Cobalt Flying Under The Radar - Poised To Be

The Best Performing Commodity Of The Next Decade

Investment Highlights

There Is No Tesla Without Cobalt

The projected demand for lithium-ion batteries, namely Tesla’s insatiable need for those batteries, propelled lithium and other ‘energy metals’ into the spotlight. Tesla is targeting annual production of a staggering 500,000 vehicles by 2018 and 1 million by 2020, driven by the heavily anticipated release of the mass-market Tesla Model 3, selling at a base price of $35,000. Tesla CEO, Elon Musk, recently announced the company is now sitting on 400,000 pre-orders, each secured with a $1,000 deposit. Bloomberg New Energy Finance (BNEF) forecasts that 35% of vehicles sold in 2040 will be electric vehicles, a pretty astounding figure considering less than 1% of current global sales are EV. Assuming that cobalt remains essential to the rechargeable battery, cobalt consumption will grow at an average annual rate of 5.1% from 2016-2020.

The Cobalt Supply Is A By-Product

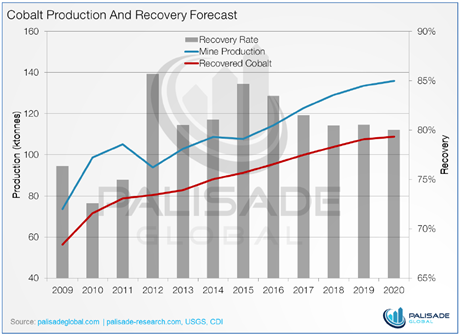

In 2015, an estimated 91,000 tonnes of refined cobalt was produced globally, with 98% of the production coming as a by-product from copper and nickel production (60% from copper, 38% from nickel). According to our analysis, the top 15 cobalt producing mines in the world account for 50% of the world’s cobalt supply.

With that much supply in the hands of so few, even small changes globally can make some significant waves. For example, when Glencore suspended operations at its Katanga mine in the Democratic Republic of Congo due to low copper prices, it also removed in excess of 3% of the world’s cobalt supply. Had Glencore also decided to shutter its Mutanda operation, there would have been another, much larger 13% decline in global cobalt supply.

Blood Cobalt? T.I.A. - This Is Africa

This might be the most eye-catching statistic about cobalt of them all - 60% of the world’s cobalt reserves and resources originate in the Democratic Republic of the Congo, in the African Copper Belt!

Over two-thirds of worldwide production comes from Africa, China, and Russia; only 2% comes from primary cobalt mines, which are located in Morocco.

With the DRC at the forefront of cobalt mining, it is perhaps not surprising to learn that the cobalt industry has been under heavy fire as of late for the use of children artisanal miners. According to the government of the DRC’s own estimates, 20% of cobalt exported from the country originates from underage artisanal miners, mostly in the south of the country. There are 110,000 to 150,000 artisanal miners, or creuseurs, who dig ore out from deep and dangerous underground tunnels. These miners can be as young as seven, rummaging through discarded tailings for any rock with traces of cobalt.

The majority of China’s cobalt is sold to end-users by a reseller, Chinese-owned operation named Congo Dongfang Mining International. Thus, Amnesty International has been able to trace cobalt mined by artisanal miners to some of the world’s most well known car manufacturers and electronics companies, including Apple, Dell, Lenovo, LG, Microsoft, Samsung, Daimler AG, and Volkswagen. As the inevitable demand for cobalt drifts upward, producers will be forced to raise their standards (leading to higher costs and lower production), or end-users will have to look elsewhere for their feed. Needless to say, there is a huge lack of primary cobalt production worldwide and there is an unhealthy reliance on geopolitically risky jurisdictions for supply.

A Brief Introduction To Cobalt (Which Also Means Goblin…)

Cobalt compounds have been used since ancient times for coloring glass, glazes, ceramics, and jewellery with a rich blue tone. The name is derived from the German word kobold, which means goblin. Smelters

failed in their first efforts to smelt copper and nickel, instead discovering cobalt oxide. Unfortunately, cobalt ores also contained arsenic, thereby yielding the highly toxic arsenic oxide. The superstitious name stuck after that.

