Greed And Fear Are Constants

Since greed and fear have remained constant throughout human history, asset bubbles are not a recent phenomenon. The Dutch tulip bulb bubble that occurred in the 1600s shared many of the same attributes of the dot-com and housing bubbles. From Investopedia:

The Tulipmania that gripped Holland in the 1630s is one of the earliest recorded instances of an irrational asset bubble. By one account, tulip prices soared 20-fold between November 1636 and February 1637, before plunging 99% by May 1637, according to former UCLA economics professor Earl A. Thompson. As bubbles typically do, Tulipmania consumed a wide cross-section of the Dutch population, and at its peak, some tulip bulbs commanded prices greater than the prices of luxury homes.

Common Traits Of Bubbles

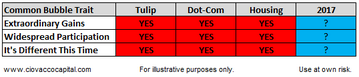

In all three cases (tulip, dot-com, and housing):

- Asset prices experienced extraordinary gains.

- A wide cross-section of the population participated near the latter stages of the bubble.

- Investors felt “this time is different”.

How Does The Present Day Compare?

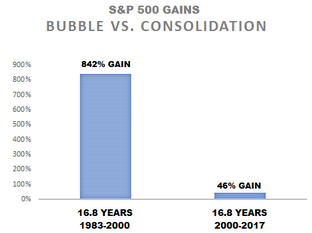

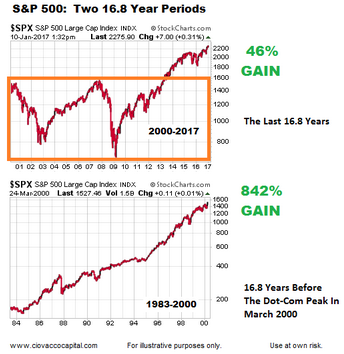

It has been 16.8 years since the end of the dot-com bubble. Have stocks experienced gains similar to the period that ended with the speculative dot-com blow-off peak in 2000? If we compare stock returns in the last 16.8 years to the returns in the last 16.8 years of the tech boom, the gains are significantly different (see bar chart below).

An 18-Fold Difference In Returns

Over the last 16.8 years (2000-2017), the S&P 500 gained 46%, which really doesn’t look anything like the eye-popping 842% gain that occurred in the prior 16.8 year period (1983-2000). The 842% gain represents an 18-fold increase over the 46% gain.

New All Time Highs vs. Consolidation

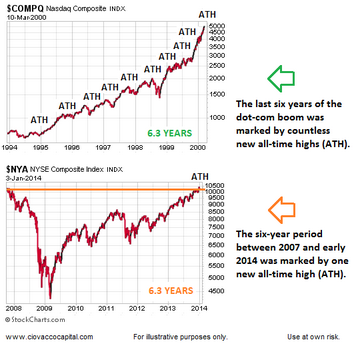

Bubbles see participants push asset prices to never seen before heights, which is exactly what occurred on almost a daily basis between 1995 and 2000. Consolidation periods are marked by a very low number of new all-time highs (ATM), which is exactly what occurred between 2007 and early 2014. Both graphs below span the exact same number of calendar days (2,286).

Bubble vs. Consolidation

On October 31, 2016, the NYSE Composite Stock Index was trading at the same levels seen nine years earlier. Contrast the “zero progress” look of the nine-year period on the bottom portion of the image below (2007-2016) with the 1,026% gain that occurred during the last nine years of the tech boom era (top portion). The top portion looks like a bubble; the bottom portion looks like consolidation.

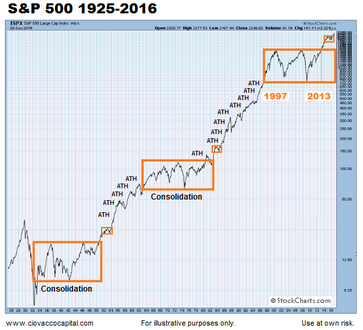

Consolidation Can Be Very Relevant

The expression, “the longer a market goes sideways, the bigger the move that follows” applies to the S&P 500 chart below, which dates back to 1925. The orange boxes highlight periods of consolidation marked by a low number of all-time highs. The periods between the orange boxes represent secular trends marked by a large number of new all-time highs. More detailed information on the concepts shown in the chart below can be found in this December analysis. The chart below was created using data from Stockcharts.com.

