Up to the end of October 2016, there has been Cdn$10.1 billion spent in Canada on upstream assets in newly announced deals in 2016. It is now over a year since Suncor Energy Inc. (TSX:SU) began its Cdn$6.6 billion takeover approach for Canadian Oil Sands Ltd., which stands out as by far the biggest deal Canada has seen since the price downturn, but 2016’s activity has also been significant. Deals in the Montney areas of Alberta and British Columbia have made huge headlines, Saskatchewan assets have frequently changed hands for large sums and Suncor was not quite finished with the oilsands sector or the Syncrude project in particular after closing the Canadian Oil Sands deal.

The top 10 deals announced in 2016 so far, up to and including deals announced on November 17, 2016, are listed below. Download the latest CanOils M&A review for October 2016 here (https://info.evaluateenergy.com/whitepapers/canada-ma-deals-monthly-review-october-2016-353574hggend-0) .

Canada's Top 10 upstream deals of 2016 so far

1) Cdn$1.9 billion - Seven Generations Energy acquires Montney assets from Paramount Resources

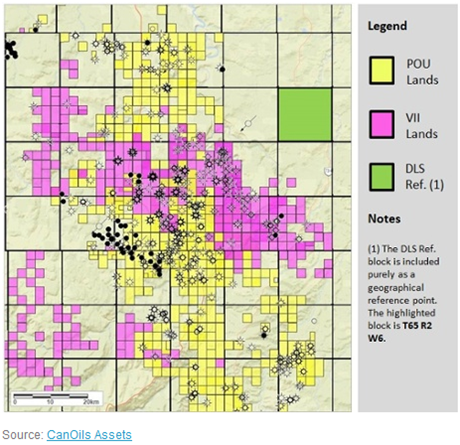

The biggest deal of 2016 so far saw Seven Generations Energy Ltd. (TSX:VII) acquire Montney production and lands from Paramount Resources Ltd. (TSX:POU) for Cdn$1.9 billion. The consideration will be made up of Cdn$475 million in cash, 33.5 million Seven Generations shares and the assumption of around Cdn$584 million of Paramount debt. By acquiring these assets, Seven Generations is boosting its portfolio with a further 199 million boe of 1P reserves, 30,000 boe/d of production in the company’s core Kakwa River area and 155 net sections of Montney land.

Full report – July 2016 and August 2016

CanOils Assets map of the Kakwa River area as of June 30, 2016

2) Cdn$1.4 billion – Tourmaline Oil Corp. acquires British Columbia Montney and Alberta Deep Basin assets from Shell Canada

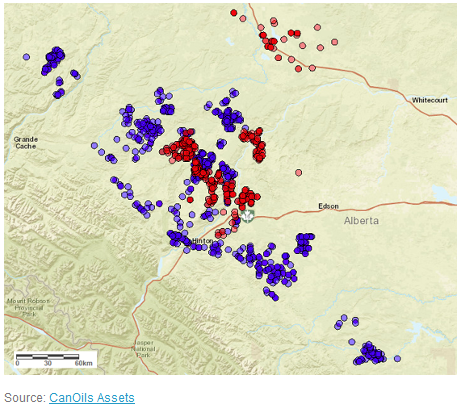

The second biggest deal of 2016 so far was announced in October and sees Tourmaline Oil Corp. (TSX:TOU) acquire assets from Shell Canada for just under Cdn$1.4 billion. The assets are located in the BC Montney and the Alberta Deep Basin. The consideration is made up of Cdn$1 billion cash and the remainder in Tourmaline stock. The cash portion of the transaction will be funded through the company’s existing credit facilities and Cdn$739.4 million that will be raised in two equity financings; Tourmaline will look to raise Cdn$100 million via a prospectus offering and a further Cdn$639.4 million via a private placement.

Full report – October 2016

CanOils Assets map of operated Tourmaline (blue) and Shell (red) wells in the Alberta Deep Basin as of September 30, 2016

3) Cdn$975 million - Teine Energy acquires Penn West Petroleum’s Saskatchewan assets

Teine Energy Ltd., with funds from its own existing credit facilities and significant financial backing from the Canada Pension Plan Investment Board, acquired Penn West Petroleum Ltd.’s (TSX:PWT) Dodsland Viking assets in Saskatchewan for C$975 million. This is the biggest deal outside of Alberta and British Columbia so far this year.

Since Q4 2014, when the price downturn really began, Penn West has sold assets in deals worth a total of C$2.5 billion, all aimed at reducing total debt. This single C$975 million asset sale resulted in a markedly improved capital structure; Penn West now says that the company is in the top tier of its peers in terms of all significant debt metrics.

Full report – June 2016

4) Cdn$937 million - Suncor Energy buys Murphy Oil out of Syncrude

Suncor Energy Inc. (TSX:SU), following the C$6.6 billion deal to acquire Canadian Oil Sands Ltd. at the start of 2016, increased its stake in Syncrude by a further 5% in June when it completed its C$937 million deal with Murphy Oil Corp. (NYSE:MUR). This now means that Suncor’s stake in the Syncrude project is 53.74%. Murphy Oil had been a participant in the Syncrude project for over 22 years.

