated a tender to re-develop the mine – the tender was unanimously supported by all political parties.

The Public Tender process was run in 2 stages, the first was a financial qualifying round after which Emerita and a local Spanish company, Minorbis, were the only companies qualified for the second round. The second round required a detailed technical plan for the development of the project. Emerita completed a full mine plan, environmental management plan, water management plan (which the Federal Water Authorities endorsed), public hearings in the community, etc. The other company did not have the expertise and as such had a significantly inferior proposal.

In 2015, the tender was awarded and there was complete shock when, by a very slim margin, Minorbis’ bid was chosen as the winner. Upon examining the details, it was clear that this was not the case and Emerita challenged the decision and filed charges of corruption against the panel.

As per today’s news, the Provincial Court of Seville has ruled in favour of Emerita in its appeal. If there is a commission of a crime in a Public Tender process, it must negate the award and the tender goes to the next qualified bidder. In this case, Emerita is the only other qualified bidder and as such expects to be awarded the project at the conclusion of the process.

The latest news on the Aznalcóllar Public Tender case is on the front page of major newspapers in Spain, e.g. Elmundo, ElPais, LaRazon, ElCorreo, CanalSur, ElConfidencial, LaVanguardia, DiarioDeSevilla, Europapress, CadenaSER, AndaluciaInformacion, EntornoInteligente

Emerita announces that the Seville Court has ruled in Emerita’s favour with respect to the Aznalcóllar Appeal

Toronto, Ontario, October 28, 2016 – Emerita Resources Corp. (the “Company” or “Emerita”) (TSX-V: EMO) is pleased to announce that the Provincial Court of Seville, an appellate court, has ruled in favour of Emerita in its appeal of the lower court’s decision that there was not sufficient evidence of any criminal act in the Aznalcóllar project tender process.

The Aznalcóllar project public tender process consisted of two stages. The first stage required bidders to provide detailed corporate information and demonstrate industry expertise. The second stage required submission of a detailed plan for the development of the Aznalcóllar project. After the first stage of the public tender process was completed, the Andalucian government panel responsible for awarding the Aznalcóllar project (the “Panel”) determined that the only qualified bidders were Emerita and a group comprised of Minorbis and Grupo Mexico (“Minorbis-Grupo Mexico”).

The appeal was heard by four judges of the Provincial Court of Seville (the “Court”) who ruled unanimously in Emerita’s favour in a 59 page judgement. The judges’ decision was based on: (i) Minorbis-Grupo Mexico failing to submit the necessary documentation as required by the tender process; (ii) a failure by the Panel to consider the technical merits of the tender bids; and (iii) granting the mining rights to the Aznalcóllar project to Los Frailes Mining, a company that did not participate in the tender process, contravened applicable laws governing public tenders in Spain.

The judges found that there is evidence of gross negligence and misconduct and indicated that there may be evidence of possible corruption and prevarication. As such, the Court has ordered the criminal case to be reopened against the Panel.

Emerita’s Spanish legal counsel has summarized the key findings from the Court’s ruling below.

Deficiencies with the bid by Minorbis Grupo-Mexico

The judges found that the bid submitted by Minorbis-Grupo Mexico should not have passed to the second stage of the tender process. The relationship between Minorbis and Grupo Mexico was not properly demonstrated in the documentation submitted to the Panel. Among other things, Grupo Mexico never registered in Spain or with the Spanish consulate, which was a requirement of participation in the Aznalcóllar tender.

Further, Minorbis-Grupo Mexico never submitted the necessary documentation demonstrating its solvency, which was a mandatory requirement established in the tender process, as set out by the Panel. The Panel contradicted the tender requirements by declaring that the Minorbis-Grupo Mexico bid was submitted solely by Minorbis and that Grupo Mexico had just provided technical and financial support. The Court determined that this was not possible since Minorbis had been formed just 3 weeks prior to the deadline for submission of the tender, and according to administrative law in Spain, a company participating in a public tender has to demonstrate minimum experience and track record in that particular industry.

Failure to Consider the Technical Merits of the Tender Bids

The judges concluded that the Panel had failed to consider the technical details of the tender bids. As an example, the Panel did not consider that Emerita’s bid contemplated double the investment compared to Minorbis-Grupo Mexico’s bid. This decision fails to consider one of the principal objectives of the tender process, promoting investment to the region and creating opportunities for the community.

