U.S. Earnings Improve

With the economically-sensitive Australian dollar (FXA) and Brazil (EWZ) showing signs of strength in 2016, there is hope for an earnings recovery in late 2016/early 2017. From The Wall Street Journal:

This is the corporate landscape that will greet the next president: improving profits buoyed by rising employment and business spending—yet tempered by the elusiveness of a more resilient recovery. Earnings for the biggest U.S. companies began to rebound in the third quarter, a glimmer of growth after four straight quarters of contractions. But some executives are already expressing caution about the coming year.

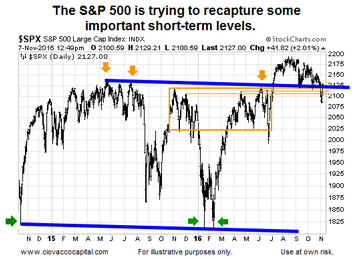

S&P Spikes On FBI/Clinton News

Following the FBI’s announcement Sunday regarding the Clinton email case, S&P futures gapped up 25 points, allowing the S&P 500 to flirt with recapturing the top of the Brexit box (see orange lines below). All things being equal, the short-term bullish case would improve with a close above the orange lines.

Normal Pullback or New Bear Market?

This week’s video looks at the good, the bad, and the ugly heading into election day, including an update on numerous Fibonacci retracements.

After you click play, use the button in the lower-right corner of the video player to view in

full-screen mode. Hit Esc to exit full-screen mode.

Some Good Signs Monday

Market breadth was very impressive during Monday’s session, especially with 90% of NYSE volume being associated with advancing issues. As shown below, the broad NYSE Composite was also able to retake a level that dates back to the 2007 market peak.

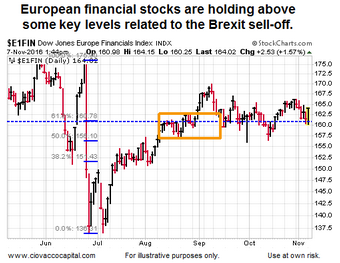

A Turning Point For European Earnings?

European financials were trying to make a stand at a logical level Monday (chart below). Similar to the United States, some data is giving hope for a long-awaited recovery in European earnings. From CNBC:

After almost six years of no earnings growth for Europe, there is hope the region’s companies hit an inflection point during this year’s third quarter, according to the Head of European Equity Strategy at UBS. With over half of European companies having already reported, Nick Nelson says the recovery seen in revenue growth is key to driving positive momentum in earnings.

This entry was posted on Monday, November 7th, 2016 at 2:05 pm and is filed under Stocks - U.S.. You can follow any responses to this entry through the RSS 2.0 feed. Both comments and pings are currently closed.

Copyright © 2016 Ciovacco Capital Management, LLC. All Rights Reserved. Chris Ciovacco is the Chief Investment Officer for Ciovacco Capital Management, LLC (CCM). Terms of Use. This article contains the current opinions of the author but not necessarily those of CCM. The opinions are subject to change without notice. This article is distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. The charts and comments are not recommendations to buy or sell any security. Market sectors and related ETFs are selected based on his opinion as to their importance in providing the viewer a comprehensive summary of market conditions for the featured period. Chart annotations are not predictive of any future market action rather they only demonstrate the opinion of the author as to a range of possibilities going forward. All material presented herein is believed to be reliable but we cannot attest to its accuracy. The information contained herein (including historical prices or values) has been obtained from sources that Ciovacco Capital Management (CCM) considers to be reliable; however, CCM makes no representation as to, or accepts any responsibility or liability for, the accuracy or completeness of the information contained herein or any decision made or action taken by you or any third party in reliance upon the data. Some results are derived using historical estimations from available data. Investment recommendations may change and readers are urged to check with tax and investment advisors before making any investment decisions. Opinions expressed in these reports may change without prior notice. This memorandum is based on information available to the public. No representation is made that it is accurate or complete. This memorandum is not an offer to buy or sell or a solicitation of an offer to buy or sell the securities mentioned. The investments discussed in this report may be unsuitable for investors depending on their specific investment objectives and financial position. Past performance is not necessarily a guide to future performance. The price or value of the investments to which this report relates, either directly or indirectly, may fall or rise against the interest of investors. All prices and yields contained in this report are subject to change without notice. This information is based on hypothetical assumptions and is intended for illustrative purposes only. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS. CCM would like to thank StockCharts.com for helping Short Takes create great looking charts Short Takes is proudly powered by WordPress . Entries (RSS)