Full report – April 2016 and June 2016

5) Cdn$700 million - Spartan Energy Corp. acquires ARC Resources’ Saskatchewan assets

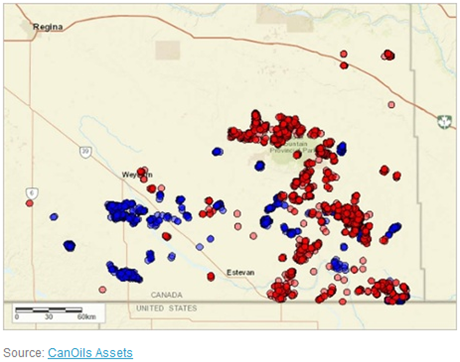

November 2016 has so far seen two significant deals with values of over Cdn$100 million in Saskatchewan. The larger of the two sees ARC Resources Ltd. (TSX:ARX) exit Saskatchewan entirely. Spartan Energy Corp. (TSX:SPE) is the acquirer of the assets, which are located in the southeast of the province and produce 7,500 boe/d (98% liquids).

Full report coming soon – sign up to our mailing list here

CanOils Assets map of working interest ARC (blue) and Spartan (red) wells in southeast Saskatchewan as of September 30, 2016

6) Cdn$625 million - Birchcliff Energy acquires Encana’s Gordondale assets in Alberta

Encana Corp. (TSX:ECA), after making two asset sales of over C$1 billion in the United States in the latter half of 2015, has now completed a significant asset sale in Canada. Birchcliff Energy Ltd. (TSX:BIR) is the acquirer, in a Cdn$625 million deal for Encana’s wells and leases in the Gordondale area of Alberta. The assets (65% gas weighted) are located in the Peace River Arch region and the target formations are the Montney and Doig resource plays.

Full report – July 2016

7) Cdn$595 million - Whitecap Resources acquires southwest Saskatchewan assets from Husky Energy

In Saskatchewan’s second biggest deal of 2016 so far, Whitecap Resources Inc. (TSX:WCP) acquired assets in southwest Saskatchewan from Husky Energy Inc. (TSX:HSE) for C$595 million. The deal increased Whitecap’s production by 11,600 boe/d and also increased the company’s oil weighting by 3% to 79%, as the assets being acquired produce 98% oil and NGLs.

Full report – May 2016 and June 2016

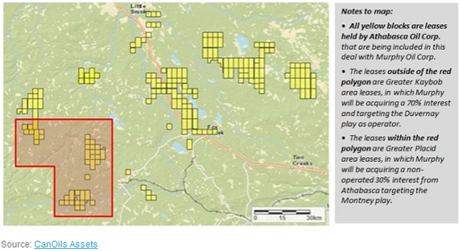

8) Cdn$486 million - Murphy Oil and Athabasca Oil Corp form Canadian shale joint venture

A few months before it agreed to leave the Syncrude project behind in a deal with Suncor, Murphy Oil Corp. (NYSE:MUR) agreed a joint venture in the Montney and Duvernay shale plays with Athabasca Oil Corp. (TSX:ATH). The deal, worth Cdn$486 million in Murphy stock, cash and cost carries, sees the two companies join forces in the Greater Kaybob and Greater Placid areas. In the Greater Kaybob area, Murphy will take a 70% stake and operatorship to target the Duvernay shale play. In the Greater Placid area, Murphy will assume a 30% non-operated interest and the target is the Montney shale play.

Map of Leases Included in the Athabasca/Murphy JV Agreement Athabasca Oil Corp. Holdings in Greater Kaybob and Greater Placid Areas

Full report – January 2016 and May 2016

9) Cdn$388 million - Tamarack Valley acquires Spur Resources

November’s other significant deal with a value of over $100 million in Saskatchewan involved Tamarack Valley Energy Ltd. (TSX:TVE) acquiring all the issued and outstanding stock of Spur Resources Ltd., a privately-held Viking oil focused company. The deal, worth Cdn$388 million including debt assumption, adds 6,250 boe/d (52% liquids) of low cost production to Tamarack Valley’s portfolio and an extensive drilling inventory of 695 net identified low-risk drilling locations with an average liquids weighting of approximately 70%.

Full report coming soon – sign up to our mailing list here

10) Cdn$268 million - Boulder Energy Ltd. goes private

2016 has seen a series of TSX-listed companies taken off the stock exchange via corporate acquisitions and become privately-held entities. The biggest acquisition involving purely Canadian assets to be announced during 2016 saw ARC Financial Corp. acquire Boulder Energy Ltd. for around Cdn$268 million including debt assumption. Boulder was only formed as an independent entity in May 2015, having been one of the two resultant companies in the reorganisation of Deethree Energy Ltd. While Granite Oil Corp. (TSX:GXO) was formed with Deethree’s South Alberta Bakken wells and gas injection EOR project, Boulder assumed Deethree’s dominant land position in the Pembina-Brazeau Belly River area of Alberta. Granite has far outperformed Boulder and, as of April 2016, is the only independent entity left from the Deethree reorganisation.

Full report – February 2016 and April 2016

For our full report history, click here.