The actual cobalt element is greyish silver, and is hard, lustrous, and metallic with fairly low thermal and electrical conductivity. Cobalt is used for preparing alloys for high-strength, elevated temperature, and magnetic applications. The recent uptick in cobalt usage is because of its conductive properties.

High-strength and temperature applications – Cobalt is used for high-performance alloys. The metal is very stable at high temperatures, primarily due to its high melting point. Consequently, it is used in jet engines and for industrial uses such as cutting tools, hard-facing, and diamond drilling. Cobalt is also used in both civilian and defense aircrafts.

Magnetic – Cobalt is used as an alloy to produce a metal that can be used in high-performance electrical equipment. Examples include being used in the manufacture of iron-alloy Alnico permanent magnets and recording materials.

Conductivity – This property accounts for a prime reason why you are reading this report to begin with. Cobalt demand has been rising due to the usage of rechargeable batteries. In nickel-cadmium (Ni-Cd) batteries, cobalt typically makes up about 1-5% of the battery, by weight of the nickel hydroxide. In nickel-metal (Ni-metal) hybrid batteries, cobalt constitutes up to 15% of the battery. The most advanced battery type, lithium-ion batteries, contains cathode material that is 60% cobalt and also more than 50% cobalt by weight.

The Demand For Cobalt – It’s A Greyish-Silver Metal, But It Should Be Green

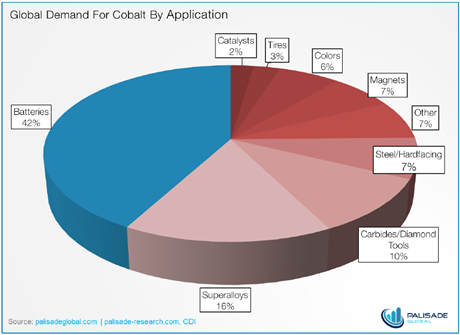

Cobalt applications can be split into two categories: chemical and metallurgical. The current demand for cobalt is largely driven by chemical purposes, with the spotlight shining on cobalt for its rechargeable battery applications.

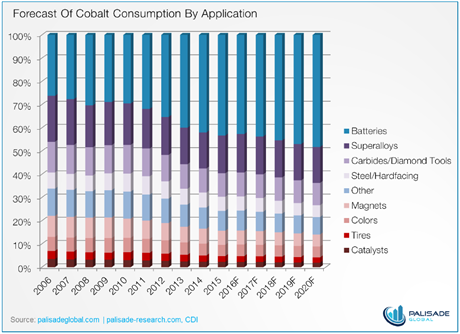

The use of cobalt in batteries has grown by an average of 13.0% annually over the last ten years; at the same time, the use of cobalt in metallurgical applications has only risen 3.4%. Intuitively then, the main driver for cobalt moving forward will be rechargeable batteries:

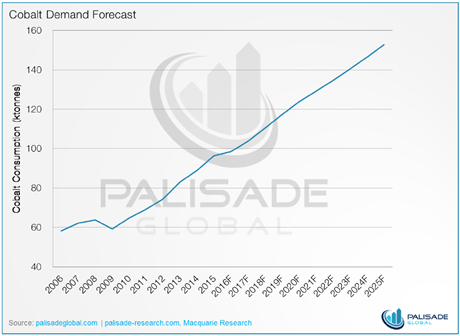

In 2015, an estimated 96,500 tonnes of cobalt were consumed. This figure is forecasted to increase by 5.1% annually for the next five years, with the demand for cobalt in battery applications increasing by 7.5% annually over the same period. In 2020, annual cobalt consumption is expected to reach 124,000 tonnes, with battery applications accounting for almost 50% of total consumption, and superalloys accounting for an additional 15%. By 2025, cobalt consumption is projected to hit 153,000 tonnes – for an increase of 60% from current levels.

