Current Price: C$0.195

Shares Outstanding: 38.4 million

Market Capitalization: C$7.5 million

52-Week Range: C$0.05 – C$0.27

Cash: ~C$0.38 million

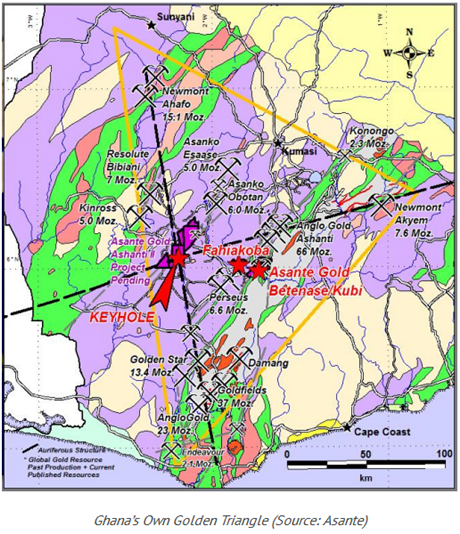

It’s not every day Ned Goodman takes an interest in a microcap, but even at his age the thrill of hunting elephants is far too exciting. Mr. Goodman, a geologist and famed investor, joined Asante Gold in June 2016, citing a new focus on Africa, where resources are both abundant and locally underinvested.

Asante Gold’s President and CEO, Douglas MacQuarrie, is the former head of PMI Gold and definitely no stranger to elephants. He acquired the prolific Obotan Gold Project and was involved in all aspects of its exploration and development, drilling the project to over 5 million ounces. PMI Gold was eventually acquired by Asanko Gold (TSX:AKG) in December 2013, for C$183 million.

Doug’s interest in Africa, namely Ghana, spans all the way back to 1993, when he ran a small junior exploration company. Looking for the next gold frontier with a mining-friendly government; Ghana was first on his list due to the liberalization of its land during the 1980s. Doug concentrated on the Asankrangwa Gold Belt, a wide-open belt owned mostly by local Chiefs and politicians, and ponied up $750,000 to fly airborne geophysics. The structural information obtained is something Doug will utilize for decades to come.

He began buying up concessions with his new company, Goknet, bolstered by a powerful board made-up of local politicians and businessmen. Goknet acquired top-tier exploration projects and eventually signed an agreement with publicly-traded PMI Gold to vend in its assets in 2003. PMI Gold made Doug its CEO, and under his helm, acquired the past-producing projects Obotan and Kubi, something that could not have been done without Doug’s knowledge and connections.

The Obotan project was acquired from the Ghanese Government in November 2006; however, was owned and mined by Resolute Mining before it was relinquished due to low gold prices. This was after extensive exploration and development (bankable feasibility study), and after one million ounces of gold was extracted. As mentioned earlier, PMI was only awarded the concession due to Doug’s political pull, and the project was eventually drilled to over five million ounces before it was acquired by Asanko.

Kubi was subsequently acquired from Nevsun Resources in September 2007, for ~C$6 million in cash and shares. The project had over US$30 million in exploration work, including ~200,000 meters of drilling and over 7,000 holes. Nevsun optioned the mine to AngloGold Ashanti in 1998, and ~60,000 ounces of gold were mined from two small open pits between 1999, and 2006. The ore was shipped to AngloGold’s Obuasi mine, and operations only ceased when all the surface veins were mined.

Goknet acquired Kubi in September 2014 from Asanko as part of an arbitration settlement, and optioned the project to Asante Gold in March 2015, making it the flagship project of Doug’s new Ghana play.

Doug has wanted to explore Kubi since it was acquired by PMI Gold. However, when he resigned as CEO the project took the backseat to the more advanced Obotan. Now Kubi can be explored and mined, and more recently, Asante Gold announced an agreement with BXC Company, a wholly-owned subsidiary of BFXC, a Shenzhen Stock Exchange-listed company, with a market capitalization of $580 million. BXC has agreed to provide $19.5 million in financing to earn 50% of Kubi and a 30% equity interest in Asante. The agreement is subject to final due diligence and closing is expected by December 31, 2016.