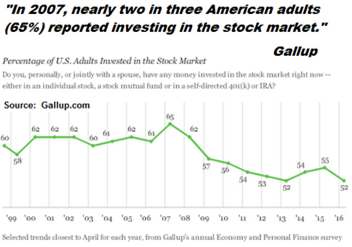

Do We Have Widespread Participation Today?

It was not unusual to go to a cocktail party in 2006 where 50% of the attendees worked as realtors, appraisers, developers, flippers, etc. It was not unusual to discuss tech stocks with your cab driver in 1999. It was also common to hear “you can’t lose money on tech stocks” or “real estate is a sure bet.”

The percentage of adults that own stocks has been declining since peaking in 2007. Therefore, participation has been on a downswing rather than a bubble-like upswing in recent years. The recent decline in stock market participation may also provide a source for new funds in the coming years, as outlined on January 6.

Are Valuations A Showstopper?

Based on numerous valuations metrics, it is difficult to make a case that stocks are cheap in 2017. However, a recent analysis of P/E ratios at major peaks, major bottoms, and within the context of secular trends says present day valuations, taken in isolation, are not a showstopper for stocks.

Historical Bubbles vs. 2017

The July 2016 description below of the current bull market hardly paints a picture of euphoric market participants with a “it’s different this time” state of mind. From The Wall Street Journal:

The seven-year bull market in stocks still doesn’t get much love. That is precisely why more milestones could be in the offing. The S&P 500 closed at a record on Monday—its first since May 2015 and the 109th of this bull market. Yet the higher stocks climb, the more skeptical investors seem to get, at least judging by where they put their money. That lack of exuberance and the market’s increasing resilience could be exactly what propel stocks in the months ahead. Consider the reaction to Brexit. Investors pulled nearly $8 billion from U.S. equity funds in the week following the June 23 U.K. vote to leave the European Union, the fourth biggest weekly withdrawal of the year, according to the Investment Company Institute.

Ultimately, personal opinions mean very little in the financial markets. Therefore, it is appropriate to leave the 2017 column in the table below blank. Only time will tell.

This entry was posted on Tuesday, January 10th, 2017 at 3:10 pm and is filed under Stocks - U.S.. You can follow any responses to this entry through the RSS 2.0 feed. Both comments and pings are currently closed.

Copyright © 2016 Ciovacco Capital Management, LLC. All Rights Reserved. Chris Ciovacco is the Chief Investment Officer for Ciovacco Capital Management, LLC (CCM). Terms of Use. This article contains the current opinions of the author but not necessarily those of CCM. The opinions are subject to change without notice. This article is distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. The charts and comments are not recommendations to buy or sell any security. Market sectors and related ETFs are selected based on his opinion as to their importance in providing the viewer a comprehensive summary of market conditions for the featured period. Chart annotations are not predictive of any future market action rather they only demonstrate the opinion of the author as to a range of possibilities going forward. All material presented herein is believed to be reliable but we cannot attest to its accuracy. The information contained herein (including historical prices or values) has been obtained from sources that Ciovacco Capital Management (CCM) considers to be reliable; however, CCM makes no representation as to, or accepts any responsibility or liability for, the accuracy or completeness of the information contained herein or any decision made or action taken by you or any third party in reliance upon the data. Some results are derived using historical estimations from available data. Investment recommendations may change and readers are urged to check with tax and investment advisors before making any investment decisions. Opinions expressed in these reports may change without prior notice. This memorandum is based on information available to the public. No representation is made that it is accurate or complete. This memorandum is not an offer to buy or sell or a solicitation of an offer to buy or sell the securities mentioned. The investments discussed in this report may be unsuitable for investors depending on their specific investment objectives and financial position. Past performance is not necessarily a guide to future performance. The price or value of the investments to which this report relates, either directly or indirectly, may fall or rise against the interest of investors. All prices and yields contained in this report are subject to change without notice. This information is based on hypothetical assumptions and is intended for illustrative purposes only. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS. CCM would like to thank StockCharts.com for helping Short Takes create great looking charts Short Takes is proudly powered by WordPress . Entries (RSS)