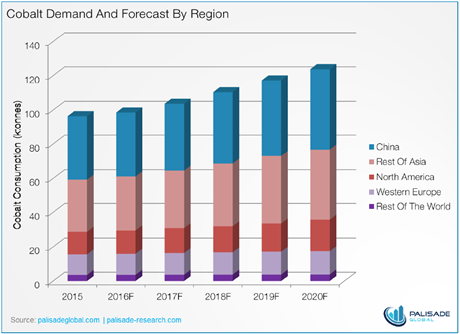

Moving forward, Asia will continue to power the demand for cobalt, with China demanding the lion’s share. The continent is home to all of the electronics powerhouses and their attendant factories. Growth will come heavily on the backs of Japan and South Korea, where there has been strong forward momentum in cathode and battery technology development. Indeed, Asia currently accounts for 70.2% of all cobalt consumption, with China alone using 38.5% of it. By 2020, Asia’s demand is forecasted to grow to 71.1%, with China’s demand falling marginally to 38.0%

As alluded to earlier in this report, Tesla’s Gigafactory will be a cobalt monster moving forward, and will be the main driver for North American demand growth. North America currently consumes 13.6% of the world’s cobalt supply; however, by 2020, this is expected to grow to 14.7%. As more automakers pivot towards electric cars, even more battery factories will be built. Volkswagen has been very vocal about its intentions and recently drew attention to a plan to construct several major battery factories around the world.

Cobalt Production – The New Conflict Material?

In 2015, an estimated 108,000 tonnes of cobalt were mined, or 91,000 tonnes of refined production. The discrepancy between what is mined and what is recovered is due to the metallurgy of cobalt, which is difficult and complicated, yielding between 80-85% after treatment. As referenced previously, the lion’s share of cobalt is produced from the Democratic Republic of the Congo, and this is expected to remain the case in the near future.

When Glencore’s Katanga mine was closed due to low copper prices, the closure removed 2,900 tonnes of cobalt supply, or 3% of the world’s production. Votorantim’s nickel mine, Tocantins, was also a victim of low commodity prices; before shutting down, it had produced an estimated 1,700 tonnes of cobalt per annum, or 2% of total global supply.

The largest producers of cobalt are Glencore’s Mutanda Mine (DRC) and China Molybdenum’s Tenke Fungurume Mine(DRC). Respectively, they account for 14,400 tonnes and 13,300 tonnes of annual global cobalt production, or in percentage terms, 13.4% and 12.4%. The DRC is one of the worst countries in the world that you could choose for mining from a geopolitical perspective – there is an expectation of bribery at all levels of government, a lack of true infrastructure, and the constant threat of retroactive taxation. While Glencore and China Molybdenum have so far maintained their business ties to the DRC, the country finds itself under greater and greater scrutiny from anti-corruption groups and human rights organizations.

Since at least 20% of DRC’s cobalt originates from artisanal mines, that implicitly means that over 10% of the world’s cobalt supply is derived from unsafe working environments that often employ child labor and use highly primitive extraction methods. At present, cobalt is not covered under US laws that ban the production of conflict minerals, and therefore is no guarantee whatsoever that lithium-ion batteries are not tainted with ‘blood cobalt.’

Several electronic manufacturers have already come forward to acknowledge these concerns and are said to be examining the supply streams for their cobalt in greater depth. That being said, there is no

documentation disclosing what efforts, if any, have been undertaken to ensure that cobalt is not derived from child labour. This lack of scrutiny is yet another jurisdictional risk that arises with the DRC.

Until now, cobalt has been a mere afterthought for most copper and nickel producers, with 98% of the production coming from copper and nickel as a by-product. Morocco is currently the only primary producer of cobalt worldwide, its largest mine being the Bou-Azzer, owned by Managem SA.

Separating cobalt from copper or nickel depends on the extraction method used for the primary metal. That of course depends of a number of other factors, including the grades of metal in the ore, and the actual mineral composition of the ore. Cobalt takes a backseat in the process, and is only treated after the extraction of copper or nickel has been completed.

Once cobalt has been mined, if a producer does not have its own refining facility, it will ship the cobalt as third-party feed. In 2015, 39% of cobalt production came from non-integrated feed supply. Most of the unprocessed cobalt was shipped to China, which is the epicentre for refined production of cobalt. China is responsible for over 47% of the world’s total refined cobalt output, 39% in the form of chemicals. Those figures are up substantially from 2006, when China was responsible for 31% of the world’s refined production, with 26% in the form of chemicals.

