- Company plans to publish a resource and reserve update for Bachelor Mine before December 31, 2016.

- Company will publish an independent PEA (all-in costs of US$891/oz) on Barry open pit before November 4, 2016, and continue to increase the value following the recommendations from the PEA -- targeting reopening Mid-2017.

- Company is highly prospective for major high-grade discovery proximal Osisko's Windfall Project – drill program on now; if it hits well the value of MTO.V is apt to increase dramatically as this area is essentially the extension of Osisko’s flagship project.

- The Company's total infrastructure is valued (estimated replacement value) at between CDN$150M to $200M. The Company's primary asset, the 100%-owned Bachelor Mill, has a replacement value of several times the Company's current market cap and is increasingly being viewed as a coveted strategic asset being the only mill within 200km in a gold-rich district. The Company has met its cash flow guarantee to Sandstorm and is now free to mill ore sourced from outside Bachelor without penalty.

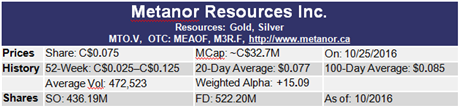

Metanor Resources Inc. (TSX-V: MTO) (US Listing: MEAOF) (Frankfurt: M3R) recently released its full-year financial results, revealing a gold producer that is holding its own, aided by increases in the price of gold, successfully executing on cost-cutting measures, and able to generate a positive free cash flow. Full copy of the financials release from source may be viewed

here.

Mr. Thibaut Lepouttre, Managing Director at Belgium-based mining and commodity research BVBA firm Caesar published a report this week on his analysis of Metanor's latest financials pointing out how astute precious metal mining investors generally do not focus on accounting profits on the income statements;

As mining and oil and gas businesses usually have a high up-front capex and low sustaining capex (relatively when compared with the initial capex), a lot of the mining companies report negative earnings whilst the cash flows are positive. Perhaps a remarkable case is Barrick Gold, which reported a net loss of $2.8B in the financial year 2015, even though its free cash flow was positive to the tune of $400M on an adjusted basis.

Just for the record, Metanor’s bottom line showed a small net loss of C$2.5M which sounds very reasonable, but you should realize this was predominantly caused by a reversal of an impairment charge of C$10.4M (see above). The entire reversal was based on the Barry deposit as Metanor thinks that project will now be profitable again at the current gold prices. The PEA on the Barry project indeed yielded positive results, but the jury is still out until we have seen the details in the technical report which will be filed any day now.

Moving over to the cash flow statements now, Metanor reported an operating cash flow of C$500,000 and whilst that’s already a substantial improvement compared to the first half of its financial year, the second semester wasn’t good enough to cover the entire capex and exploration programs during FY 2016. The next table breaks the performance down to see how Metanor performed in both semesters. We will use the adjusted cash flows, excluding changes in Metanor’s working capital position. We are also including all exploration expenses in the equation. Technically, we would only have to include the sustaining exploration expenses meant to keep the mine life stable, but given the short ‘official’ mine life at the Bachelor Lake mine and the need to bring Barry back online, we will qualify all exploration expenditures as sustaining.

As you can see, Metanor reported a positive operating cash flow in the second half of the year, but the capex also increased, due to an increased exploration spending (C$1.9M in H2, which will hopefully pay off if the Barry project is being brought back into production). It’s also a reason why we prefer companies to be debt-free, as Metanor paid in excess of C$1M on interest expenses.

On an annualized basis, Metanor would be generating C$3.6M in operating cash flow which would be sufficient to cover the sustaining capex on the equipment (C$2.2M), but the company’s exploration programs are increasing the cash outflow. Unfortunately the company has no other option, because it needs to increase its confidence in the Barry project by completing some more infill drilling to validate the PEA expectations.

------ ------ ------ ------ ------ ------ ------ ------ ------

Barry Open-Pit Mine Reopening Targeted for Mid-2017:

Our biggest take-away from the financials was the impairment reversal on the Barry Mine (now that it appears economical at current gold prices), signaling Metanor's intention to make it the focus of future production beginning mid-2017, with processing at the Bachelor Mill. The mill will either juxtapose Bachelor and Barry ore, or simply totally supplant Bachelor ore all together with higher-margin Barry ore (additionally saving dramatically by not having underground development, labour, and streaming costs from Bachelor in the process). Metanor originally mined ore from Barry when it first took the refurbished Bachelor Gold Mill online several years ago, while it was still prepping to access the high-grade underground ore at Bachelor mine, it poured a total of ~45,000 oz gold from Barry sourced ore during that initial interim period. Metanor is now eager to return to Barry; the mill is proven and the recoveries are higher, loan and streaming obligations that consumed cash flow are satisfied, the crews are experienced, and the price of gold is higher.

With open-pit production targeted to begin in Summer-2017 and ramp-up expected to attain 37,573 ounces/annum for year two, Metanor will attain significant positive cash flow at Barry with all-in production cost projected at only $1,114/oz (US $891/oz) -- this PEA estimate was made using a gold price of only C$1,560/oz -- the financial analysis using higher gold prices of C$1,710/oz would generate a NPV at $78.07 million with an IRR of 246% before taxes. Spot gold is currently (as of October 25, 2016) near C$1,700, and many believe substantially higher gold prices are in the cards. Under the base PEA we are looking possibly C$15M+ in positive cash flow per annum from Barry, under current gold prices we are looking closer to C$23M+ per annum in positive cash flow. Important to note is that Metanor will pay no taxes for at least the first 2 - 3 years with its loss carry forward on the books, plus there is no streaming agreement on the Barry project.

Currently at Barry the Company has a 8,000 meter drill campaign underway. The objective is to increase the mineral resources around the pits at Barry and to increase their quality by converting mineral resources from the inferred category to the indicated category.

Highly prospective for major discovery proximal Osisko's Windfall Project: As part of the current 8,000 m drill program at Barry the Company is targeting for high-grade speculation outside the pit at the Moss showing, located 7 km north-east of the Barry pit and 4 km south-west of the Windfall deposit (belonging to Osisko Mining Inc.). The geological context and the structure controlling the Windfall deposit extend to this showing. Drill results from 2014 revealed the presence of gold anomalies near surface on a 3 km stretch extending to the south-west. The upcoming drill holes will target the extensions of the gold anomalies, if it hits well the value of MTO.V is apt to increase dramatically as this area is essentially the extension of Osisko’s flagship project.

The following research links have been identified for further DD on Metanor Resources Inc.

Fredrick William, BA Ec.

Fredrick is a freelance information services professional for various media relation firms and consultant to several publicly traded entities. He monitors and invests in the resource, technology, consumer staples, healthcare, agriculture, financial, energy, utilities, and biotechnology/pharmaceutical sectors and is the managing director of Market Equities Research Group.

***

Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. The author has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. The author makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of the author only and are subject to change without notice. The author assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, the author assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report. The author does not currently own shares of Metanor Resources Inc. – MTO.V however intends to accumulate.