Los Frailes Mining did not participate in the Tender Process

The judges concluded that awarding the Aznalcóllar project rights to Los Frailes Mining, a company that never participated in the tender process, contravened the laws and regulations governing public tenders in Spain. Although it is not clear if it was Minorbis or Minorbis-Grupo Mexico that participated in the tender, the Aznalcóllar project was granted to Los Frailes Mining, a company that was created after the completion of the tender process.

The conclusion by the Court is that there are numerous administrative irregularities of a serious nature which occurred during both stages of the public tender process and as such the crime of “Prevarication” cannot be discounted. The judges have ordered the case reopened against the Panel. This is a firm decision by the Court which cannot be appealed.

The Court’s decision is a lengthy document written in Spanish. The Company is having it translated to English and is working with its Spanish legal advisors to fully analyze the ruling and will provide a more detailed update in the near future. The Company is also seeking advice on the legal process moving forward. The Company’s Spanish legal counsel has advised that under Spanish law, if it is found that the awarding of a tender involves the commission of a crime, the tender is automatically awarded to the next qualified bidder. In the Aznalcóllar tender, Emerita is the only qualified bidder.

The Aznalcóllar project hosts the past producing Aznalcóllar and Los Frailes zinc-lead-silver deposits. If awarded the tender, the Los Frailes deposit would be Emerita’s focus of development for restarting mining operations at the site. The local community is strongly supportive of an environmentally and socially responsible approach to developing the site.

According to Joaquin Merino, President and CEO of Emerita; “We are excited by this development. Emerita continues to maintain that its bid was superior and it should have been awarded the Aznalcóllar project pursuant to the tender process. We are fully committed to working with the Government and the community to develop the Aznalcóllar project to the highest environmental and social standards.”

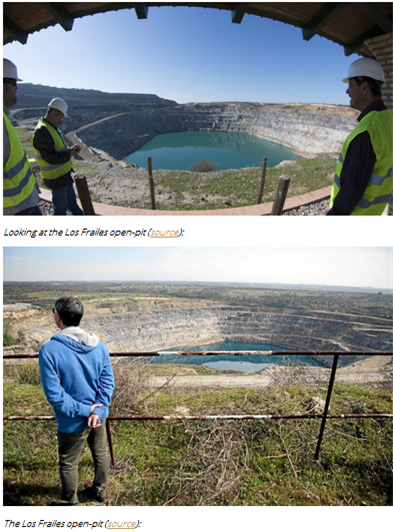

• A high-grade core of approximately 20 million tonnes at approximately 10% zinc-lead exists, accessible by ramp from the existing pit.

• All of the deposits on the property are open at depth as these were only drilled to open-pit mining depth.

• Some of the highest grade holes are the deeper ones on the Los Frailes Deposit.

• The proposal counterplates a focus on high-grade zones with underground mining (benefits: no huge waste rock piles, tailings go back underground as paste fill, lower capital, smaller mill, etc.).

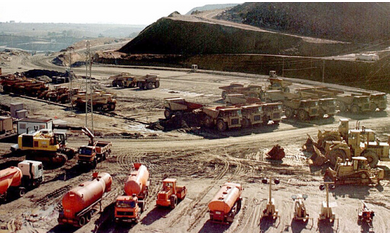

Technical experts examining the Aznalcóllar open-pit 12 months ago (source):

About Emerita

Emerita Resources Corp. is a resource company engaged in the acquisition, exploration and development of mineral properties, with a primary focus on Spain and Brazil. The company’s corporate office and technical team are based in Sevilla, Spain, with an administrative office in Toronto, Canada.

Emerita owns 100% of the Las Morras Gold Project in the Extremadura Region of western Spain.

On July 21, 2016, Emerita initiated exploration at its Sierra Alta Gold Project in the Asturias Region of northwestern Spain.

On June 13, 2016, Emerita entered into option agreement to acquire the Falcon Litio MG Lithium Project in Brazil, adjacent to Brazil’s only lithium mining operation owned by Companhia Brasileira de Li´tio.