China receives more than 90% of its feed from the DRC, having limited domestic production sources and reserves. However, as the superpower has done in other arenas, it is securing feed by purchasing mines directly. Most recently, state-owned China Molybdenum acquired the majority stake in Freeport

McMoran’s Tenke Fungurume operation in the DRC, for a consideration of $2.65 billion. Furthermore, Freeport has also granted China Molybdenum an exclusive option to acquire its interest in the Kokkola Cobalt Refinery in Finland, for US$100 million, and the Kisanfu exploration project, located in the DRC, for US$50 million.

For a long time, cobalt from Tenke has been shipped to Kokkola for refinement into chemical applications; however, moving forward we expect all of that cobalt to be shipped to China. Regardless, the acquisition immediately makes China a major player in upstream cobalt. Expect China to continue to make waves in the cobalt space, securing both primary cobalt mines and downstream assets.

Supply And Demand – Where Are Cobalt Prices Headed?

On the supply side, cobalt production will continue to depend on the DRC, a precarious jurisdiction to say the least. On the demand side, cobalt consumption will depend primarily on the growth of the rechargeable batteries market – a market we foresee growing rapidly as the world pivots toward electric vehicles.

The market is already in a deficit, drawing down supplies from stockpiles to satisfy growing cobalt demand. In the years ahead, the main issue is not necessarily a lack of raw production, but more so the availability of refining capacity to fulfill the growing non-metallurgical consumption of cobalt, or in this case, chemical applications. This means China will continue to be the focal point for refined production. Combined with the fact that the DRC provides the bulk of raw cobalt production worldwide, it readily

becomes apparent that you have a supply chain that could be easily prone to devastating and unforeseen shocks.

Looking at the state of current cobalt production, there is not enough supply to satiate the impending green energy revolution. There are no large-scale copper or nickel projects, with cobalt by-product credits, that are poised to break ground any time soon; it will entirely up to the DRC to shoulder the burden of the supply load moving forward. In all likelihood, then, that indicates that cobalt prices have nowhere to go but up.

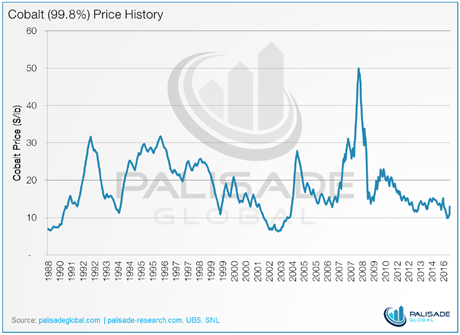

Cobalt is typically traded in 99.8% cathode form, with sales executed by individual producers. The metal began trading on the LME in 2010, and like any metal, has relatively cyclical trading patterns. Arguments have circulated that cobalt prices have historically been manipulated by central governments and influential traders. In the early 1990s, prices moved downward due to the selling of cobalt from both US and former Soviet Union stockpiles. From 1991 onwards, exaggerated price swings in the price of cobalt arose as a result of contracts that were based on a formula that amplified volatility. As illustrated above, when cobalt began trading on the London Metal Exchange in February 2010, a lot of the instability was removed.

The huge price spike in cobalt, beginning in 2007, came about when it appeared that China’s economic growth and appetite for commodities had no bounds. At the time, China was acquiring as much ore and concentrates from anywhere it could. Taking notice, the United States began reducing the sale of its cobalt to ensure its strategic stocks were maintained at healthy levels. Cobalt is considered a critical

metal to the United States, essential to its economic health and national defense. The supply squeeze peaked when the DRC placed a moratorium on all cobalt exports. The chain of events resulted in cobalt prices increasing from $15.00/lb to $50.00/lb.

We believe that there are similar economic forces at play today: insufficient supply and surging demand. And this will result in an inevitable increase in cobalt prices. We forecast in the next five years, cobalt could more than double from its current price of ~$13.00/lb to over $30.00/lb.