Kubi is a brownfield project with an estimated 12 to 18 month timeline to complete exploration; resource to reserve definition drilling; the portal and decline; final mine planning; and permitting and surface works. Asante is targeting 35,000 of Au per year and according to our analysis, at current gold prices, Kubi will be cash flowing close to US$2.0 million year 2, ramping up to US4.5 million from years 4 onwards. This is significant as Asante will utilize the funds to explore its other exploration projects.

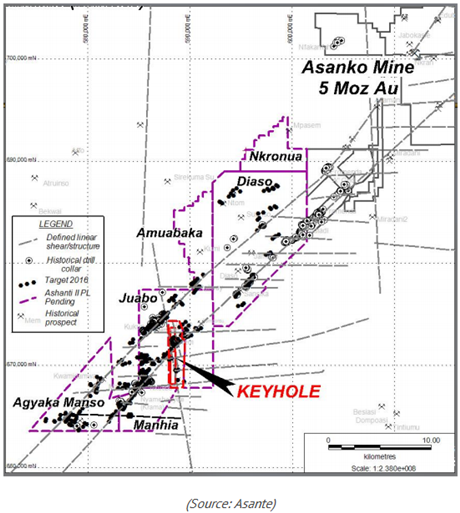

The Keyhole Option – Is an exploration project that Doug has had his eyes on for decades. The project is described as his ‘unicorn’, but unfortunately, has been occupied by artisanals, mining for alluvial gold for the last 40 years. The day has finally come, and all the surface gold has been mined. Asante’s option covers the 7 kilometer length of the Ankobra River, with historical channel samples of up to 8 meters of 25 g/t Au in quartz reefs in underground workings and surface dump samples of 54.0, 49.3, 23.05, 12.03, 11.4, 1.9, 1.84, and 0.14 g/t Au.

Doug has been itching to explore Keyhole; the project has numerous targets at the intersection of major regional EW, NE SW, and NS linears/shears. Asante is currently planning on running an 80-line kilometer IP/Resistivity, as well as 800 meters of drilling.

The Betenase Option – Perseus Mining was one of many miners struggling during the recent resource bear market. To control costs, its exploration budget was decreased significantly and many projects were put on the block. Perseus’ exploration manager called up Doug and negotiated a friendly option. The property is directly south of AngloGold’s Obuasi Mine, with initial drilling in then IP high yielding 3.14 g/t Au over 4.0 meters. Betenase contains major NS & EW structures, with nearby alluvial gold workings. Like Keyhole, Asante plans on running IP/resistivity (30 line kilometer) and following-up with an 800 meter drill program.

Asante Gold currently has a 5,555,555 unit private placement open, at 18 cents per unit for aggregate gross proceeds of C$1 million. Each unit consists of one common share of the company and one-half warrant, with a price of 25 cents for 24 months from the closing date. Proceeds will be used for exploration and drilling.

Douglas MacQuarrie has put his money where his mouth is. He currently owns 30% of Asante, and has supported the company through the bad, and now hopefully, the good. Asante is Doug’s final song in Ghana, and is comprised of projects he has literally courted for decades. He is now in a position to explore and finally unearth value in a belt he helped discover. Asante is already being carried to cash flow, and we are excited to see what Keyhole and Betenase reveal. With drilling slated for the near future, we believe Asante is incredibly undervalued and poised for a great run.

Palisade Global Investments Limited holds shares of Asante Gold. We receive either monetary or securities compensation for our services. We stand to benefit from any volume this write-up may generate. The information contained in such write-ups is not intended as individual investment advice and is not designed to meet your personal financial situation. Information contained in this report is obtained from sources we believe to be reliable, but its accuracy cannot be guaranteed. The opinions expressed in this report are those of Palisade Global Investments and are subject to change without notice. The information in this report may become outdated and there is no obligation to update any such information. Do your own due diligence.