Management & Board of Directors

Joaquín Merino-Márquez (President & CEO)

Mr. Merino-Márquez is a professional geologist with 18 years of experience in the mining industry. He was previously Vice President, Exploration for Primero Mining Corp. (TSX: P; current market capitalization: $358 million CAD) and before that Vice President Exploration for Apogee Minerals Ltd. From 2003-2006, he was the Exploration Manager for Placer Dome at Porgera Mine and prior to that Chief Mine Geologist at Hecla Mining’s La Camorra mine. Joaquin has extensive international experience in South America, Europe and Asia-Pacific regions. Joaquin holds a Master degree in Sciences from Queens University (Ontario), and a Bachelor degree in Geology from University of Seville (Spain). He is a member of the Association of Professional Geoscientists of Ontario.

Marilia Bento (Director)

Ms. Bento has over 20 years of experience in the financial industry and Canadian capital markets. Currently Ms. Bento is Vice President of Corporate Development for the South American Resource Group at Forbes & Manhattan, a premier merchant bank focused on building resource companies. Some of Ms. Bento’s previous positions include, Managing Director and Head of Equity Capital Markets Canada at Macquarie Capital Markets Canada Ltd. (formerly Orion Securities Inc.) and Vice President of Corporate Development for Apogee Silver Ltd. Marilia was on the Board of Directors of Orion Securities Inc. and has been a board member of junior mining companies.

David Gower (Director)

Mr. Gower has over 20 years of experience in exploration with Falconbridge, Noranda (now X-strata) most recently as Director of Global Nickel and PGM exploration. He was a member of the Senior Operating Team responsible for mining projects with Falconbridge. He has led exploration teams which were responsible for brownfields discoveries at Raglan and Sudbury, Matagami, Falcondo – DR, and greenfield discoveries at Araguaia in Brazil, Kabanga in Tanzania and significant increases in known resources at Kabanga in Tanzania and El Pilar in Mexico.

Catherine Stretch (Director)

Catherine Stretch has been CEO of DT Plantations Ltd., a 40,000 hectare palm oil plantation under development in southern Philippines since mid-2012. Previously, Catherine was a partner and the Chief Operating Officer of a Canadian investment firm which had $1 billion in assets under management and focused on managing resource oriented investment funds. In this role Catherine helped research, develop and structure early stage investments and investment vehicles in Canada and overseas working with legal teams, securities regulators and local partners as well as overseeing day-to-day operations and financial reporting requirements of the company. Catherine has a BA in Economics from the University of Western Ontario and an MBA in International Business from the Schulich School of Business at York University.

David Patterson (Director)

Mr. Patterson has been involved with exploration companies for over 2 decades. He has an MBA from Vancouver’s Simon Fraser University. Mr. Patterson has an extensive European and North American network which has enabled him to raise in excess of $100 million CAD for mineral exploration companies, including Donner Metals Ltd.

Colin Watt (Director)

Mr. Watt (B.Com.) has 15 years of public resource company management experience. He is President of Squall Capital Corp., a private Canadian based company specialized in financing, restructuring and providing management services to early stage public companies.

Greg Duras (CFO)

Mr. Duras has over 10 years of corporate and project finance experience in the resource sector. Some of his previous positions include, Vice President of Finance and Administration at S.C. Rosia Montana Gold Corporation S.A. (RMGC), a mineral exploration and mining development company based in Romania and a number of senior finance roles, including Controller of TSX-listed Gabriel Resources Ltd. and High River Gold Mines Ltd. He is a Certified General Accountant and a Certified Professional Accountant, and holds a Bachelor of Administration from Lakehead University.

Damian Lopez (Corporate Secretary)

Mr. Lopez is a corporate securities lawyer who works as a legal consultant to various TSX and TSX Venture listed companies. He previously worked as a securities and merger & acquisitions lawyer at a large Toronto corporate legal firm, where he worked on a variety of corporate and commercial transactions. Mr. Lopez obtained a Juris Doctor from Osgoode Hall and he received a Bachelor of Commerce with a major in Economics from Rotman Commerce at the University of Toronto. He is also a director of the Canadian Hispanic Bar Association.

Company Details

Emerita Resources Corp.

Suite 800 – 65 Queen Street West

Toronto, Ontario M5H 2M5 Canada

Phone: +1 416 309 4293 (Toronto)

Phone: +34 628 1754 66 (Spain)

Email: info@emeritaresources.com

www.emeritaresources.com

Shares Issued & Outstanding: 83,597,829