The ‘smart money’ agrees as the first movers have already positioned themselves for the inevitable cobalt bull. Anthony Milewski of Pala Investments, stresses similar fundamentals, starting with the electric vehicle revolution that will continue to underpin the unquenchable demand for cobalt. Moreover, he prefers cobalt over lithium because of supply side constraints and inability of producers to ramp up cobalt production in a short period of time. He reiterates that cobalt is primarily a by-product of nickel and copper mining and subject to jurisdictional risk.

How To Benefit From The Blue Bull

When scouring the cobalt universe, there were several items on our checklist that were critical to our investment mandate. First and foremost, finding a cobalt project in North America. We do not consider the DRC a safe mining jurisdiction, and in the past, the country has shown it is not afraid to ‘turn the taps off.’ Furthermore, we believe that China will continue to aggressively pursue the cobalt supplies of the DRC and surrounding nations. It is no secret that China has forced its way into many African nations, chiefly for the purpose of securing access to natural resources. Just last December, China stunned even its African allies with a pledge of $60 billion in financial support.

Continuing with the theme of jurisdiction and cobalt assets, we are looking for brownfield projects that will provide the greatest optionality, or leverage to cobalt prices. Specifically, it makes sense to look at projects that are in proven cobalt camps or that have been past producing mines.

Besides the right jurisdiction, we are also searching for projects where cobalt is the primary commodity, or occurs as very high-grade. As far as we are concerned, copper and nickel are still several years away from entering their respective bull markets, and any project where cobalt is a by-product will likely remain dormant. Funding in the mining sector is still hard to come by; a primary cobalt story will have a distinct advantage in receiving any sort of equity financing.

Where Better To Find Cobalt Than Cobalt, Ontario?

The Cobalt Mining Camp is actually among the most prolific silver mining areas in the world. When silver was first discovered in the early 1900s, the subsequent rush was like a mini Klondike Gold Rush, when a hundred thousand miners risked their lives traveling to Dawson City, Yukon.

Cobalt was discovered in 1903 by J. H. McKinley and Ernest Darragh, who were in the area supplying ties for the newly built railway. While the two were in Booth Limits buying lumber, the glimmering rocks at the southeast end of Loog Lake caught their eyes. To their surprise, the flakes in the rocks were so soft they could bend it with their fingers. The contractors shipped some samples to Montreal to see exactly what they were dealing with. It turned out the rock contained a sample of 3,600 ounce Ag per tonne – word quickly spread and the rush was on. The duo quickly applied for and received a mining lease from the government, and on their first claim, the McKinley-Darragh Mine was discovered.

At virtually the same time, blacksmith Fred LaRose was having a hard time with a pesky fox, and in frustration threw his hammer. Missing the fox and striking a rock wall, he fortuitously discovered a silver vein that had been chipped away by the hurling of the hammer against the rock. This vein turned out to be the precursor to the LaRose Mine – a true testament to how prolific the area really was.

By 1911 over 30 million ounces of silver had been produced in the area, and over the next 60 years, the mines in the Cobalt camp shipped over 420 million ounces of silver. Despite the prolific production, back in the day, Cobalt was appropriately named the ‘poor man’s mining camp.’ Most of the silver deposits were close to the surface; thus, miners did not need costly or large operations to undertake mining. When all the low hanging fruit was finally picked, Cobalt began to suffer. Exaggerated by a decline in silver prices, the town of Cobalt looked to its namesake for rescue and sustenance.

In the Cobalt area, silver-cobalt mineralization has historically occurred in steeply-dipping carbonate veins. Most of the silver-cobalt has been extracted from veins within the Coleman sediments; however, the lower diabase-volcanics are now being revealed to host significant mineralization.

As mentioned earlier, cobalt was historically a nuisance for silver miners (goblins…), especially in smelting and refining. However, uses for cobalt began to emerge with the improvement of technology; soon the element was being used in alloys and cutting tools. With the threat of global war looming, the merits of cobalt became apparent, and the metal soon became one of the world’s most revered elements. And to the benefit of the town of Cobalt, the camp became one of the few areas in the world to host primary cobalt mines; it eventually produced over 50 million pounds of cobalt.

Cobalt Power Group Inc. (TSXV:CPO) – The Pure Cobalt Explorer

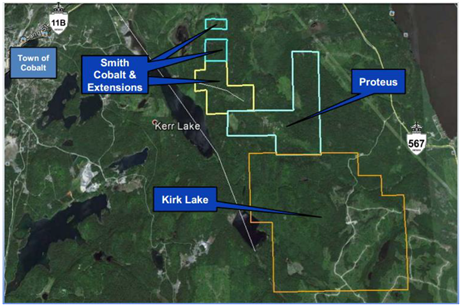

Cobalt Power is one of the newest cobalt player on the block. Making its official entrance in September 2016, Cobalt Power already has four 100%-owned projects under its control. The projects are located in a tight cluster, approximately 420 kilometers northwest of Ottawa, near the town of Cobalt.

Current Price: C$0.08

Shares Outstanding: 33.1 million

Market Capitalization: C$2.6 million

52-Week Range: C$0.035 – C$0.10

Cash: ~C$0.5 million

Total Liabilities: C$0.0 million

Cobalt Power‘s projects include Smith Cobalt, Smith Cobalt Extensions, Proteus and Kirk Lake. The projects are all high-grade cobalt-silver properties, picked specifically for their geological merits and substantial exploration upside.

The Smith Cobalt project covers just over 170 acres and is made up of nine patented mining claims. The property is the closest of the projects to Cobalt, located just 4 kilometres southeast of the town. The actual claims are just off of Highway 11, and accessible by historic mining roads, with power and water nearby.

The past-producing Deer Horn mine is located just west of Smith Cobalt; up until 1966, it produced 11 million ounces of silver and over 100,000 pounds of cobalt. Several of Deer Horn’s veins extend onto the Smith Cobalt property; in fact, four steeply dipping cobalt-nickel veins were encountered in the underground workings, with at least two near-horizontal faults.

The Smith Cobalt property was first explored when silver was discovered in Cobalt, back in 1903. It was explored by several companies between 1926 and 1960; in 1935, it produced over 10,000 pounds of cobalt. The property laid dormant until 1959, when Dolmac Mines drilled over 1,800 meters through 12 surface diamond drill holes. In 1984, another exploration program was undertaken by Phaeton Exploration; the company drilled 690 meters over three diamond drill holes. Phaeton’s drilling confirmed the presence of Coleman conglomerates below the Nipissing diabase, which has historically demonstrated the localization of mineralized veins. There has been no significant exploration since.

The Proteus project covers just over 360 acres and is made up of three patented mining claims. The claims are just off of Highway 567 and accessible by historic mining roads; power and water is available nearby.

Proteus is contiguous to Smith Cobalt, and has also been explored since the early 1900s. A major campaign occurred from 1985 to 1986; the property saw 55 diamond drill holes for an aggregate of over 9,700 meters of drilling. The drilling identified numerous pink and white carbonate veins, with associated significant silver values, including 23.34 oz Ag/t, and the presence of cobalt arsenide minerals. An IP and resistivity survey was completed in 2011, which delineated drill targets for future exploration.

Cobalt Power ‘smost recent acquisitions were the Smith Cobalt Extensions and Kirk Lake properties. In 2005, the Ontario Department of Mines conducted a sampling program at the Kirk Lake project and found silver values ranging from 103 to 6,800 parts per million. Furthermore, historical data indicate that Kirk Lake contains the southeasterly extension of the veins previously mined at the Deer Horn mine.

The company has not wasted any time and is already exploring at its projects. Phase 1 of its exploration campaign will include an airborne magnetic LiDAR survey to delineate orientations of the structurally controlled cobalt-silver mineralized veins. The company will also concurrently review historical data and conduct surface exploration work. Phase 1 reconnaissance will allow Cobalt Power to sample historic trenches for grade estimation purposes and to define drill targets.

Phase 2 is expected to begin in early 2017, and will consist of exposing historic mine shafts (one on the Smith cobalt property and four on the Kirk Lake property) and re-establishing the underground workings. This will allow the company direct access to previously mined veins to facilitate their sampling.

Cobalt Power aims to be drilling by Q2 2017; in the meantime, the company will likely be releasing material news in regards to sampling and mine shaft openings. With a market capitalization of just C$2.3 million, Cobalt Power is a highly logical and inexpensive vehicle to participate in the coming cobalt bull market. We anticipate stronger volumes as the market realizes it is not a copper play – the company recently changed its name from Global Copper – the stock is set to greatly appreciate once data from its exploration activities begins to be released.

LiCo Energy Metals Inc. (TSXV:LIC) – The Most Advanced

LiCo Energy has entered into an option agreement to acquire up to a 100% interest of the prolific Teledyne property. The property covers a total of 1370 acres and consists of 5 mining claims and 6 staked crown claims in the Buck and Lorrain Townships, located in the district of Temiskaming and is located only 6 kilometers away from Cobalt. Teledyne is on-strike with the Agaunico Mine, the area’s most prolific past-producing cobalt mine.

Current Price: C$0.18

Shares Outstanding: 81.0 million

Market Capitalization: C$14.6 million

52-Week Range: C$0.025 – C$0.205

Cash: ~C$1.8 million

Total Liabilities: C$0.0 million

The Teledyne project is an advanced stage cobalt asset that will likely be fast-tracked to production. There has been over $25 million (inflation-adjusted) of work already completed on-site, including a development ramp and a modern adit going down 500 feet parallel to the vein.

A previous owner of Teledye completed 6 diamond drill holes in 1979, as well as an additional 22 holes underground to confirm previous surface drilling in 1980. The initial program supported a development ramp of 2,300 feet to reach the delineated orezone, with the face of the ramp just 70 feet east of the orezone.

4 out of the 6 surface drill holes in the 1979 drilling campaign intersected ore grade cobalt, with individual cobalt grades of up to 10.6%. The underground drilling program produced similar results, with 18 out of the 22 intersecting ore grade cobalt, with individual cobalt grades reaching up to 10.2%. The average grade of the underground program was 0.57% cobalt with a width of 1.6 meters. Based on the drilling, pre NI 43-101 probable and inferred reserves accessible from the current ramp are estimated to be in excess of a 90,700 tonnes at 0.45% cobalt. That grade makes Teledyne one of highest-grade cobalt projects in the world.

Furthermore and of great importance, the drilling program has confirmed the continuation of the high grade Agaunico cobalt ore zone onto Teledyne with a strike length of at least 150 metres. The zone remains open to the south, with another 650 metres of potential mineralized strike length, representing an excellent target for a future drilling campaign.

Similar to Cobalt Power, LiCo Energy is a new entrant to the cobalt space and recently filed a NI 43-101 compliant, summary report on the Teledyne cobalt-silver property on SEDAR. The report contains historical exploration data, as well as recommendations to conduct an exploration program consisting of geologic compilation, geophysics and drilling. Phase 1 of the program is expected to begin in the next 3 to 4 weeks, and will cost an estimated C$700,000.

In our opinion, LiCo Energy is highly undervalued. Its flagship project has already been de-risked with significant drilling, and there is no denying the high-grade cobalt that is contained within. Teledyne is on trend with the past-producing Agaunico mine – further drilling was only cut short because of plummeting cobalt prices. Lastly, Teledyne has significant infrastructure in place, and is the likeliest candidate to be the next producing cobalt mine in North America – Buy now and hold.

Disclaimer – Please Read

Palisade Global Investments Limited holds shares of Cobalt Power and LiCo Energy. Palisade Global Investments also owns a significant amount of Palisade Resources, the company LiCo Energy optioned the Teledyne Project from. Needless to say, we stand to benefit greatly from any volume this write-up may generate more ways than one.

Furthermore, we receive either monetary or securities compensation for our services. The information contained in such write-ups is not intended as individual investment advice and is not designed to meet your personal financial situation. Information contained in this report is obtained from sources we believe to be reliable, but its accuracy cannot be guaranteed. The opinions expressed in this report are those of Palisade Global Investments and are subject to change without notice. The information in this report may become outdated and there is no obligation to update any such information. We highly recommend you do your own due diligence.